The latest Consumer Price Index print was 20 basis points lower than last month’s 8.5% report, but it was above predictions of an 8.1% drop. However, Bitcoin went against the bullish outlook at the time the CPI data was released.

The Bureau of Labor Statistics released its latest Consumer Price Index report on Tuesday, showing that commodity prices rose 8.3% year-on-year in August. Data shows that US inflation is on the decline and this is the second month to record this.

Markets reacted to the report in typical panic mode. Futures for the S&P 500, Dow Jones, and Nasdaq all fell ahead of the start of the US market.

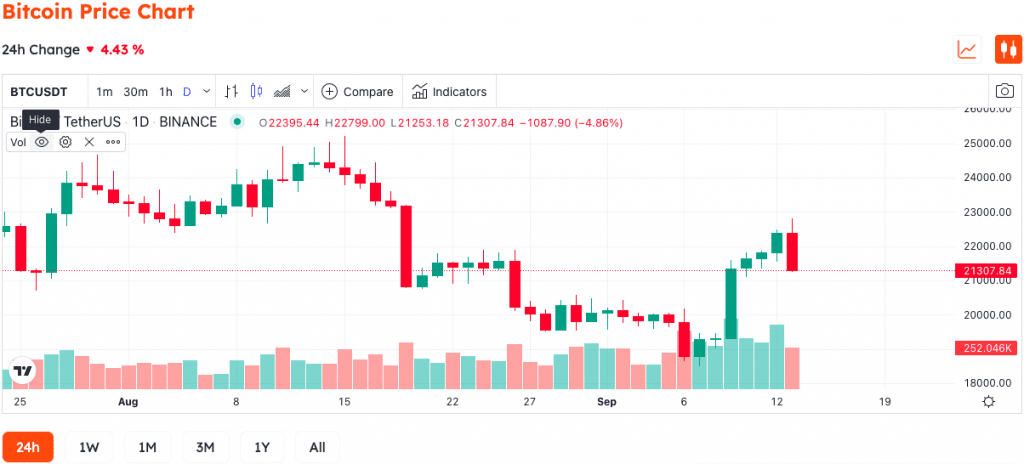

Bitcoin also fell sharply in response to the report, falling 4.4% to roughly $21,307 at press time.

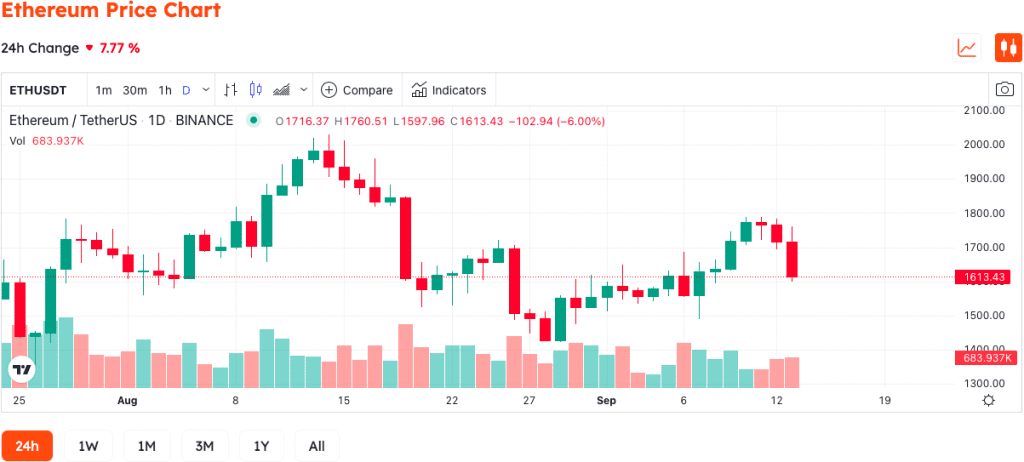

Ethereum suffered the most, falling 7.8% to about $1,613. The selloffs are most likely due to the print exceeding estimates of a 40 basis point fall.

Inflation is a major concern for households in the United States and around the world this year as countries face widespread price increases. Last month’s CPI data showed the prospect of economic recovery but the market was contrary to belief.

Florida Chief Financial Officer Jimmy Patronis emphasized that “the Inflation Reduction Act didn’t reduce inflation.”

Bitcoin, with a hard supply limit of 21 million, is frequently regarded as an inflation hedge. However, it has frequently demonstrated that at least this year, it trades in conjunction with traditional markets.

The Fed is also prepared to announce additional increases, as the extended period will be extremely challenging for the market in general and Bitcoin in particular. The upcoming FOMC meeting will most likely see strong price movement from the market.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join CoinCu Telegram to keep track of news: https://t.me/coincunews

Follow CoinCu Youtube Channel | Follow CoinCu Facebook page

Harold

CoinCu News