In a Twitter thread, DeFi trader Vivek Raman argued that Ethereum’s Merge will not reduce network fees as many would expect.

According to his tweet, the high gas fees on Ethereum are due to increased demand for block space rather than a function of the “consensus mechanism”. The purpose of Merge is to deprecate the PoW consensus mechanism and replace it with PoS.

He concludes that network fees will not decrease. Instead, users can use layer 2 solutions to reduce costs.

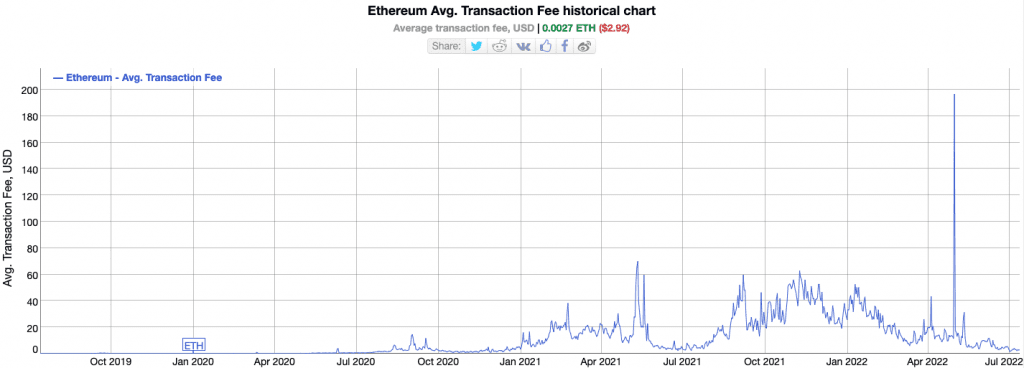

Ethereum’s high transaction fees are a no-brainer in the crypto space. This shortcoming has pushed many users to rival layer 1 blockchains like Solana, Cardano, and others with lower gas fees.

However, the average gas fee on Ethereum recently hit a low of $1.57, according to data from BitInfoCharts.

Vivek disagrees with the view that ETH’s PoS network will not be secure. According to him, Ethereum will be more secure after Merge because it costs more computation to attack.

He cites a post by Vitalik Buterin to back up his point. According to Buterin, the PoS network has a superior blockchain security mechanism compared to PoW.

Ethereum will become less energy-consuming after Merge. This is one of the strongest arguments made in favor of the transition to a PoS consensus mechanism. According to Vivek:

“The Ethereum blockchain will be more sustainable than the Bitcoin blockchain.”

Vivek expects ETH staking profits to increase by at least 50% after the Merge. Currently, the staking return for ETH is 4.2% and will grow to over 6%. At the same time, validators also receive transaction fees. He added that Ethereum will become a complementary digital bond to Bitcoin’s store of value and collateral use cases as it is the primary collateral in DeFi.

Meanwhile, Ethereum will continue to develop and have more improvements such as data sharding, state management, staking withdrawal, etc. after Merge.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join CoinCu Telegram to keep track of news: https://t.me/coincunews

Follow CoinCu Youtube Channel | Follow CoinCu Facebook page

Harold

CoinCu News