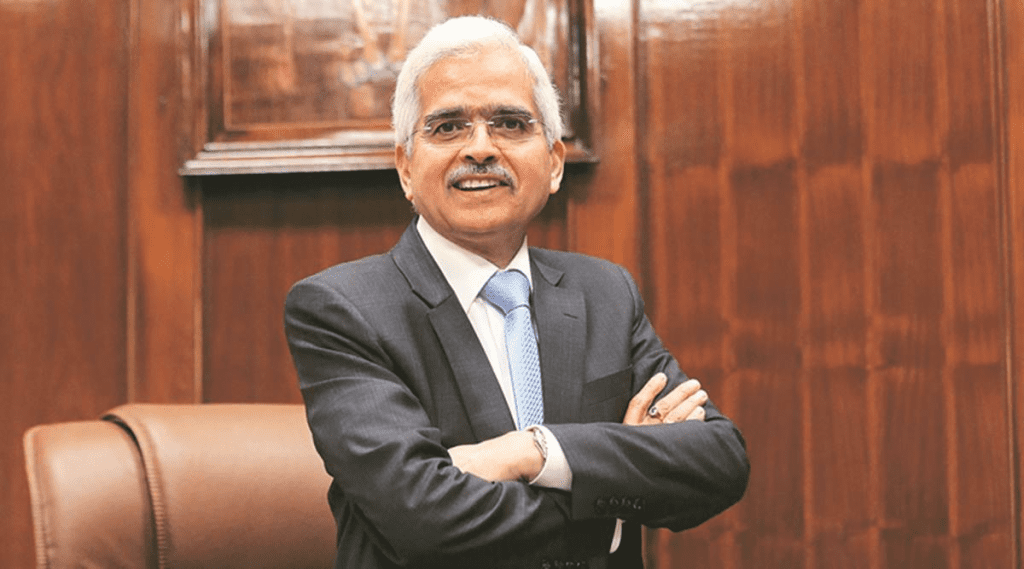

Shaktikanta Das, Governor of the Reserve Bank of India (RBI), stated on September 20 that the country’s central bank is committed to supporting innovation for financial technology enterprises while also ensuring customer safety.

Das, speaking at the Global Fintech Festival in Mumbai, stated that technology, innovation, and fintech are all working together to boost the industry’s fervor, while also stating that the RBI will begin issuing digital rupees, also known as Central Bank Digital Currency (CBDC), during the current fiscal year.

The Governor of the RBI hopes that promoting CBDC development will bring more economic benefits:

“Technology, innovation and fintech are working in tandem and contributing to the dynamism of this sector.

The RBI is now actively working towards a phased implementation of Central Bank Digital Currency (CBDC) in both wholesale and retail segments. This is expected to give further fillip to the digital ecosystem.”

According to Das, the central bank would continue to support technology innovation while also working to increase consumer safety, cybersecurity, and resilience while also ensuring financial stability. Furthermore, he stated that issues regarding governance and conduct in the fintech business must be addressed.

Meanwhile, India’s Finance Minister Nirmala Sitharaman urged the fintech industry to break down barriers and expand the number of interactions it has with the government and its institutions in order to build confidence.

The RBI wants to build an integrated platform to give frictionless lending to rural regions; Das highlighted that India’s fintech sector is maturing and ready to take a great jump.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join CoinCu Telegram to keep track of news: https://t.me/coincunews

Follow CoinCu Youtube Channel | Follow CoinCu Facebook page

Harold

CoinCu News