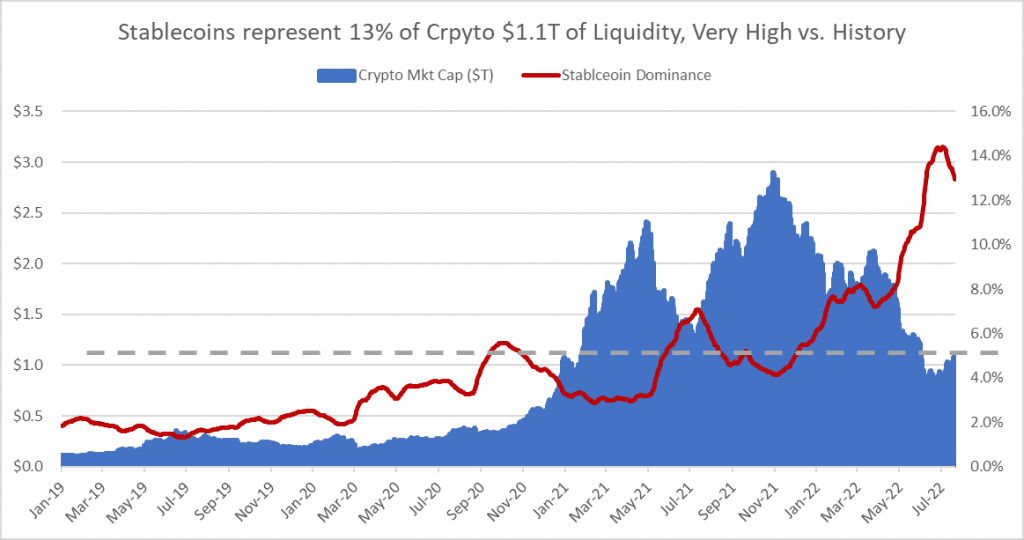

As many had predicted, the crypto market stabilized in July without the eventual capitulation event. There is a large pool of money in stablecoins waiting to re-enter the market when the time is right.

Three of the top 10 crypto assets by market capitalization are stablecoins. Their combined value at the time of writing is $138 billion, according to CoinGecko.

Tether’s USDT is the third largest cryptocurrency with $66 billion, Circle’s USDC is fourth with $54.4 billion, and Binance’s BUSD is seventh with $17.8 billion.

On July 31, Binance CEO Changpeng Zhao pointed out that a lot of money is lying on the sidelines, waiting to return to the market.

Those who need to get out of crypto will convert to fiat and withdraw from exchanges. This mostly happened in mid-June, when more than $400 billion exited the market in a week.

Since then, the crypto market has generally traded in a range, with recent gains pushing total capitalization to $1.17 trillion, up 33% from the $875 billion cyclical low.

The funds are in the top three stablecoins representing 12% of the total crypto market capitalization. It remains at historic highs despite falling over the past month with a shrinking Tether supply and a small rally.

“Stablecoin dominance (stablecoin cap versus total market cap) is 13%. For the first time crypto hits the $1 trillion cap, the rate is 3%.”

An important topic is an inflation. As much of the world is suffering from a cost of living crisis, retail traders don’t have enough money to invest in high-risk assets like cryptocurrencies. As a result, the cryptocurrency market is unlikely to turn bullish until inflation drops significantly.

High inflation is another reason to keep stablecoins in countries leveraging dollars as a hedge against their local currencies. In several Latin American countries with double-digit inflation, the demand for stablecoins is growing.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join CoinCu Telegram to keep track of news: https://t.me/coincunews

Follow CoinCu Youtube Channel | Follow CoinCu Facebook page

Harold

CoinCu News