- BlackRock CEO Larry Fink acknowledges Bitcoin as “digital gold” in October 2025.

- Fink’s remarks reflect a significant shift in institutional sentiment.

- Bitcoin’s legitimacy reinforced by global financial leaders like BlackRock.

BlackRock CEO Larry Fink stated in October 2025 that global digital wallets for cryptocurrencies, stablecoins, and tokenized assets hold over $4.50 trillion.

Fink’s endorsement highlights a significant shift in institutional attitudes toward crypto, increasing Bitcoin’s appeal as ‘digital gold’ and catalyzing further market growth.

BlackRock CEO Acknowledges Bitcoin’s Evolving Role with Market Impact

BlackRock CEO Larry Fink’s admission of Bitcoin as “digital gold” represents a substantial change in his earlier perspective. Formerly skeptical, Fink now acknowledges Bitcoin’s role in modern finance. His statement came during an interview in October 2025, highlighting complex shifts in institutional outlooks.

The shift signals growing acceptance of Bitcoin among institutional investors. Such endorsements from major financial leaders are enhancing Bitcoin’s position in global markets. Increased legitimacy could drive further adoption, influencing both mainstream financial entities and retail investors.

Market reactions varied, but Bitcoin’s value and interest surged from these insights. No immediate official data supports the $4.5 trillion figure cited by some reports, but growing institutional involvement is evident through market movements and asset inflows. As Larry Fink mentioned in a CBS 60 Minutes interview, “The market teaches you to always rethink your assumptions. […] It is not a bad asset, but I don’t believe it should be a large component of your portfolio.”

Bitcoin’s Market Dynamics Under Scrutiny amid Institutional Endorsements

Did you know? The term “digital gold,” now used by Larry Fink to describe Bitcoin, reflects its evolving role similar to gold following major endorsements by public companies like MicroStrategy and Tesla in past years.

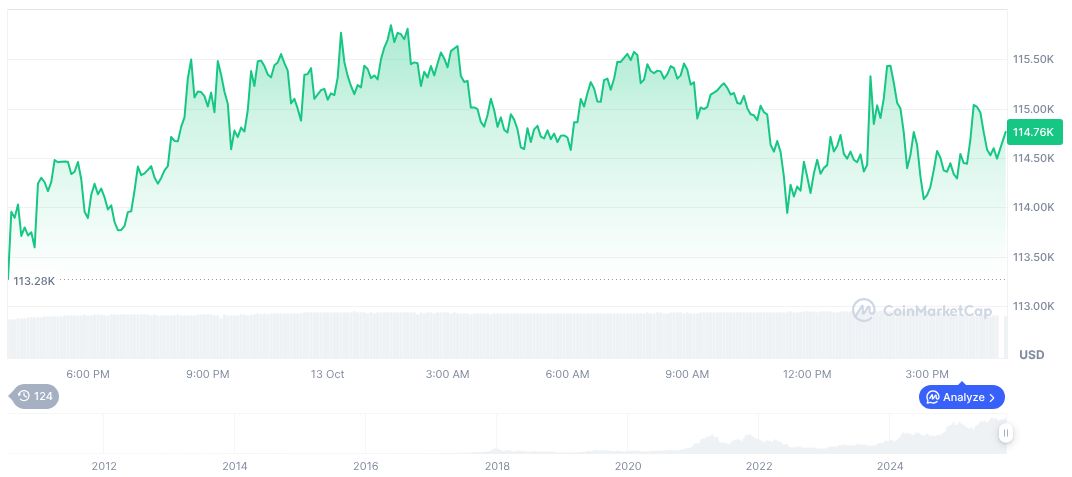

As of October 14, 2025, Bitcoin (BTC) holds a market price of $111,192.58 with a market cap just exceeding $2.22 trillion, according to CoinMarketCap. Holding a 59.01% dominance, Bitcoin displays notable market presence despite recent declines—down 2.80% over 24 hours and 10.69% over the week.

Insights from Coincu analysis suggest such high-profile endorsements could bolster Bitcoin’s integration into traditional investment portfolios. As institutions recognize its potential, Bitcoin may secure a firmer foothold amid growing discussions on financial, regulatory, and technological advancements. For further insight, Larry Fink’s perspectives are elaborated in the Larry Fink’s Annual Chairman’s Letter.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |