Cryptocurrency lending firm Celsius Network, which is undergoing bankruptcy proceedings, says a new $70 million worth of cash found through “collection” will likely help it stay afloat until the end of 2022.

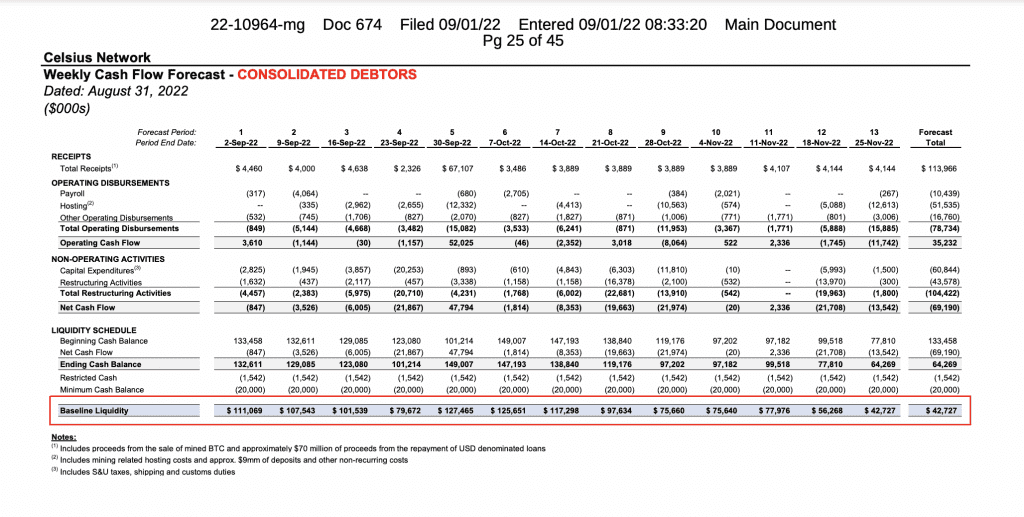

According to a document filed on September 1 by Kirkland & Ellis, the law firm Celsius has hired to help it restructure, Celsius expects “approximately $70 million of proceeds from the repayment of USD denominated loans”.

During a hearing in the U.S. Bankruptcy Court for the Southern District of New York on Thursday, a Kirkland & Ellis lawyer said the loans were mistakenly believed to be in dollar-pegged stablecoins, which the lender wouldn’t have been able to use to finance its operations.

The additional funds provide Celsius with a much-needed boost in its limited liquidity and will increase its runway to pay for business and restructuring expenses as it looks for a more long-lasting solution to its cash crunch issue. The company’s expenses greatly outweigh the money it makes from its unsuccessful bitcoin mining business.

By October 7, Celsius anticipates receiving the majority of the refund. By the end of November, the estimate predicts that its available cash balance will be $42 million. Extrapolating its net cash flow over a weekly basis, the cash reserve will hardly endure until the end of current year.

Without taking loan repayments into account, the company initially predicted that it would run out of money by October. Later, noting $61 million in loans coming due, it updated its projection to indicate that it would probably survive until the end of the year. The most recent cash-flow prediction was published in a document that listed a somewhat higher number $70 million.

The distressed lender discovered itself in the midst of a recent cryptocurrency sector insolvency crisis. The company claimed it owed its clients $2.8 billion in cryptocurrency holdings after filing for Chapter 11 bankruptcy protection in July.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join CoinCu Telegram to keep track of news: https://t.me/coincunews

Follow CoinCu Youtube Channel | Follow CoinCu Facebook page

Foxy

CoinCu News