- SEC files lawsuit against VBit CEO for alleged $48.5M fraud.

- Funds reportedly misused for personal expenses and gambling.

- VBit has ceased operations following SEC allegations.

The U.S. SEC has filed a lawsuit against Danh Vo, CEO of VBit, alleging misappropriation of $48.5 million through fraudulent investment in Bitcoin mining.

This case highlights significant financial misconduct risks in cryptocurrency investments, impacting investor trust and regulatory scrutiny within the evolving digital asset market.

SEC Alleges $95.6 Million Raised in Fraud Scheme

On December 18, PANews reported that the SEC filed a lawsuit against Danh Vo, accusing him of fraud related to VBit’s investment activities. Vo purportedly raised over $95.6 million from 6,400 investors via an unregistered “Bitcoin mining custody agreement.” The SEC claims Vo misrepresented the mining operation’s scale and profitability, diverting funds for gambling and family.

The SEC’s legal action has effectively ceased VBit’s operations, uncovering significant concerns within the crypto sector. Investors could see substantial losses, emphasizing the scrutiny on crypto ventures. Regulatory experts stress the need for more stringent regulations to curb similar activities and protect investors more effectively. An article from MLex covers the broader implications of such enforcement actions in the tech industry.

No major crypto key opinion leaders have publicly commented on the SEC’s allegations against Vo. However, the situation has heightened scrutiny of mining companies’ promises and operations, pushing industry insiders to advocate for transparency and regulation compliance.

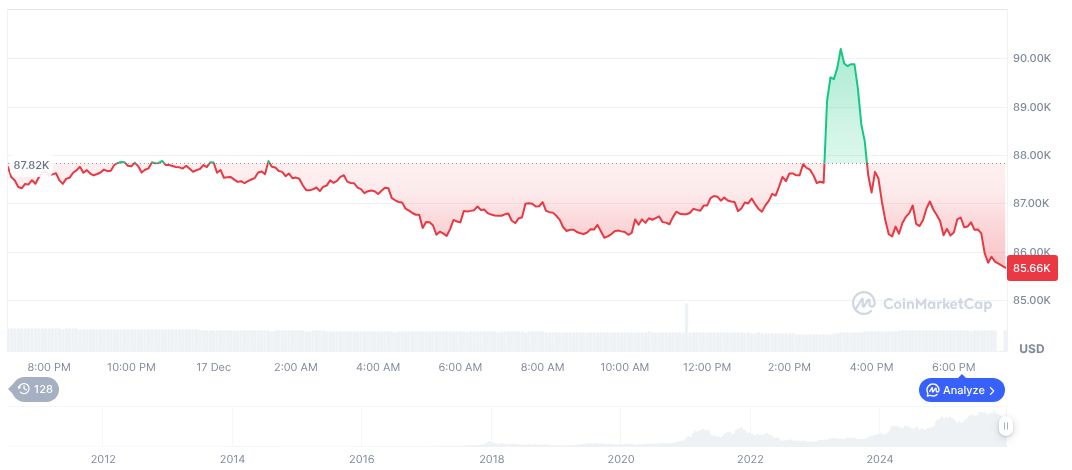

Bitcoin’s Market Reaction and Expert Predictions

Did you know? The SEC’s crackdown on VBit highlights the ongoing regulatory challenges facing the crypto mining sector. With increased scrutiny, industry leaders may push for adopting higher operational standards, potentially redefining mining investments globally.

According to CoinMarketCap, Bitcoin’s current price is $88,151.78 with a market cap of $1.76 trillion. In the last 24 hours, trading volume surged by 25.15% to $46.61 billion, while its price dropped by 2.02%. Bitcoin’s dominant market presence is 59.16% as of December 18, 2025.

Insights from Coincu experts suggest this SEC action might drive tighter regulations and impact investor confidence in crypto investments. Historical precedents indicate regulatory actions can significantly affect market dynamics, reducing the perceived safety of undetermined ventures in the crypto ecosystem.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |