The latest Bitcoin price data revealed a few reasons why a Bitcoin (BTC) rally to $30,000 will trigger a new Bull Run.

The weekly MA200 is currently at around $22,700. The Bitcoin price fluctuates for weeks below the moving average, which is said to be the bottom of a super cycle, which is unprecedented.

Bitcoin price is currently above the upper moving average but has not yet closed the July candle, and the buyer is not strong. The recovery to $30,000 will increase the likelihood of a close of the July candle above the upper 200WMA. And that will cause the 200WMA to change its role from resistance to new support for the super cycle.

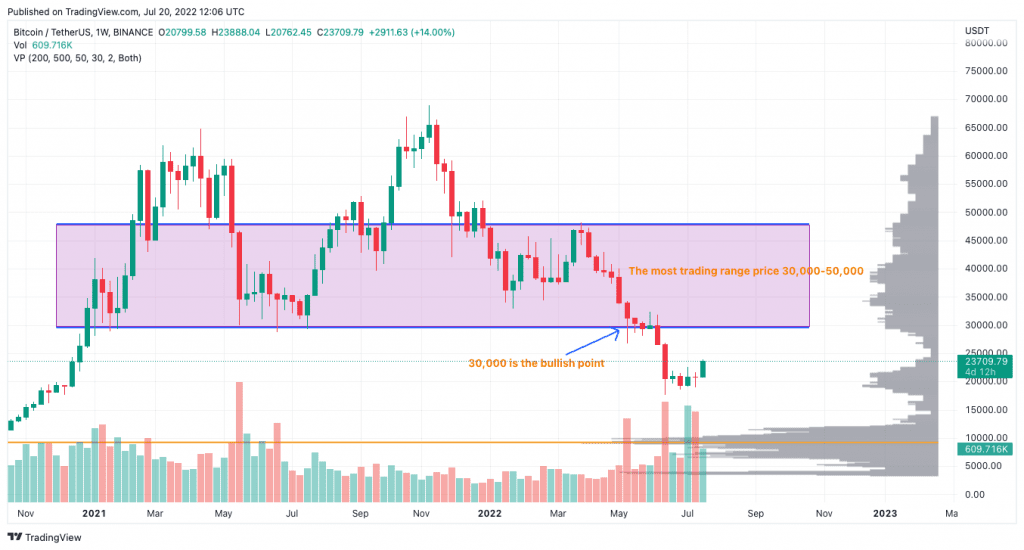

We can see the possibility of Bitcoin entering a new higher-priced sideways range when BTC hits $30,000. The perspective of the Volume Profile shows that.

The highest point of the bell volume profile indicator is also the place that shows the most actively traded price zone. In other words, it is the highest consensus price zone. From there, it acts as a “magnet” to attract prices.

The current range corresponds to a bell volume profile between $18,000 – $24,000. Breaking out of this range and recovering to $30,000 will make the BTC price quickly return to the area that has been swinging the most in the past two years.

Coincidentally, the $30,000 price point is also the average of all Bitcoin purchases by large fund Microstrategy.

$30,000 is also a psychological price. Breaking out of this price level, the market is seen as coming out of a state of prolonged fear. The fear-greed index can quantify this. From there, Bitcoin has the potential to stimulate new buying from new investors.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join CoinCu Telegram to keep track of news: https://t.me/coincunews

Follow CoinCu Youtube Channel | Follow CoinCu Facebook page

Harold

CoinCu News