DeBot Processes Compensation After $250K Wallet Data Breach

- DeBot data breach results in $250,000 loss, compensation processed.

- Hackers exploited user wallet data post-migration.

- All compensation claims have now been fully addressed.

On December 27, hackers exploited leaked data linked to DeBot’s data center expansion, compromising users’ wallets and causing a loss of approximately $250,000, according to the company’s updates.

The incident raises concerns about data security in cryptocurrency platforms as more users demand transparency and immediate compensation for affected assets, impacting trust in decentralized financial systems.

DeBot Breach Results in $250K Loss, Compensation Issued

DeBot’s recent statement revealed that their data center expansion led to user wallet data exposure. Hackers exploited this data beginning December 27, transferring funds out of affected wallets. DeBot took swift actions to secure other assets and processed all compensation claims.

Immediate actions included isolating compromised accounts and communicating with affected users. The breach highlighted the risks associated with data migrations if not properly managed with security protocols. Ongoing investigations seek to prevent future incidents.

“In the wake of the incident, the team is currently following up on the DeBot incident and monitoring on-chain activity. According to him, users’ private keys associated with DeBot have been compromised, and the hacker has so far profited approximately $255,000, with theft still ongoing.” — Cos, Founder, SlowMist, source.

Community responses were mixed, with concerns over technical vulnerabilities. SlowMist confirmed approximately $255,000 remains at risk, stressing vigilance among users. DeBot’s official update aimed to assure users of ongoing security measures.

Crypto Security Failures Highlight Need for Enhanced Oversight

Did you know? Similar breaches have plagued cryptocurrency platforms, with Trust Wallet losing up to $7 million on December 25, 2025, highlighting persistent security challenges in the crypto space.

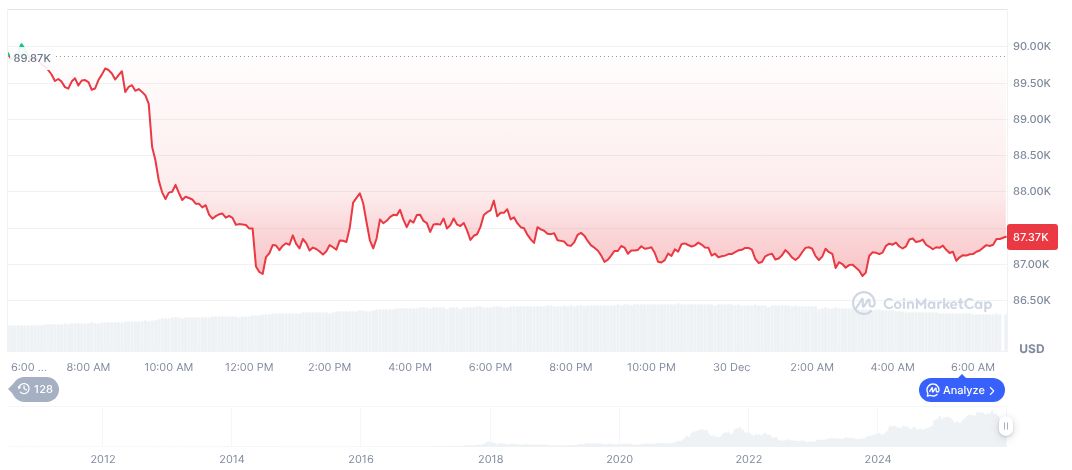

Bitcoin, the leading cryptocurrency, stands at $87,952.55 as of December 30, 2025. Its market cap reached approximately $1.76 trillion, with a dominance of 59.01%. Over the past 90 days, prices have dropped by 25.07%, according to CoinMarketCap, while the last 30 days saw a 3.71% decline.

Coincu research suggests increased scrutiny on exchanges and projects regarding data security measures. Regulatory bodies may intensify their oversight, pushing for stringent guidelines to safeguard user data against future breaches. The shift demands robust technical changes in how data is managed.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |