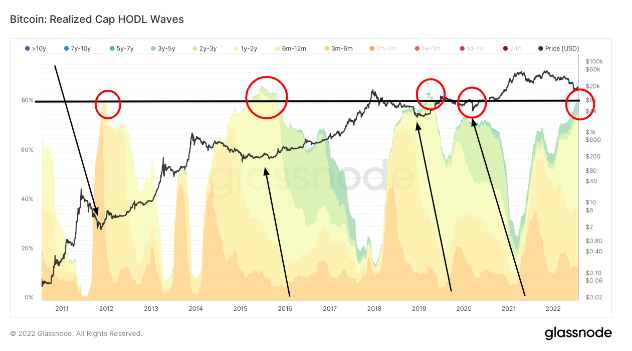

Cycle tops and bottoms could be determined using a variety of measures, but realized cap Bitcoin HOLD waves are hardly ever addressed in the group.

The metric, also known as HODL waves, is a collection of all active supply age bands. Each colored band in the graph below displays the share of all BTC in circulation that has moved recently, weighted by its realized price.

Data from Glassnode has shown that 80% of BTC’s circulating supply sits in the hands of long-term holders (LTHs). Defined as users that have owned BTC for at least six months, LTHs are usually the ones forming strong support for BTC’s market cycle bottoms.

In Bitcoin markets, LTHs are regarded as “smart money” and are frequently observed acquiring BTC when markets are repressed. LTHs are the ones that distribute the amassed BTC and reap the majority of the rewards once a bull market takes hold.

On-chain data firmly backs up this hypothesis. The graph above plainly demonstrates that LTHs sold off their holdings each time Bitcoin reached a new all-time high (ATH). LTHs are the last-ditch hodlers who give Bitcoin substantial support during each cycle bottom.

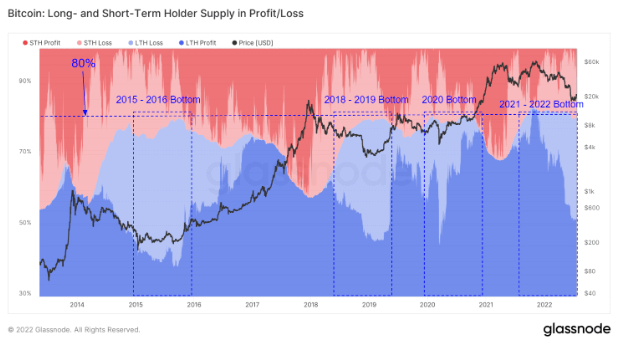

This assertion is further supported by Glassnode’s examination of long- and short-term holder supply in profit and loss.

The graphic below demonstrates that LTHs hold 80% of the total supply of Bitcoin

Short-term holders (STHs) own the final 20% of the supply, which is highlighted in red. LTHs had essentially no capitulation this market cycle, as evidenced by their holdings declining from 82% to 80% of the supply, which overlaps the blue and red zones of the chart.

The market has been making lower highs, as evidenced by the fact that the 2 percent decline is significantly less than what we have seen in previous cycles. LTHs appear to confirm their trust in the value of bitcoin as these lower highs strengthen the network.

Only a small portion of the supply of Bitcoin was transferred from LTHs to STHs during the bear market that started in May because LTHs viewed it as a chance to hodl or keep buying Bitcoin.

It’s still too early to tell whether the industry is set to go in a more bullish direction, despite the fact that the current bear market strangely resembles all past market cycle bottoms. However, if Bitcoin has indeed reached the bottom of this cycle, a recovery may be on the horizon.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join CoinCu Telegram to keep track of news: https://t.me/coincunews

Follow CoinCu Youtube Channel | Follow CoinCu Facebook page

Annie

CoinCu News