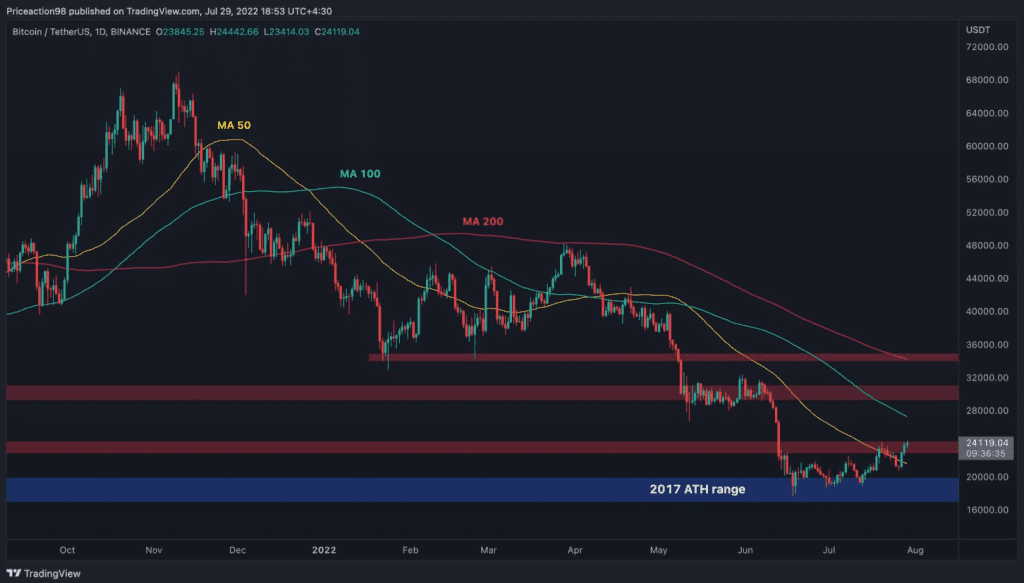

Bitcoin’s price action is similar to the bottom formation phase, as it recovered from the $17,000 – $20,000 range. After making several higher lows over the past few weeks, the market has shown signs of strengthening, indicating that an uptrend is forming, at least in the short term.

Technical analysis

The critical $24,000 resistance level remains intact, and the bulls need to break through it to attract more impetus. In the event of a breakout, the 100-day moving average ($28,000) will be the first hurdle ahead of the $30,000 supply zone. On the other hand, the 50-day MA could act as a strong support if a bearish pullback occurs in the short term.

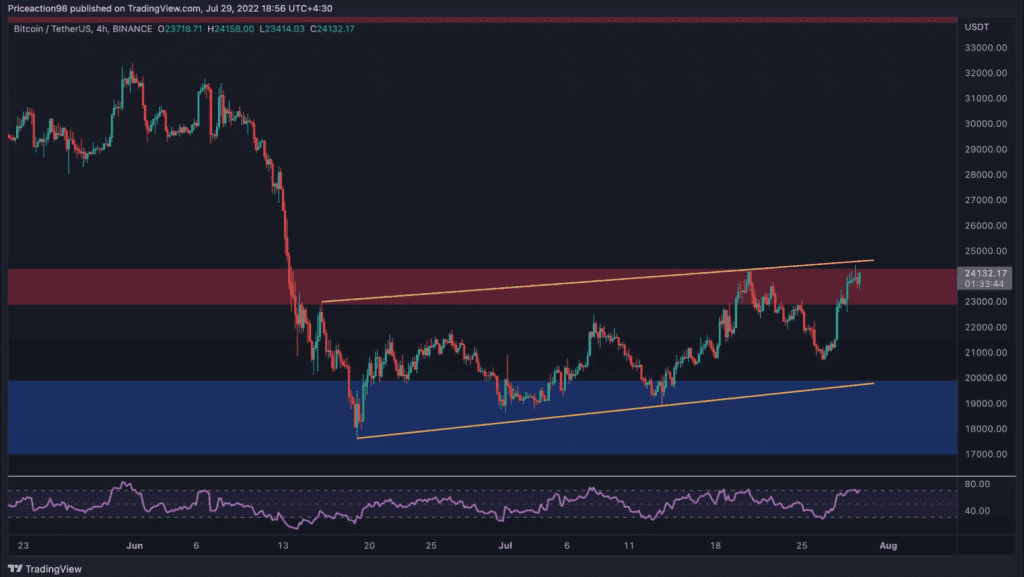

In the 4-hour timeframe, it is clear that the price has not broken out above the bearish flag. The cryptocurrency is testing the pattern’s upper boundary for the third time, and if it breaks out successfully, a rally towards the $30,000 supply zone will follow.

However, a rejection and continued decline cannot be ruled out, especially when the RSI signals that the market is in an overbought state (values above 70%). A bearish scenario is likely if the price fails to break above the flag in the next few days, and in this case, a drop to the $17,000 support and even lower will occur.

On-chain analysis

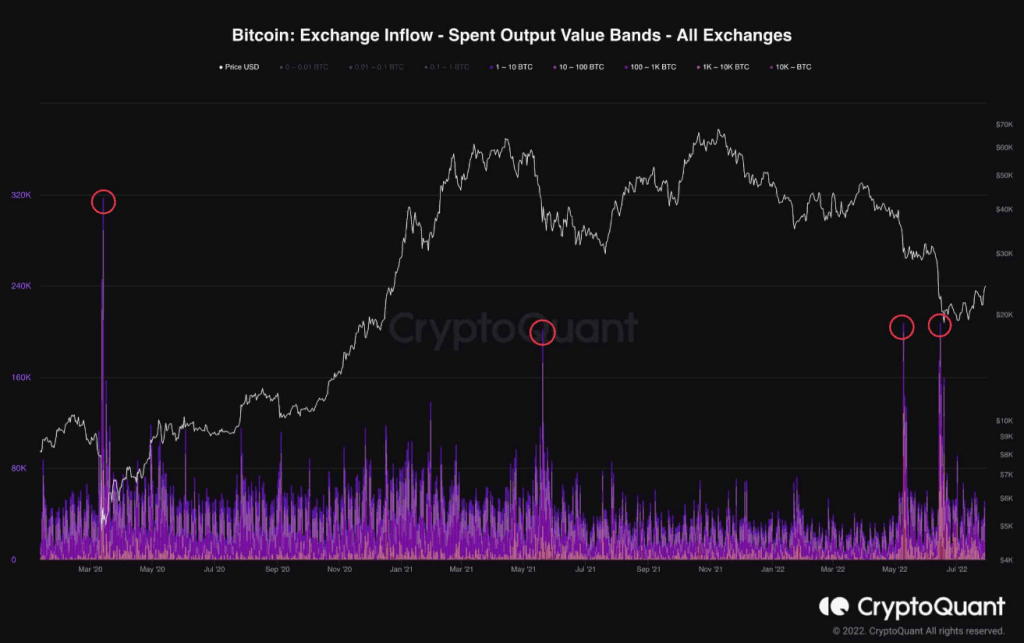

Bitcoin has been on a steep downtrend for the past six months, leading many investors to lose confidence and cut their losses by selling their coins in a panic.

As the Exchange Inflow – Spent Output Value Bands chart shows, even the wealthier group in the Bitcoin market is no exception for capitulating when the price drops lower.

This metric shows an inflow of more than 1 BTC to exchanges, so it filters out smaller entities. Some of the most recent marked peaks indicate capitulation events where large amounts of Bitcoin have been deposited on exchanges.

Both occurred during the rapid drop in May and June 2022, when Bitcoin broke below $40,000 and $30,000.

Interestingly, these two occasions resemble the capitulation events of larger entities in March 2020 and May 2021, both of which marked the bottom of a downtrend. If history rhymes, then it is very likely that BTC has bottomed out.

At the time of writing, BTC is trading at $23,800.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join CoinCu Telegram to keep track of news: https://t.me/coincunews

Follow CoinCu Youtube Channel | Follow CoinCu Facebook page

Harold

CoinCu News