- Trump pardons Binance’s CZ, prompting market rally and political debate.

- Market reaction boosts BTC, ETH, XRP prices over 7.5%.

- Waters condemns pardon, labeling it corrupt pay-to-play.

Changpeng Zhao, founder of Binance, was granted a presidential pardon by US President Donald Trump on October 24, 2025, following a recommendation amid public controversy over his prosecution.

The pardon provoked significant reactions, with accusations of corruption and resulting shifts in cryptocurrency prices, sparking debates about the intersection of politics and crypto industry regulation.

Trump’s Pardon Spurs Crypto Market Surge and Controversy

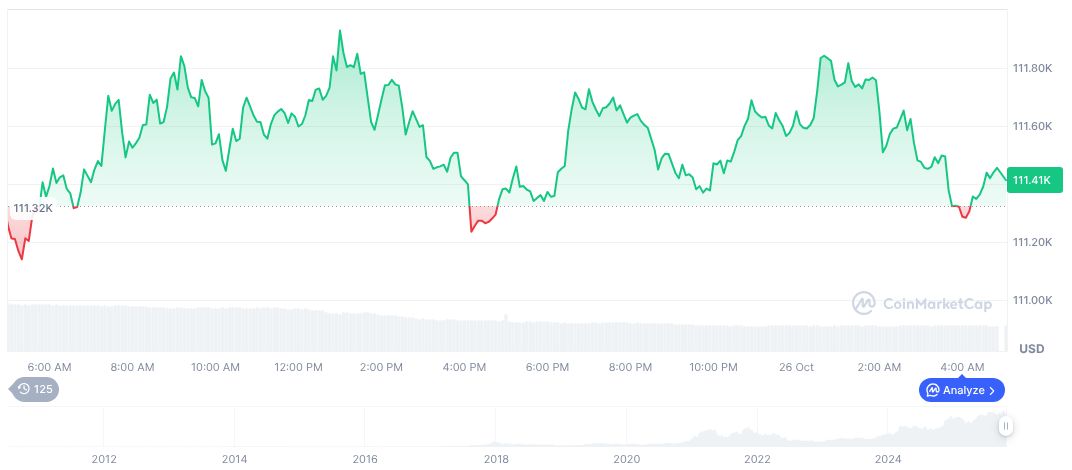

Trump pardoned Changpeng Zhao, founder of Binance, after lobbying from Zhao’s supporters. Zhao had pled guilty to money laundering charges and settled with the US DOJ and is now free of those charges. Key cryptocurrencies like BTC, ETH, and XRP spiked in response to the news, reversing weeks of declines. These price movements were driven largely by improved market sentiment following the pardon. Critics like Congresswoman Waters have labeled the pardon as pay-to-play corruption, citing Zhao’s financial connections to Trump’s business interests. Trump defended his decision, stating Zhao’s prosecution was unjust.

Despite the criticism, the market’s positive response indicates investor optimism following the pardon.

“I don’t know him. I don’t believe I’ve ever met him, but I’ve been told by a lot of support. He had a lot of support and they said that what he did is not even a crime. It wasn’t a crime that he was persecuted by the Biden administration. Uh and so I gave him a pardon at the request of a lot of very good people.” — Donald Trump, President, United States

Bitcoin Soars Past $115K as Regulatory Talks Intensify

Did you know? Market rallies are not uncommon following presidential pardons, especially amidst negative sentiment in financial sectors.

Bitcoin’s price surged to $115,285.69, with a market cap exceeding $2.29 trillion. CoinMarketCap data shows a 24-hour trading volume of $43.81 billion, reflecting an 82.49% increase. The past week saw Bitcoin’s price rise by 6.70%, reaching its highest in weeks. Recent national policies could align with technological progress, says Coincu research. Enhanced regulatory frameworks may stabilize crypto exchanges, though challenges such as transparency persist. Active discussions on regulation and market structures may lead to significant shifts in the industry’s landscape.

Despite the criticism, the market’s positive response indicates investor optimism following the pardon.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |