Bitcoin trading volume will reflect the excitement of the market. If fully synthesized in terms of mass, it can give the observer a new perspective.

The latest observation by Alex Krüger (@krugermacro) suggests that there are very few times when Bitcoin transaction volume has reached a record like now.

Just observing the volume on certain exchanges or spot volume alone will not be able to objectively assess the excitement of the market. Alex Krüger made a synthetic observation and made the following observations:

- There are only a few special moments when the volume spikes. Those are March 2020, May 2021, and May 2022. The surge of May 2022 came from the Luna incident and was followed by a series of domino collapse effects.

- History shows that these spikes are the bottoms of the market for a medium to long-term recovery/growth phase. What is even more special is that the current period is the period of the highest total Bitcoin (spot and future) trading volume ever.

Thus, from this perspective, Bitcoin is likely entering a new bull cycle. The wait until this cycle kicks in after a volume spike can be as long as 4-5 months.

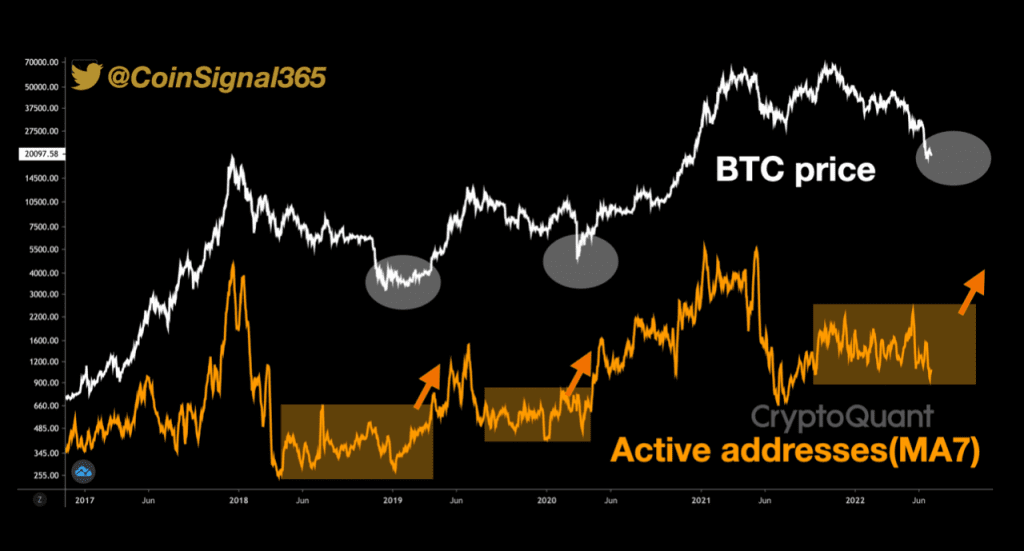

CoinSignal365’s observations provide yet another perspective on the current state of Bitcoin. The downtrend is still happening. But this is an early signal to see the uptrend coming back.

- In the period from ATH $69,000 to now, the number of active addresses of Bitcoin has not spiked anymore. It reflects that new investors are no longer constantly entering the market and trading.

- Meanwhile, the trading role of the new investor (or returning investor) is the driving force behind a recovery/growth. Volume can increase, but it needs to be investor volume to come back.

If Alex Krüger’s Bitcoin volume is viewed as a long-term prediction, CoinSignal 365’s observation is an early signal for the above long-term cycle.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join CoinCu Telegram to keep track of news: https://t.me/coincunews

Follow CoinCu Youtube Channel | Follow CoinCu Facebook page

Harold

CoinCu News