Key Insights:

- XRP faces rejection at $3.10 resistance, testing $3.00 as key support for bullish continuation.

- A bullish pennant pattern signals possible upside toward $5–$6 if momentum continues into late October.

- RSI and price structure show short-term consolidation as the market awaits confirmation above the $3.00 level.

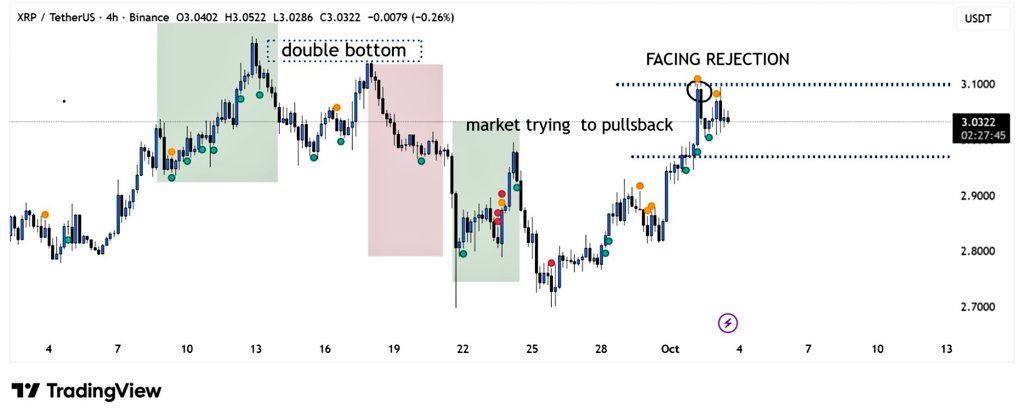

XRP reached $3.10 before meeting resistance and pulling back slightly. The move came after a strong rally from a double bottom pattern, which had acted as a bullish reversal setup. The price is now trading close to $3.00, a level that remains important for keeping market structure intact.

At the time of writing, XRP was priced at $2.99, with a 1% decline in the last 24 hours and a 7% gain over the week. Trading volume stands at $5.64 billion, showing continued activity as traders monitor whether buyers can defend the $3.00 level.

Chart Structure Points to a Pullback Zone

The 4-hour chart shows XRP has moved into a short-term pullback phase after hitting the $3.10 resistance zone. The earlier breakout from the double bottom pattern lifted the price sharply, but sellers have since stepped in. The nearest support sits around $3.00 to $2.95, where buyers are expected to respond.

Market watcher BitGuru stated,

“$XRP formed a double bottom that pushed price higher, but now it’s facing rejection near $3.10.”

The post added that “holding above $3.00 will be key for bulls to regain momentum.” The data supports this view, as a close above this range could keep the market setup bullish.

Pennant Pattern Signals Possible Upside Toward $5–$6

A separate analysis from XRPunkie shows XRP forming a bullish pennant pattern on the daily chart. The post mentions a technical target near $5.70, suggesting the move could extend to $6.00 by late October if the breakout matches the strength and timing of the previous rally.

Fibonacci projections on the same chart show intermediate resistance at $5.74 and $6.17.

The analyst wrote,

“The technical target of this pennant is around $5.70+-. If the length and time of the breakout is the same as the previous breakout, that should put $XRP around $5–$6 by late Oct.”

The scenario remains speculative but shows growing focus on XRP’s potential continuation pattern.

Key Levels to Watch in the Short Term

The key resistance remains at $3.10, with $3.00 acting as immediate support. Holding above this level will be critical for buyers to maintain momentum. A rebound could keep the trend structure bullish, while a move below $3.00 may lead to further consolidation.

Market participants are watching closely as XRP trades near a crucial point. Whether it holds above $3.00 will decide if the next move continues upward or pauses for a correction.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |