- Fnality raised $136 million for expanding its blockchain-based settlement network.

- Institutional commitment strengthens blockchain financing innovations.

- Market implications extend to tokenized bonds and repurchase transactions.

BlockBeats News reported that London-based blockchain startup Fnality raised $136 million in Series C funding on September 23rd to expand its global bank settlement network.

This significant funding aims to enhance Fnality’s interoperability and liquidity tools, potentially impacting tokenized asset transactions and facilitating financial market integration with blockchain technology.

Fnality’s $136M Boost for Blockchain Infrastructure

Fnality’s Series C funding, led by WisdomTree, Bank of America, and other leading investors, marks a significant development in blockchain payment systems. The startup plans to extend its network to major currencies, utilizing real-time settlement channels backed by the Bank of England.

The expansion promises enhanced interoperability between traditional and decentralized finance. Fnality aims to build liquidity tools and incorporate stablecoins into its settlements, aligning with institutions’ digital asset strategies.

Market reactions reveal strong confidence from institutions, as evidenced by Jonathan Steinberg, CEO of WisdomTree, stating, “Our investment in Fnality reflects our ambition to plug directly into the rapidly growing tokenized markets.”

Analysis: Regulatory Hurdles and Financial Innovations Ahead

Did you know? Fnality raised approximately $67 million in 2019 to develop its Utility Settlement Coin, attracting major bank interest for secure blockchain-based transactions.

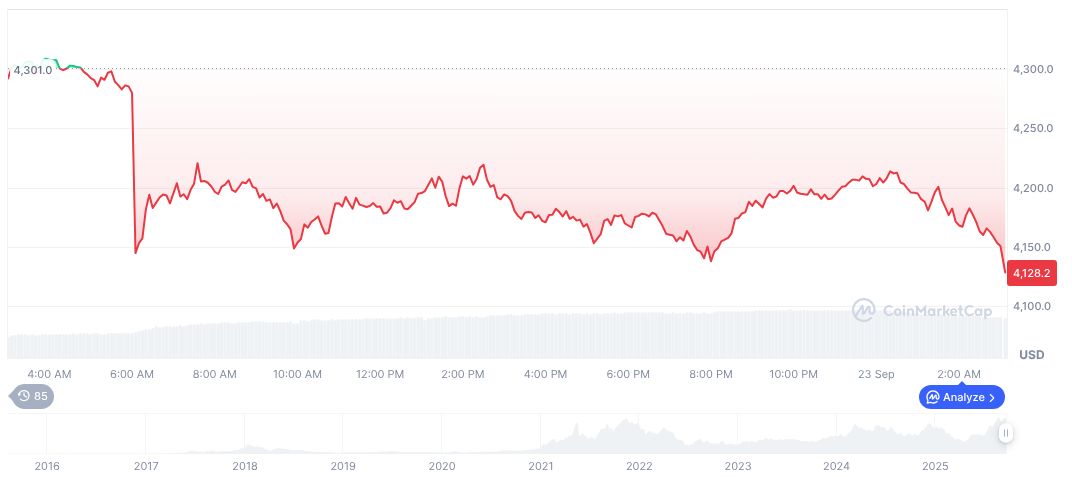

Ethereum‘s (ETH) price stands at $4,193.76, with a market cap of $506.20 billion and a trading volume decrease of 26.72% over 24 hours, as reported by CoinMarketCap. Price changes include a 0.27% hike in 24 hours and a significant 73.41% rise over 90 days.

Coincu’s research highlights possible regulatory challenges, especially concerning USD and EUR markets, pending approvals from central banking authorities. The financial landscape is evolving, with inter-bank blockchain settlements gaining traction among traditional finance institutions.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |