World Liberty Financial Faces Token Expenditure Debate Over USD1 Plan

- World Liberty Financial proposes WLFI token expenditure for USD1 stablecoin growth.

- The proposal aims to use up to 5% of token reserves.

- Community debate arises over potential price impact and ecosystem benefits.

World Liberty Financial proposed using up to 5% of WLFI token reserves for its USD1 stablecoin partnership, sparking community debate over potential impacts on token holder interests.

The proposal addresses long-term ecosystem value, yet raises concerns about price impact for 80% of locked WLFI tokens, reflecting community tension over financial strategies.

WLFI Proposal to Use 5% Token Reserves

World Liberty Financial’s proposal suggests using a portion of the WLFI token reserves to support USD1 stablecoin initiatives. The allocation targets strategic partnerships and liquidity incentives. Community opinions diverge as holders discuss the proposal’s long-term value versus short-term price effects.

The changes aim to fund USD1 growth initiatives. Proponents argue it could bolster the WLFI ecosystem, while critics worry about the potential negative impact on locked WLFI token holders. Approximately 80% of tokens remain locked, heightening concerns among these stakeholders.

“Using a portion of the WLFI treasury as incentives to accelerate USD1 adoption is a smart, long-term decision focused on building real utility: not short-term price action.” – Governance Participant, WLFI Community Member, World Liberty Financial

WLFI Market Dynamics and Future Outlook

Did you know? World Liberty Financial’s recent $10 million WLFI buyback was hailed as a show of confidence, similar to past initiatives by major DeFi projects to support token price stability.

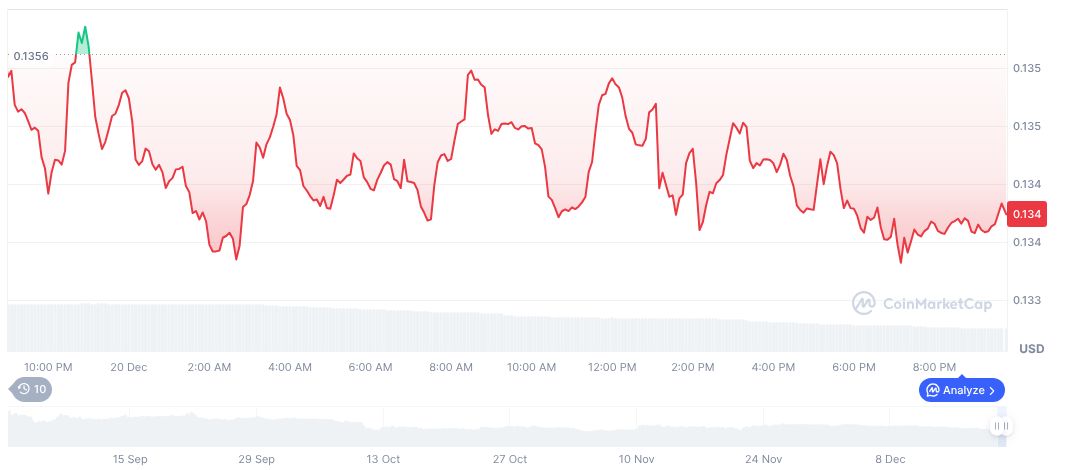

As of the latest update on December 20, 2025, CoinMarketCap reports WLFI at $0.13, with a market cap of approximately $3.59 billion and dominance at 0.12%. Trading volumes have decreased sharply by 50.13% over 24 hours. Notably, WLFI has seen a 45.58% decline over the past 90 days, although it recorded modest gains over the past 60 days. The circulating supply stands at 26.73 billion tokens, from a maximum supply of 100 billion. [Source: CoinMarketCap]

The Coincu research team indicates potential for financial and technological advancements through strategic maneuvering by World Liberty Financial. The outcomes are tied to adoption and utility expansion, where regulatory landscapes and broader DeFi market dynamics play pivotal roles in future developments.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |