- Hyperliquid tests BorrowLendingProtocol on Hypercore, impacting USDC and PURR.

- Market speculation affects HYPE token price movements.

- Analyst discussions focus on potential multi-margin trading features.

The Hyperliquid team is testing the BorrowLendingProtocol (BLP) on its Hypercore testnet, involving USDC and PURR tokens, in early November according to MLM on X.

The development suggests potential for a native lending market, impacting USDC and PURR usage, while the HYPE token experienced a price upswing amid market speculation.

Hyperliquid’s BLP Testnet Sparks Ecosystem Speculation

The Hyperliquid team is testing a protocol known as BLP, suggested to stand for BorrowLendingProtocol, on the Hypercore testnet. This protocol is anticipated to facilitate lending, providing, and withdrawing functionalities. Currently, only USDC and PURR tokens are supported on this testnet. Rumors suggest a native borrowing lending market could be in development, but concrete details have yet to materialize from the team.

As BLP testing unfolds, there is increased speculation regarding its influence on the Hyperliquid ecosystem, especially its potential to underpin multi-margin trading. Despite the high interest, specifics about an underlying lending layer remain speculative, as official confirmations are lacking.

Market reactions have been notable, especially from HYPE token movements, experiencing a ~7% price uptick after the news. DeFi analyst MLM highlighted the uncertainty surrounding the possible inclusion of multi-margin trading features within BLP, urging caution amid the speculative environment.

“The Hyperliquid team is currently testing a protocol called BLP on the Hypercore testnet. It’s speculated that BLP stands for BorrowLendingProtocol, seemingly a native lending market on Hypercore, with functions for lending, providing, and withdrawing.” – PANews report

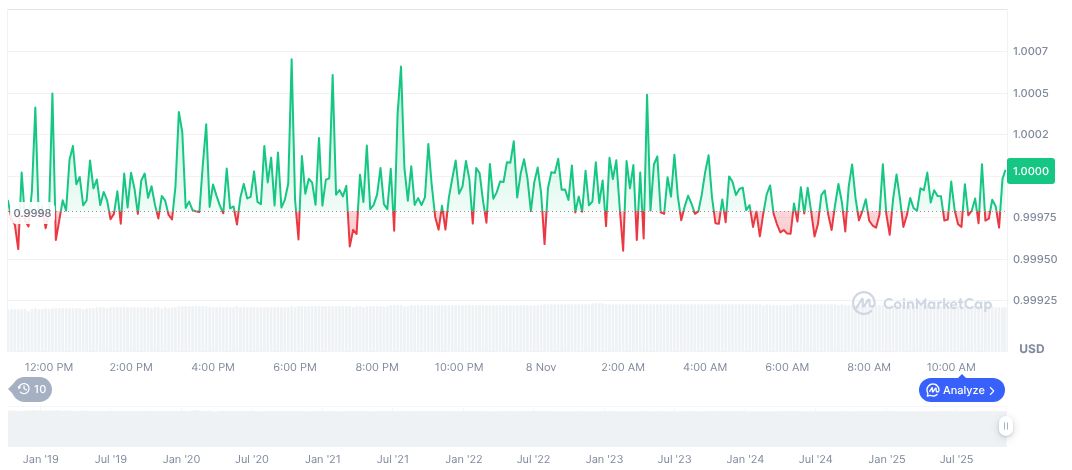

USDC Market Steadiness Despite DeFi Innovations

Did you know? Curve’s lending markets and Uniswap’s liquidity modules both saw major volume spikes on mainnet launch. Similar advancements in DeFi historically led to notable trading volume and utilization upticks.

On November 8, 2025, USDC remains a widely circulated stablecoin with a market cap of $75.71 billion and a trading volume decline of 47.46%. Its stable price is noted at $1.00 with nearly steady demand over the past 90 days, as per CoinMarketCap data.

Expert analysis suggests that introducing innovative lending protocols like BLP could potentially impact DeFi by increasing liquidity and providing advanced trading mechanisms. However, official confirmation and detailed release plans are awaited for clear assessments.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |