- Revolut introduces zero-fee USD to stablecoin swap service.

- Aims to alleviate currency exchange pain points.

- Impacts SMEs in regions with high economic volatility.

Revolut Ltd. has introduced a zero-fee USD-to-stablecoin exchange, allowing users to swap large sums on multiple blockchains without transaction fees or currency spreads.

This initiative simplifies crypto-fiat interactions, enhancing financial efficiency for firms in volatile economies.

Revolut Implements Zero-Fee Stablecoin Exchange on Six Blockchains

Revolut’s new feature allows for zero-fee USD-to-stablecoin exchanges, utilizing blockchains like Ethereum and Solana. Led by Leonid Bashlykov, this step addresses liquidity and operational challenges in crypto transactions, aiming to streamline financial operations for its users.

Businesses in economically unstable regions stand to benefit from this service, minimizing foreign exchange losses and transaction costs. Turkish companies can now optimize capital management with easier stablecoin transactions, reducing barriers to cross-border payments and currency exchange expenses.

Market participants describe the launch as transformative, particularly for capital management in high-volatility areas. Leonid Bashlykov stated that this initiative removes “all anxiety” of fiat-to-crypto transactions, enhancing financial strategies for affected businesses.

Stablecoin Market Dynamics and Regulatory Potential

Did you know? Revolut’s initiative helps Turkish businesses by reducing currency exchange losses and transfer fees, crucial in overcoming local economic instability.

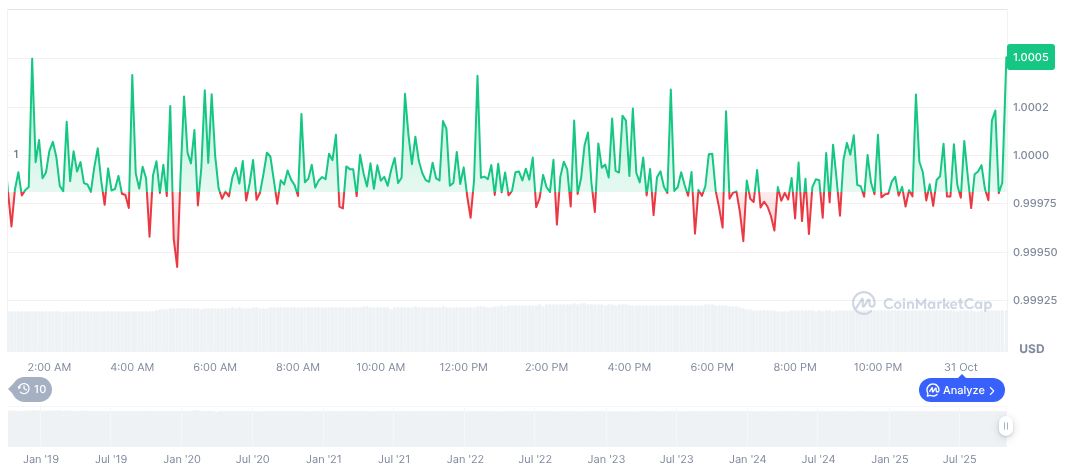

USDC’s current price remains at $1.00 with a market cap of $75.75 billion as reported by CoinMarketCap. Despite minor fluctuations, its stable value over recent months reflects confidence amidst market challenges, with 24-hour trading volume at $19.24 billion and a slight decrease of 12.42%.

Research from Coincu highlights potential regulatory benefits, anticipating changes in stablecoin regulatory frameworks globally. As firms adapt to Revolut’s model, enhanced cross-chain liquidity and efficient capital flows could redefine the future dynamics of financial services.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |