- Fed’s cautious interest rate stance delays USD and crypto market reactions.

- Delayed data creates uncertainty; USD initially benefits as a safe haven.

- Crypto markets watch closely for possible trend reversals post-data release.

Analyst Francesco Pesole from ING Bank stated on October 14th that Federal Reserve Chairman Powell’s cautious stance on interest rate cuts could strengthen the US Dollar.

This stance impacts global markets, heightening USD volatility amid delayed employment data and potential crypto market effects.

Fed’s Stance Amplifies USD Concerns Amid Data Delays

The USD faces upside risks as a safe haven initially; however, its strength could diminish if the released data highlight a deteriorating employment landscape.

Economic stakeholders eagerly anticipate Powell’s further communications and the eventual release of employment figures. Francesco Pesole stressed that the market’s response hinges critically on this data, which may ultimately influence the USD’s path and, consequently, crypto market trends.

“If US macro data resumes and comes in weaker than expected, the market may pivot dovishly towards the Fed, potentially pressuring the USD and invigorating an environment for crypto rallies.” – Francesco Pesole, FX Analyst, ING Bank, ING Forecasts

Crypto Markets Eye USD Movements Post-Government Shutdown

Did you know? In past government shutdowns, such as in 2018-2019, USD initially gained strength only to weaken later upon negative economic data disclosures. Crypto markets tended to rally with the USD’s depreciation.

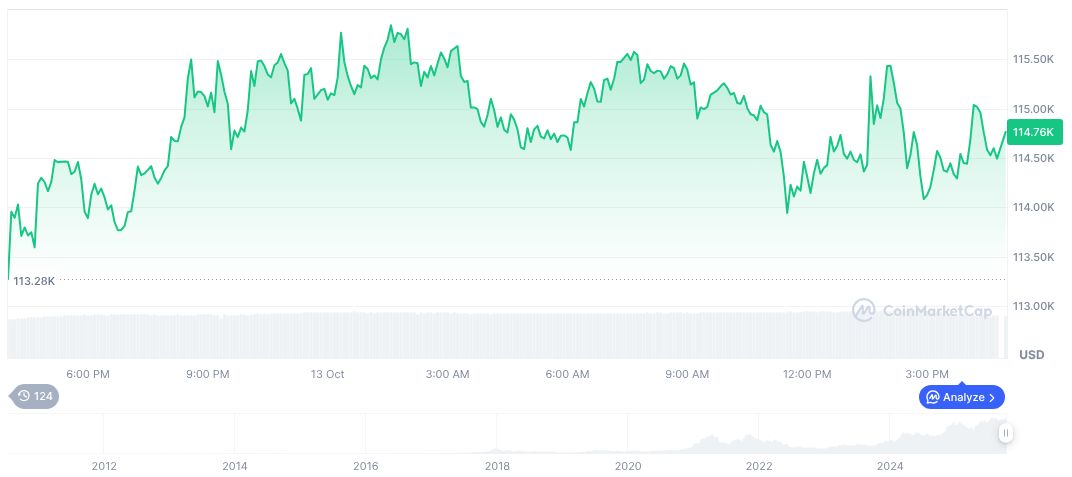

As of October 14, 2025, Bitcoin (BTC) is valued at $111,679.24 with a market cap of $2.21 trillion and a 24-hour trading volume of $79.39 billion—a decline of 16.01%. Bitcoin’s price has decreased by 3.76% in the past 24 hours, according to CoinMarketCap.

Coincu researchers suggest that a potential Fed dovish turn could strengthen crypto markets. Historical trends indicate that market anticipations around USD fluctuations and Federal Reserve decisions can trigger volatility and promote crypto market activity.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |