After suspending the “Impermanent Loss Protection” feature, Bancor was criticized by the community. It can be seen that recent figures are not entirely positive for the project.

Today, the Twitter page of the project also posted the latest updates about many changes in the near future.

Bancor is prioritizing the burning of BNT tokens from the number of fees collected, but the price to pay is that the number of fees for the liquidity provider (LP) will be reduced.

After the liquidity crisis broke out in early June, the DEX suspended the “Impermanent Loss Protection” feature. The project explains that this step is necessary to protect the Bancor community, especially after Celsius repeatedly withdrew liquidity from the DEX because of liquidity and debt-related issues.

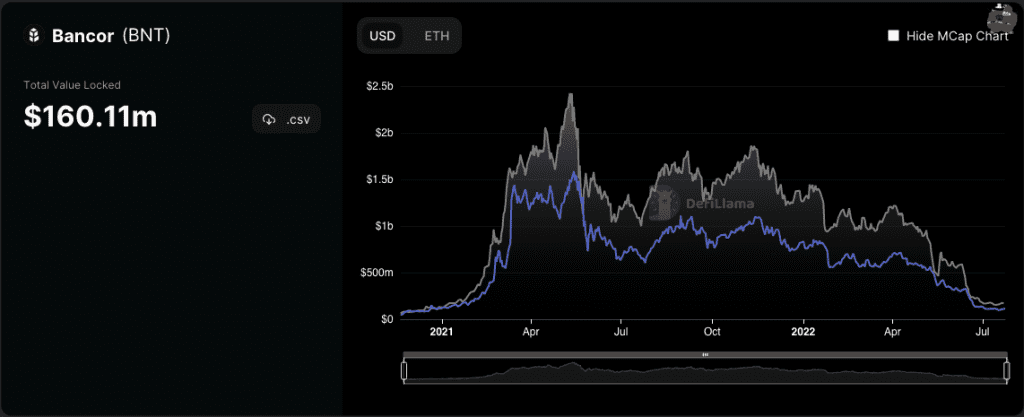

At the time of writing, according to data from Defillama, it is $160 million, down 30% since the project announced the decision to suspend IL Protection.

Most of the other DEXs have recovered to the TVL index in parallel with the market trend. However, Bancor has not yet seen the end of the fleeing wave.

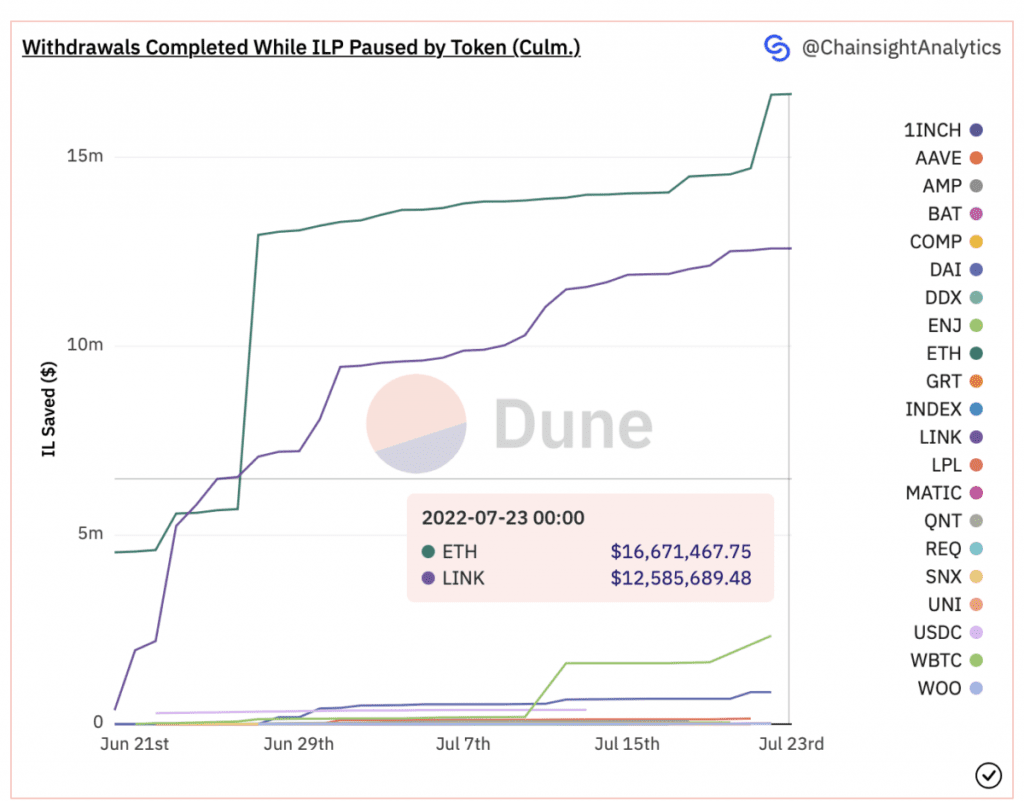

The most withdrawals come from 2 assets, Ethereum and LINK; this is a sign that liquidity is slowly moving away from the project as Ether has seen a steady increase over the past week.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join CoinCu Telegram to keep track of news: https://t.me/coincunews

Follow CoinCu Youtube Channel | Follow CoinCu Facebook page

Harold

CoinCu News