In Brief

- Solana ETF assets top $1.02B, with Bitwise BSOL holding over 66% market share.

- Solana price climbs to $138, gaining 10.92% over the past week.

- Crypto markets rally in 2026, liquidating $765M in shorts and boosting investor confidence.

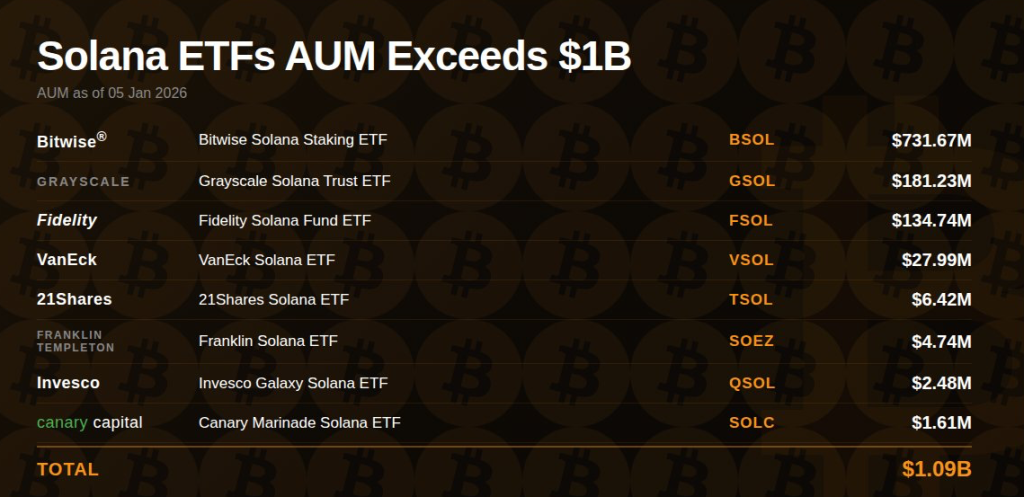

Solana-based ETFs have officially surpassed $1.09 billion in assets under management as of January 5, 2026. Bitwise dominates with $731.67 million in AUM, securing nearly 67% of the total market share. Grayscale’s GSOL and Fidelity’s FSOL follow with $181.23 million and $134.74 million, respectively.

VanEck’s VSOL holds $27.99 million, while smaller ETFs like 21Shares and Franklin Templeton manage $6.42 million and $4.74 million. Invesco’s QSOL and Canary Capital’s SOLC round out the list with $2.48 million and $1.61 million. This strong start to 2026 highlights growing institutional confidence in Solana exposure.

ETF inflows remain consistent, with capital entering the sector for 20 straight trading days. These inflows now total $792 million, showing a clear and sustained investor appetite. Bitwise continues to outperform rivals, helped by its staking-based yield strategy that enhances returns.

Positive Momentum Reflects Broader Crypto Market Optimism

Crypto markets began 2026 with renewed strength after a weak fourth quarter in 2025 left investors cautious. Bitcoin rebounded to over $93,000, helped by $1.49B net Inflow since January 1st. Solana also gained traction, boosted by ETF inflows and broader market confidence.

Analysts now predict a continued bullish trend as markets break away from the traditional four-year cycle model. Institutional leaders remain optimistic, with some projecting substantial long-term returns for Solana. This sentiment is reflected in steady ETF performance and sustained inflows from traditional finance investors.

At press time, Solana trades at $138.03, up 10.92% over the past week and 2.09% in the last 24 hours. Hourly movement shows a modest 0.25% rise, hinting at short-term consolidation. However, the consistent weekly uptrend suggests growing strength and rising confidence among investors.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |