- Coinbase launches deBridge (DBR) on October 29; liquidity dependent.

- deBridge (DBR) sees increased exposure post-listing.

- No major liquidity shifts expected beyond immediate trading volume.

Coinbase is set to launch deBridge (DBR) spot trading on October 29, making the DBR-USD pair available if liquidity conditions are satisfied.

This listing could impact DBR’s liquidity and market capitalization, as Coinbase listings often lead to increased trading activity and price fluctuations.

Coinbase Expands Token Offering with deBridge (DBR)

Coinbase’s announcement on adding deBridge (DBR) to its trading platform on October 29 marks another attempt by the exchange to expand its token offerings. The listing will initially be conditional upon meeting certain liquidity thresholds before enabling trading for the DBR-USD pair in eligible areas.

By introducing DBR, Coinbase provides increased accessibility and potential exposure for deBridge, a protocol focusing on cross-chain bridge technology. However, the move may not substantially alter DBR’s standings or directly affect broader crypto assets like ETH.

Community engagement remains quiet, with no official responses from the deBridge team on social channels. Despite the listing, industry and regulatory responses appear subdued, as documented by recent analysis.

deBridge (DBR) Listing: Market Analysis and Forecast

Did you know? Historically, Coinbase listings increase token visibility, sometimes causing short-term trading surges before stabilization.

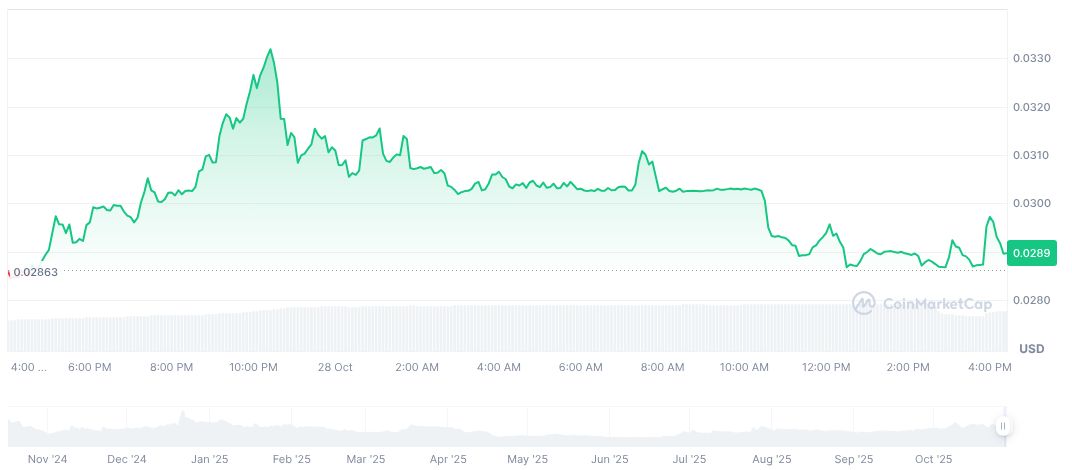

According to CoinGecko, deBridge (DBR) trades at $0.03 with a market cap of $55.73 million. The token’s 24-hour trading volume increased by 25.70%, reflecting a recent shift in market activity. DBR’s circulating supply is over 1.92 billion.

Expert commentary from the Coincu research team suggests that while deBridge’s listing may temporarily boost trading activity, the broader regulatory implications remain minimal. As documented in official channels:

No direct quote available, but the launch date is confirmed for October 29 at 9 AM Pacific Time, contingent on liquidity conditions.

Observations indicate limited long-term financial shifts unless accompanied by substantial ecosystem developments.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |