- The White House may pull support from a crypto bill over Coinbase’s stance.

- Coinbase withdrew support for the CLARITY Act recently.

- No primary confirmations from official sources about White House’s decision.

The White House is reportedly reconsidering its stance on the crypto market structure bill amid Coinbase’s abrupt withdrawal, sparked by a disagreement over the bill’s current draft.

The potential shift in the White House’s position could affect regulatory stability within the cryptocurrency market, highlighting tensions between government priorities and industry actions.

White House Considerations in Crypto Policy Debates

The White House is reportedly considering revoking support for the CLARITY Act if Coinbase does not negotiate a new yield agreement benefiting banks. Coinbase’s recent action was described by sources familiar with the issue as unexpected for both the White House and the broader industry, reflecting the ongoing complexity within legislative processes.

Coinbase’s withdrawal from the CLARITY Act signals broader strains between centralized governance motives and decentralized platform objectives. Political reactions suggest a potential shift in how crypto legislation could evolve, with a focus on reconciling diverse interests.

“After reviewing the Senate Banking draft text over the last 48hrs, Coinbase unfortunately can’t support the bill as written. There are too many issues, including: – A defacto ban on tokenized equities – DeFi prohibitions, giving the government unlimited access to your financial…” — Brian Armstrong, CEO and Co-Founder, Coinbase source

Coinbase Influence on Regulatory Frameworks and Market Dynamics

Did you know?

In 2021, Coinbase became the first major cryptocurrency company to go public, significantly impacting how the industry is perceived in regulatory circles today.

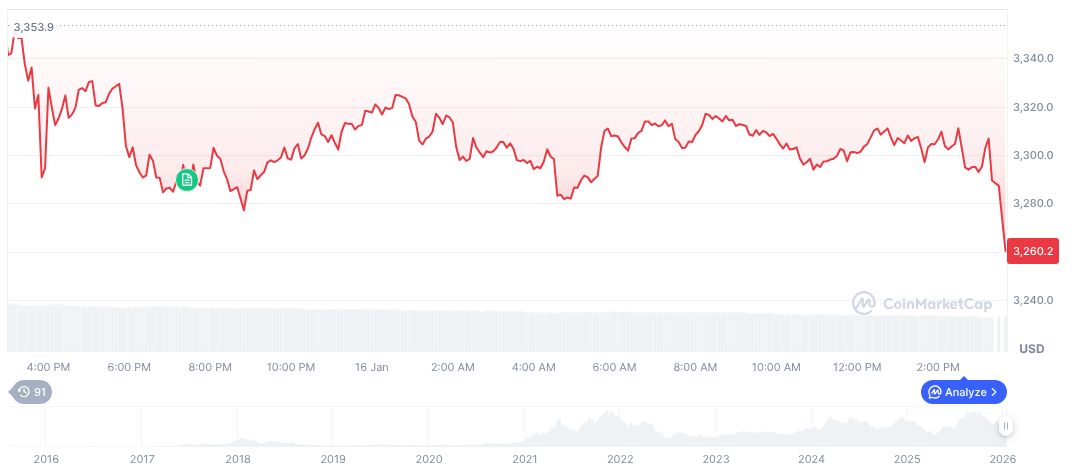

CoinMarketCap data indicates Ethereum (ETH) holds a market cap of $397.57 billion, despite a recent 24-hour price decrease of 0.53%, echoing the crypto sector’s volatile nature. Over the past 30 days, Ethereum’s price rose by 15.7%, showcasing notable growth. Current trading volume reflects a change of -21.37%, pointing to shifting market dynamics.

According to the Coincu research team, potential outcomes of this developing situation could shape future regulatory frameworks and compliance standards across the cryptocurrency landscape. Predictive analyses point towards evolving strategies balancing innovation with oversight.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |