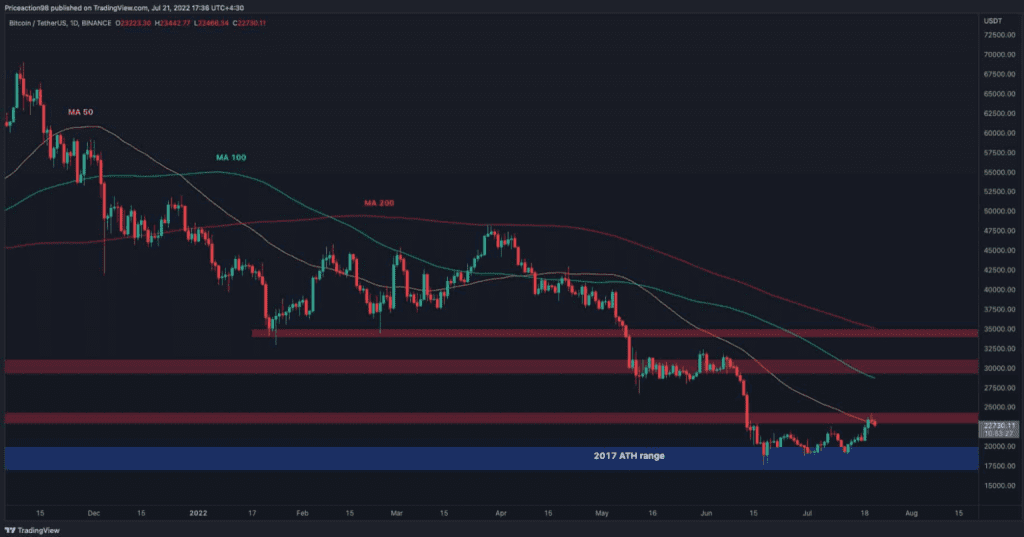

Recently, Bitcoin bounced from the $20,000 support area. However, it looks like the rally is about to stop, as the price is being rejected by the $23,000-$24,000 resistance area.

Technical analysis

Currently, the 50-day moving average is acting as an additional resistance, potentially pushing the price back to lower levels around $20,000. The drop of Bitcoin could continue in this case as the $20,000 level will become weaker after multiple tests. A break below it could trigger another rapid decline towards the $15,000 region in the short term.

On the downside, a break above $24,000 and the 50-day MA will invalidate the bearish scenario. Next, Bitcoin could initiate a rally towards the $30,000 supply zone. However, the price action suggests that the former scenario is more likely.

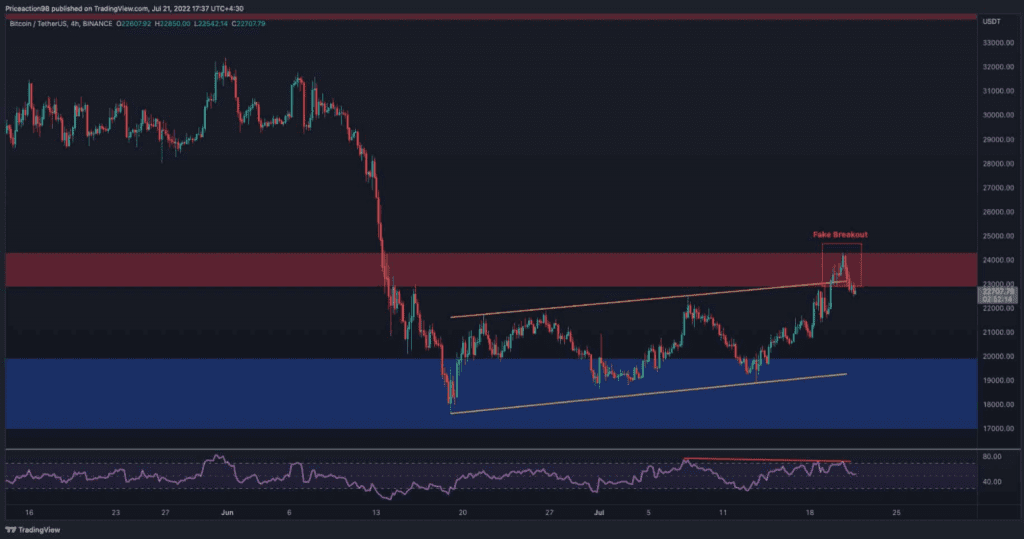

On the 4-hour time frame, the price finally broke through the bearish flag pattern, which had formed over the past month. However, the bulls could not sustain the higher high as the price dropped back to the pattern, creating a false breakout.

The RSI has also produced a significant bearish divergence between the last two peaks, indicating that the uptrend has exhausted and a potential bearish reversal. If the price breaks below the bearish flag, a move to new lows is expected in the next few weeks.

Psychological analysis

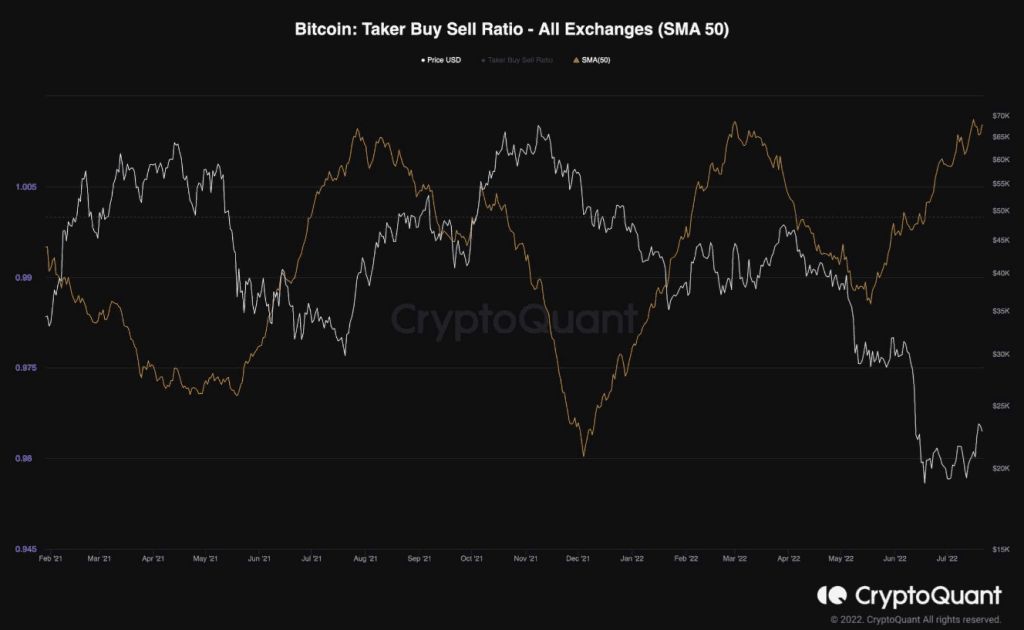

The Taker Buy/Sell Ratio of Bitcoin is shown on the following chart, indicating whether buyers or sellers are more active in the order book. A value above 1 implies strong demand in the market, while a value below 1 indicates that selling pressure dominates.

It is clear that the buyers are dominating, but recently this indicator has reached the high range. If the Taker Buy/Sell Ratio turns down over the next few weeks and drops below 1, the drop is expected to continue.

However, it is still too early to conclude that this scenario will happen as the index is still heading higher, and there is no reversal signal. Therefore, the Taker Buy/Sell Ratio should be watched carefully over the next few days to determine the market’s short-term trend.

You can see the Bitcoin price here.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join CoinCu Telegram to keep track of news: https://t.me/coincunews

Follow CoinCu Youtube Channel | Follow CoinCu Facebook page

Harold

CoinCu News