Solana Price Retests $145 Resistance as ETF Inflows Strengthen Trend

In Brief

- Solana retests $145 resistance after sharp rebound from monthly lows below $135.

- ETF inflows hit $41.1M as institutional demand for Solana outpaces Bitcoin and Ethereum.

- New wallet creation drops to 7.3M, signaling weakening network growth amid rising prices.

Solana’s price has rallied back above $140 within days, recovering quickly from its recent monthly low below $135. This move pushes SOL into a long-standing resistance range around $145, tested multiple times since November 2025.

However, past rejections in this zone led to sharp declines of up to 16%, revealing strong overhead supply pressure. This time, the price has corrected only 3%–4% before rebounding, which shows increased bullish resilience and buying interest.

Even so, network data reveals weakening fundamentals that could limit the rally’s sustainability beyond $145. New wallet creation on Solana has dropped sharply, falling from 30.2 million in November 2024 to just 7.3 million.

The slowdown in wallet growth points to reduced user onboarding, which historically has supported stronger price rallies. Without renewed network expansion, Solana could face reduced demand near resistance, raising the risk of another rejection.

ETF Inflows and Positioning Signal Stronger Bullish Bias But Not Without Risks

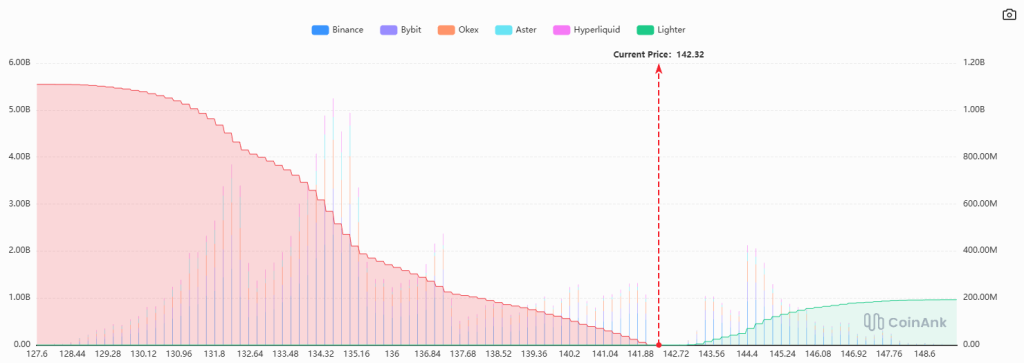

Meanwhile, derivatives data shows heavy long positioning below $142, with $5–5.5 billion in cumulative bids building key price support. In contrast, sell-side liquidity above $144 remains thin, while short interest rises only beyond $145.

Source: X

This suggests bulls currently control positioning, which could support a breakout attempt if momentum continues above current levels. But this setup also increases liquidation risks in the event of a quick reversal and failed breakout.

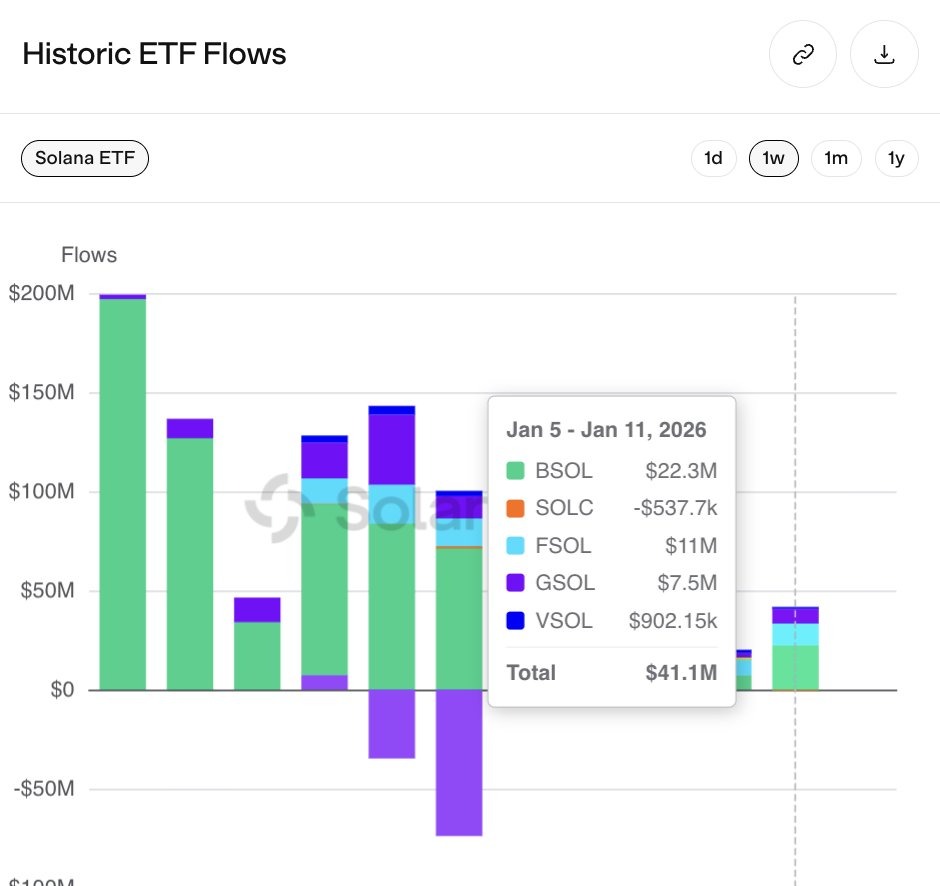

ETF flows further support a bullish bias as Solana-linked spot ETFs saw $41.1 million in net inflows during the week of January 5–11. Total cumulative inflows now stand at $827.7 million, led by BSOL and FSOL, while SOLC recorded slight outflows.

Solana ETF Flows | Source: Solana Floor

These inflows mark a sharp contrast to net outflows in BTC and ETH ETFs, highlighting growing institutional interest in Solana exposure. Together, strong ETF demand and positioning favor an upside attempt, but weakening network growth could temper near-term breakout hopes.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |