Before Ethereum switched from proof-of-work (PoW) to proof-of-stake (PoS), a simulation by The Merge showed that the network’s issuance rate would decrease following the rule change. Statistics now show that the simulation’s predictions came true after September 15.

From August 5, 2021, Ethereum changed from inflation to deflation by introducing the EIP -1559 upgrade. Since the upgrade, the network has destroyed 2,627,061 ETH worth $8.56 billion. Since The Merge, however, Ethereum is a lot more deflationary as the change redefined the issuance rate of the protocol.

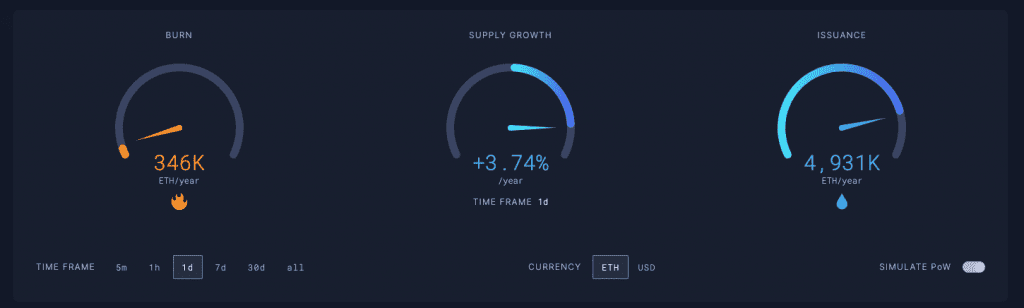

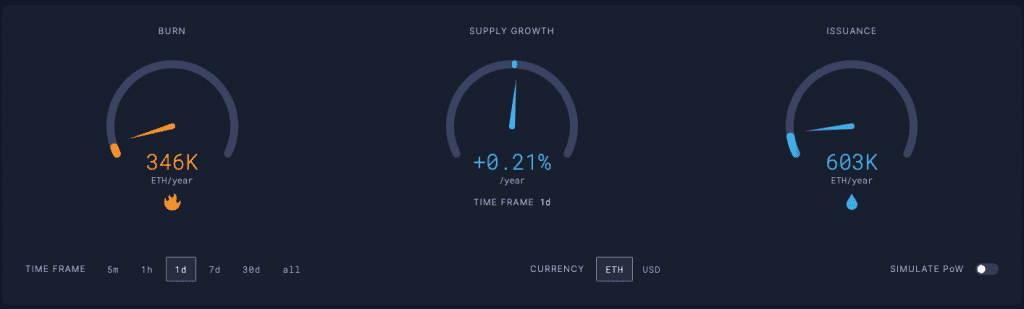

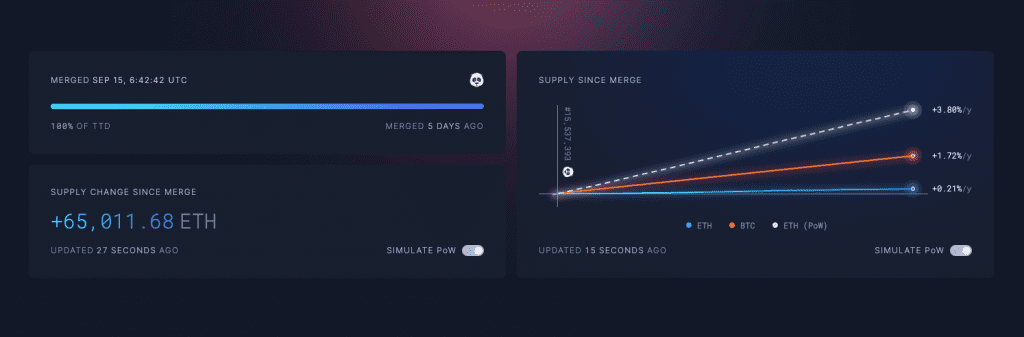

Currently, the data after The Merge indicates that 297,000 ETH will be burned annually at the current rate, and issuance has decreased from 3.74% per year to 0.21% per year. Before The Merge, miners would generate 4,931,000 ETH per year but since the protocol changed to PoS, the annual issuance has dropped to 603,000 new ETH per year.

Ultrasound.money data shows ETH issuance if PoW remains:

This means that if Ethereum is never Merge, on September 19, 2023, the total supply will be around 125,514,249 without taking into account the burn rate of EIP-1559. With the burn rate and post-Merge rules, the total supply of ETH on September 19, 2023, is estimated to be 120,889,249 or 4,625,000 ETH less than the previous PoW consensus rules.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join CoinCu Telegram to keep track of news: https://t.me/coincunews

Follow CoinCu Youtube Channel | Follow CoinCu Facebook page

Harold

CoinCu News