- The U.S. Treasury yield fell to 4% for the first time since September 17th.

- Potentially shifts investment interest towards riskier assets like cryptocurrencies.

- Cryptocurrencies could see increased demand amid changing financial landscape.

On October 14th, the U.S. 10-year Treasury yield fell by 4 basis points to 4%, marking the first occurrence since September 17th, according to Xinhua Finance.

This decline could shift investor interest towards riskier assets, including cryptocurrencies, as they search for better returns amid changing interest rates.

Treasury Yield Hits Lowest Since Mid-September: Crypto Implications

On October 14th, the U.S. 10-year Treasury yield dropped by 4 basis points, achieving 4% for the first time since September 17th, as reported by BlockBeats News. This event, noted by experts, indicates investor movement due to altered interest rate expectations. Investors are particularly attentive to this trend, questioning its implications for broader financial markets.

Many investors are now considering the pivot to riskier assets, cryptocurrencies being a prime example, as Treasury yield adjustments can often signal broader shifts in investment strategies. Historically, such changes have led market players to explore digital assets offering potentially higher returns.

Responses from industry leaders have yet to surface directly concerning this yield dip. However, the crypto community is keenly observing potential impacts on Bitcoin (BTC) and Ethereum (ETH) as alternatives to traditional financial instruments. The yield shift encourages a fresh look at new asset classes and portfolio adjustments.

“With Treasury yields declining, investors are seeking alternatives to preserve their purchasing power, which often leads them to consider Bitcoin.” – David Rosenberg, Chief Economist, Rosenberg Research

Bitcoin Slips 3.83% as Investors Eye Regulatory Changes

Did you know? Changes in Treasury yields often lead investors to cryptocurrencies for potential gains, as seen in past yield adjustments.

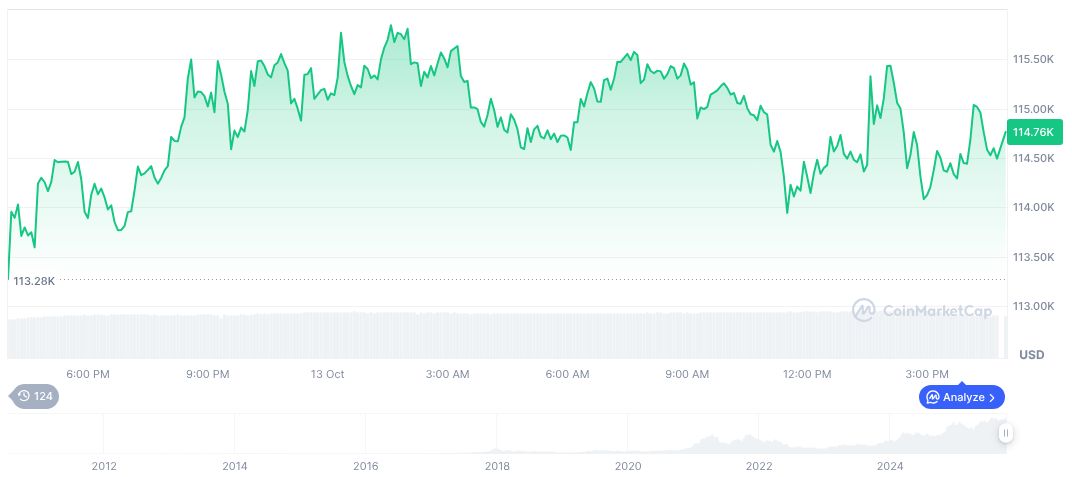

Bitcoin (BTC), currently valued at $110,722.23, with a market cap of 2.21 trillion, witnessed a 3.83% drop in 24 hours as trading volume decreased 17.70% to 77.30 billion. In recent months, prices fell 4.58%, with supply at 19.93 million as per CoinMarketCap.

According to Coincu, analysts suggest the shifting Treasury yield landscape could drive regulatory interest as governments evaluate economic policies. Technological innovation in crypto could further attract institutional investment and shape future economic structures, highlighting crypto’s appeal in volatile times.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |