Canadian Bitcoin (BTC) mining company Hut 8 Mining Corp added to its massive BTC stockpile in July, as the company maintained its long-term “HODL strategy” during market downturns.

The Alberta-based company generated 330 BTC in July with an average production rate of 10.61 BTC per day, bringing its total reserves to 7,736 BTC. The company revealed its monthly production rate equivalent to 113.01 BTC per exahash.

According to industry data, Hut 8, which trades on the Nasdaq and Toronto stock exchanges, is one of the largest public Bitcoin holders.

As part of an ongoing HODL strategy, Hut 8 has deposited all of its self-mined Bitcoins in custody, stopping the growing trend of miners selling their reserves in a bear market.

As CoinCu reported, Texas mining company Core Scientific sold 7,202 BTC in June at an average price of $23,000 to cover expenses and repay debt. The company recouped 1,221 BTC the following month after increasing its mining output by 10%.

Meanwhile, mining company Argo Blockchain reduced its 887 BTC holdings in July to repay Galaxy Digital and fund its business. Separately, Riot Blockchain cut its Bitcoin holdings for the third consecutive month in June to raise capital for its operations.

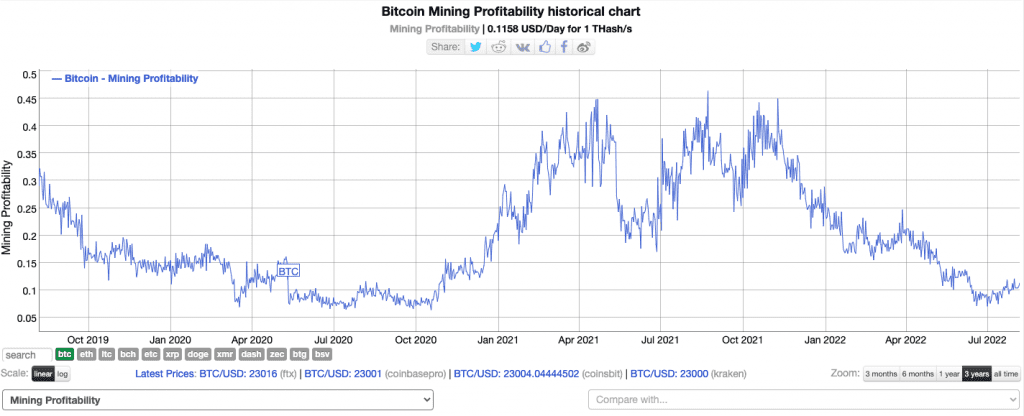

Bitcoin mining is a highly lucrative business in 2021, as the average revenue per BTC mined is four times higher than the previous year average. With the Bitcoin price plunging in 2022, losing miners were forced to sell BTC.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join CoinCu Telegram to keep track of news: https://t.me/coincunews

Follow CoinCu Youtube Channel | Follow CoinCu Facebook page

Harold

CoinCu News