- Large AAVE transfer from exchanges to Galaxy Digital’s OTC wallet.

- $51 million involves key market players.

- No formal statements from involved parties.

On-chain analyst Yu Jin reported 210,000 AAVE ($51.32 million) were withdrawn from Binance, OKX, and Bybit to a Galaxy Digital OTC wallet within the past 11 hours.

This large transfer suggests significant market activity potentially involving Multicoin Capital, yet no official updates from involved parties or exchanges have emerged.

$51M AAVE Moved from Exchanges to OTC Wallet

The recent transfer of 210,000 AAVE tokens from major exchanges Binance, OKX, and Bybit, valued at over 51 million USD, to the Galaxy Digital OTC wallet, marks a significant transaction within the crypto ecosystem. Following the withdrawal, these tokens were moved to the 0x73AC address, identified by Nansen as belonging to Multicoin Capital within half an hour.

This potential accumulation by a major investment firm suggests strategic repositioning or entry into holding AAVE assets, impacting market perceptions. The rapid movement from exchanges to an OTC environment could imply reduced immediate liquidity on the platforms involved.

Currently, there are no direct quotes or confirmations from primary sources regarding the recent AAVE withdrawal and related events. Therefore, I’ll recap the structured assessment based on your requirements, which shows a lack of public statements from key players and entities involved in this significant on-chain event.

Historical Context, Price Data, and Expert Analysis

Did you know? In large-scale OTC transactions, this volume movement of AAVE—over 2.5% of its circulating supply—could lead to downstream liquidity effects not immediately visible to retail investors.

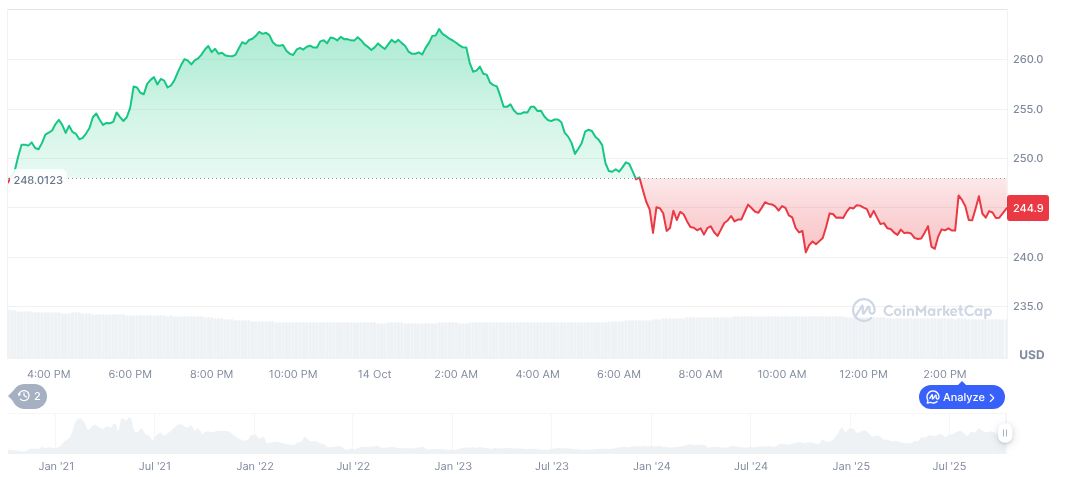

According to CoinMarketCap data, Aave (AAVE) stands at $244.38, with a market cap of $3.73 billion and a 24-hour trading volume of $522.83 million, marking a decrease of 16.63%. During the past 24 hours, AAVE has depreciated by 2.78%. Its declining trend extends to -13.18% over the past week and -19.52% in the last 30 days.

Coincu analysts suggest this significant withdrawal may influence the DeFi landscape by altering AAVE’s short-term supply dynamics. Historically, large accumulations like these have sometimes preceded substantial market shifts. Investors should watch for potential regulatory clarifications and changes in technological infrastructure that might arise from such substantial movements, similar to advisory positions taken by major financial institutions.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |