The past week has been a volatile yet positive week for cryptocurrencies. Accordingly, traders who ignore the warnings of more price drops from the veteran crypto winter expert will return at the first sign of a bounce.

The Fear & Greed Index is the best example of a reversal sentiment. Specifically, the index rallied back to fear after having a record time in the extreme fear zone due to the price crash in May and June.

In addition to sentiment, another cause for the bull run was the July 15 announcement of the expected date of Merge Ethereum.

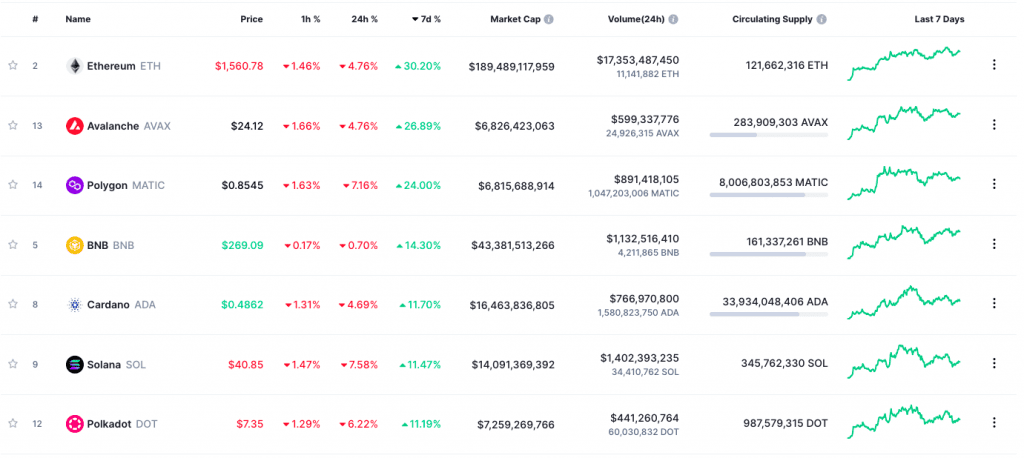

Data from CoinCu shows that, following the reveal of the mainnet Merge implementation date, ETH price increased 38.5% from $1,190 to a daily high of $1,650 on July 22 in an overall green day in the market.

Along with ETH’s price increase, the total crypto market capitalization increased 15% over the past week to its current $1.042 trillion.

Further evidence of the euphoria surrounding Ethereum’s transition can be found by looking at the driving force behind the coins that have gained the most over the past week, including many projects linked to the cryptographic protocol.

When Ethereum moves to PoS, the massive mining network that currently secures the network will not be able to continue operating and will need a new chain for mining.

Ethereum Classic (ETC) is one of the best choices regarding network design and compatibility because it is technically a PoW chain derived from Ethereum.

The ETC price has been up 100% in the past ten days, showing that many traders predict miners will migrate to Ethereum Classic. This could herald a token price performing well in the long term.

Another notable bullish coin benefiting from Ethereum-related developments is the Lido DAO (LDO). Lido DAO is a liquidity staking platform that allows depositors to stake their ETH in exchange for stETH. stETH has the same price as ETH, used as collateral in decentralized finance.

With the momentum gained from the Ethereum Merge announcement, the LDO price also benefits from the addition of support for other protocols, such as Solana (SOL) and Polkadot (DOT), as well as an expansion to a layer 2 protocol.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join CoinCu Telegram to keep track of news: https://t.me/coincunews

Follow CoinCu Youtube Channel | Follow CoinCu Facebook page

Harold

CoinCu News