Frax Finance, an algorithmic stablecoin protocol, announces the launch of the Fraxlend lending marketplace open to all users.

Algorithmic stablecoin protocol Frax Finance has announced the successful launch of the Fraxlend lending marketplace. Accordingly, Fraxlend will generate more cash flow for Frax Finance, which can be used to buyback and burn FXS.

The platform operates around two tokens: stablecoin Frax (FRAX) and governance token Frax Shares (FXS). In particular, FRAX maintains a price stability mechanism with USD and is partially collateralized by USDC and a trading algorithm between FRAX and FXS. Frax is leading algorithmic stablecoin protocols with $1.18 billion in assets locked up on chain (TVL), according to DeFiLlama.

Veteran Frax Finance developer Drake Evans recently highlighted two important use cases for Fraxlend in the Flywheelpod podcast.

First, Fraxlend enables the new FRAX mint protocol through the borrowing and lending process. Users can borrow directly on Frax Finance using FRAX and earn interest through existing money markets.

As of now, the only way to do that is to take out an over-collateralized loan on a lending platform like Curve. With Fraxlend, the protocol can personally do this entire process, creating an additional cash flow that can be used to “buyback and burn FXS” similar to how MakerDAO burns MKR, according to Frax’s website Finance.

The second new application Drake highlighted is the ability to create custom term sheets for protocol-to-protocol deals. Typically, these deals — such as when a DAO wants to send another DAO tokens — are worked out via Telegram chats and finalized as OTC deals involving multi-sig wallets. Fraxlend lets DAOs set up the deal on chain, automating the process and making it more transparent.

“Fraxlend is one of the newest generations of lending protocols that will showcase new innovations in onchain debt origination,(…). Some of these features have never been built before in any kind of lending system so we are extremely excited to finally bring these use cases to DeFi.”

Frax Finance founder Sam Kazemian said

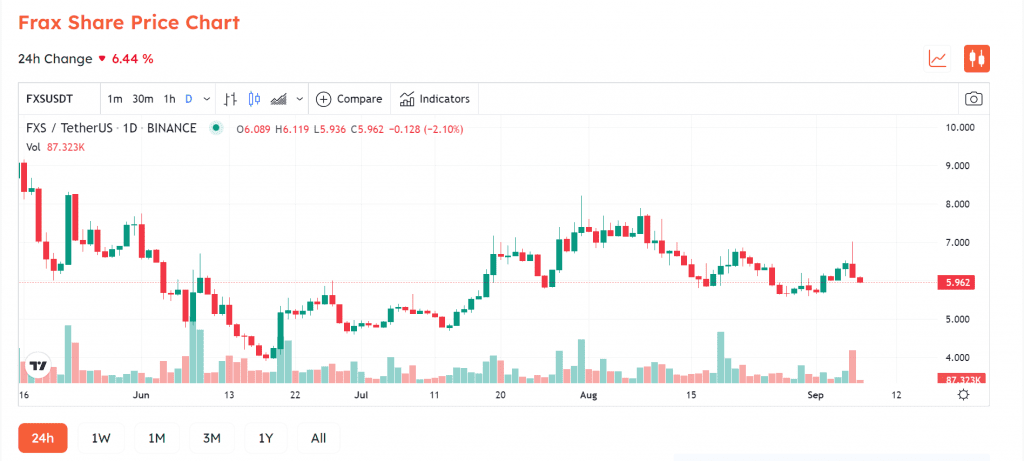

However, the positive information from the platform could not pull the price of FXS. Currently FXS is trading at $5,964, down 6.44% in 24 hours.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join CoinCu Telegram to keep track of news: https://t.me/coincunews

Follow CoinCu Youtube Channel | Follow CoinCu Facebook page

Foxy

CoinCu News