Decentarlized is a term that is no longer unfamiliar to those who are interested in cryptocurrencies, so what about Decentralized Autonomous Organization. An organization in which the participants will have the same voting. So whether this is a really necessary organization for the development of blockchain, weaknesses and strengths. Let’s find out more detail.

What is Decentralized Autonomous Organization (DAO)?

A decentralized autonomous organization (DAOs) is an entity with no central leadership. Decisions get made from the bottom-up, governed by a community organized around a specific set of rules enforced on a blockchain.

Think of them like an internet-native business that’s collectively owned and managed by its members. They have built-in treasuries that no one has the authority to access without the approval of the group. Decisions are governed by proposals and voting to ensure everyone in the organization has a voice. There’s no CEO who can authorize spending based on their own whims and no chance of a dodgy CFO manipulating the books. Everything is out in the open and the rules around spending are baked via its code.

- Member-owned communities without centralized leadership.

- A safe way to collaborate with internet strangers.

- A safe place to commit funds to a specific cause.

Why do we need DAOs?

You need to have a lot of faith in the individuals you’re working with if you want to start an organization with them that entails fundraising and money. But it’s difficult to believe someone you’ve only ever communicated with online. You just need to trust the DAO’s code, which is completely transparent and verifiable by anybody, while using DAOs; you don’t need to trust the other members of the group. This opens up so many new opportunities for global collaboration and coordination.

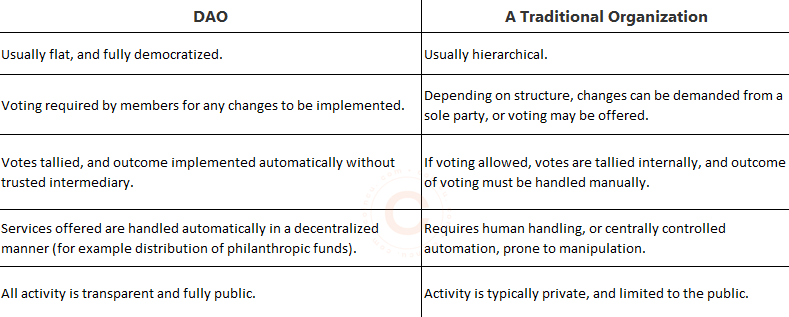

A comparison

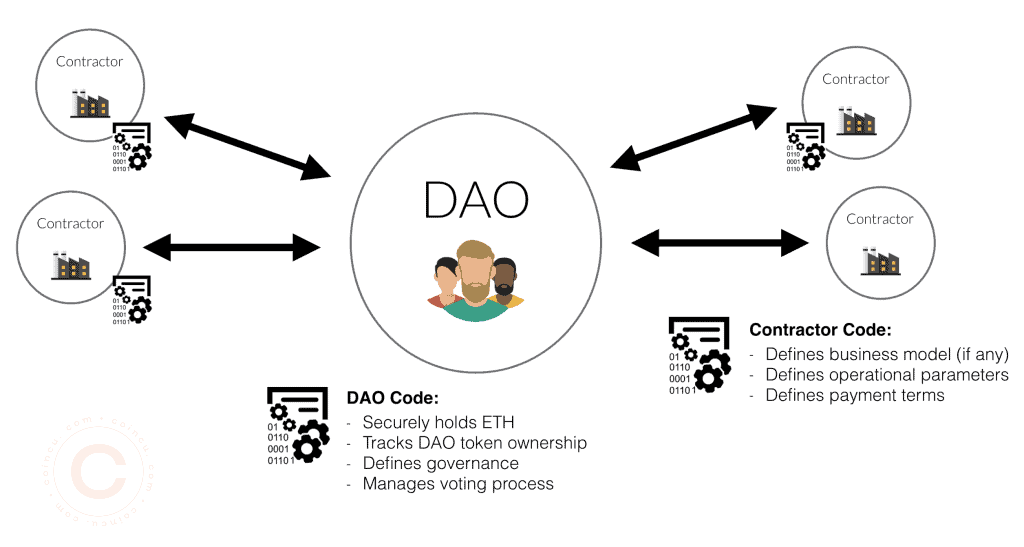

How does a DAO work?

To help this make more sense, here’s a few examples of how you could use:

- A charity – you can accept membership and donations from anyone in the world and the group can decide how they want to spend donations.

- A freelancer network – you could create a network of contractors who pool their funds for office spaces and software subscriptions.

- Ventures and grants – you could create a venture fund that pools investment capital and votes on ventures to back. Repaid money could later be redistributed amongst members.

The backbone of a DAO is its smart contract. The contract defines the rules of the organization and holds the group’s treasury. Once the contract is live no one can change the rules except by a vote. If anyone tries to do something that’s not covered by the rules and logic in the code, it will fail. And because the treasury is defined by the smart contract too that means no one can spend the money without the group’s approval either. This means that don’t need a central authority. Instead, the group makes decisions collectively, and payments are automatically authorized when votes pass.

These smart contracts establish the DAO’s rules. Those with a stake in a DAO then get voting rights and may influence how the organization operates by deciding on or creating new governance proposals. This model prevents being spammed with proposals: A proposal will only pass once the majority of stakeholders approve it.

And it are fully autonomous and transparent. As they are built on open-source blockchains, anyone can view their code. Anyone can also audit their built-in treasuries, as the blockchain records all financial transactions.

DAO membership

There are different models for membership. Membership can determine how voting works and other key parts.

Token-based membership: Usually fully permissionless, depending on the token used. Mostly these governance tokens can be traded permissionlessly on a decentralized exchange. Others must be earned through providing liquidity or some other ‘proof-of-work’. Either way, simply holding the token grants access to voting.

Share-based membership: Share-based are more permissioned, but still quite open. Any prospective members can submit a proposal to join, usually offering a tribute of some value in the form of tokens or work. Shares represent direct voting power and ownership. Members can exit at any time with their proportionate share of the treasury.

Reputation-based membership: Reputation represents proof of participation and grants voting power. Unlike token or share-based membership, reputation-based DAOs don’t transfer ownership to contributors. Reputation cannot be bought, transferred or delegated; Members must earn reputation through participation. On-chain voting is permissionless and prospective members can freely submit proposals to join and request to receive reputation and tokens as a reward in exchange for their contributions.

DAO Examples

DAO Maker requires that users lock up a fixed minimum number of tokens in order to participate in launches. Users must stake at least 500 DAO in DAO Maker’s vaults. Users will receive 1 power for every DAO staked. Users can also triple their power by staking DAO-USDC Uniswap LP tokens instead. By staking , users also earn a yield in the form of a selected project token, e.g. Evolution (EVN), Yield Protocol (YIELD), Open Ocean (OOE).

Users allocate their power to the sale they want to participate in. This then enters them into a lottery to win an allocation. The more power a user allocates to a sale, the better their chances of winning. According to the official guidelines, users are separated into one of five tranches depending on the number spent, these tranches are:

- Tranche 1: 500–999 DAO Power

- Tranche 2: 1,000–1,999 DAO Power

- Tranche 3: 2,000–3,999 Power

- Tranche 4: 4,000–9,999 Power

- Tranche 5: 10,000+ Power

Each tranche brings with it an increased chance of winning. If a user wins a participation slot, their allocation will be automatically funded by their USD Coin (USDC) balance, and their DAO power will be locked for 10 days — after which it resets. Unsuccessful users will be free to spend their DAO power again right away.

Verdict

With the basic information above, hope you can understand more about DAO. In the following sections, we will go into the problems that the DAO is facing and the solutions for the DAO.

If you have any questions, comments, suggestions, or ideas about the project, please email ventures@coincu.com.

DISCLAIMER: The Information on this website is provided as general market commentary, and does not constitute investment advice. We encourage you to do your own research before investing.

Alan

Coincu Ventures