Chainalysis analysts have discovered the root cause of the Terra ecosystem falling into disrepair and causing an estimated $60 billion in damage to the industry as a whole. According to a recent report, two traders triggered the TerraUSD (UST) stablecoin disaster as well as the entire Terra ecosystem.

Uncover the cause of Terra’s collapse

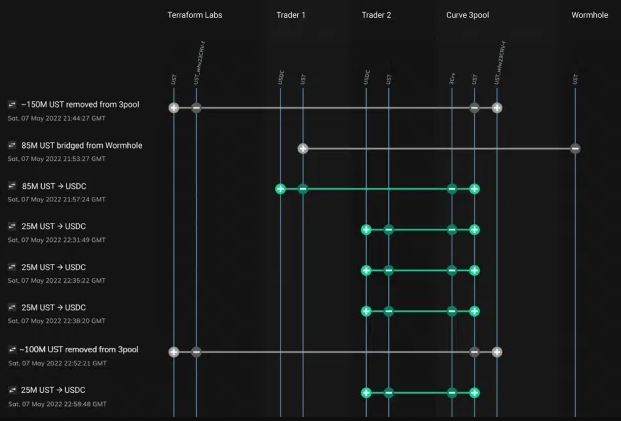

According to experts, it all started on the night of May 7, when Terraform Labs withdrew 150 million UST from the 3pool liquidity pool based on Curve according to the operational plan. Such a large move has increased the pool’s volatility, analysts say.

Just 13 minutes later, a large trader discovered the vulnerability and traded 85 million UST for USDC to increase volatility.

Over the next hour, another trader converted a total of 100 million UST to USDC in 4 consecutive trades, driving volatility even higher. As such, manipulators need less than $200 million to completely destroy a thriving $60 billion ecosystem.

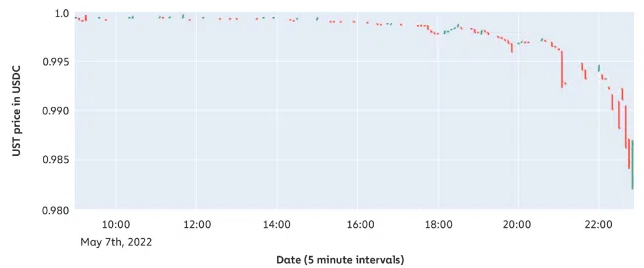

Consequences: UST lost its peg against the US dollar

In response to these actions, Terraform Labs withdrew an additional 100 million UST from 3pool to “balance” the UST rate against other stablecoins.

However, previous large trades as well as many smaller ones broke the UST’s peg to the US dollar.

On May 8 and 9, three unknown UST holders converted a total of $480 million USDT into UST to save the project and balance the 3pool.

Also on May 9, Luna Foundation Guard (LFG) sold billions of dollars in Bitcoin to convert into UST. However, on May 10, the reserves were exhausted and the UST rate was still plunging.

In just the first few days of May, the price of UST freely fell from $1 to $0.12. The native token LUNC (formerly LUNA) of the Terra ecosystem was also affected, losing nearly 100% of its value.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join CoinCu Telegram to keep track of news: https://t.me/coincunews

Follow CoinCu Youtube Channel | Follow CoinCu Facebook page

Harold

CoinCu News