- Flow blockchain halted due to a $3.9M exploit affecting assets.

- User funds remain secure, deposits unaffected.

- Market sees a temporary dip, with efforts focused on recovery.

Flow’s blockchain halted after attackers exploited a vulnerability, moving approximately $3.9 million in assets on December 27, 2025, prompting a network shutdown for safety measures.

The incident highlights ongoing vulnerabilities in blockchain execution layers, driving significant token price drops and invoking asset freeze requests amid market shock and community concern.

$3.9 Million Exploit Forces Flow Blockchain Pause

Attackers exploited a vulnerability in Flow’s execution layer, moving about $3.9 million in assets before a network halt. The Flow Foundation, together with Dapper Labs, flagged the attacker’s wallet and requested asset freezes from major exchanges.

The attack halted the network to protect user deposits, which remain unaffected. Efforts continue for a network restart with forensic data released by Find Labs. The breach highlights ongoing vulnerabilities in blockchain networks.

The attack profile indicates that the attacker minted 5 million FLOW and sold them, possibly using compromised private keys. — Wazz, Blockchain Analyst

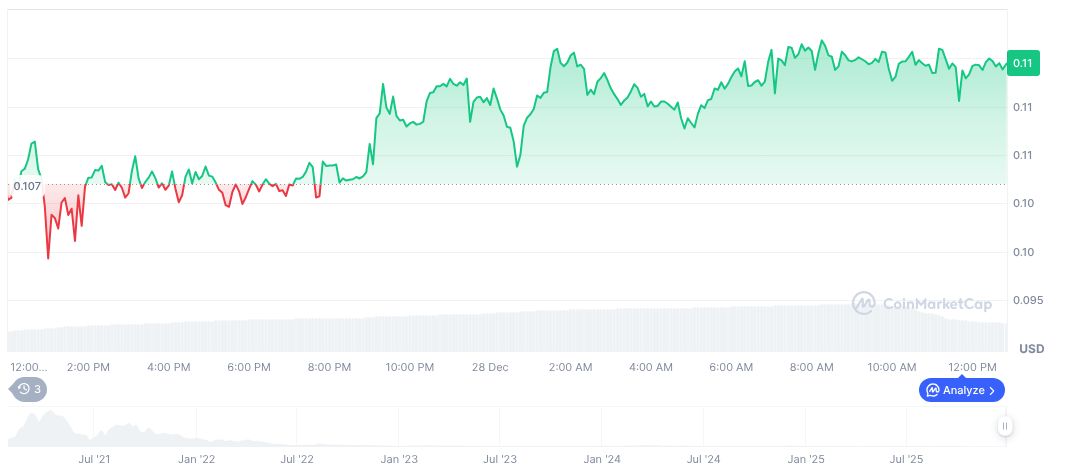

Flow Token Dives 50% Amid Security Vulnerability Concerns

Did you know? Crypto exploits in 2025 surpassed $2.7 billion, showcasing recurring vulnerabilities in cross-chain bridges and smart contracts, similar to Flow’s recent breach.

Flow (FLOW) currently trades at $0.11, with a market cap of $182.42 million and a 24-hour trading volume drop of 36.72% (CoinMarketCap). Over the past three months, FLOW’s value decreased by 68.40%.

Experts from the Coincu research team assert that ongoing developments necessitate robust security measures. Blockchain systems may need technological upgrades to withstand vulnerabilities present in execution layers and bridge infrastructures. Refer to insights shared by PeckShieldAlert for current security trends in the crypto industry.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |