The crypto economy and its players are riding out the bear market, according to Dappradar’s newest crypto industry analysis, which covers the third quarter of 2022.

A lot of macroeconomic events have recently affected the crypto market, and Dappradar experts believe it is now difficult to forecast a worldwide expansion of cryptocurrencies in the absence of a widespread rebound in traditional financial markets.

The crypto sector is still battling with the crypto winter, according to the most recent Dappradar data, and markets and participants are trucking through the storm.

According to Dappradar, Bitcoin (BTC) and Ethereum (ETH) have been trading at about the same price since the end of June, although the two largest assets have a significant association with equities markets.

Dappradar’s researcher Sara Gherghelas said:

“In Q3, the correlation between BTC and the S&P 500 increased, showing that investors still consider cryptos in the same category as risky stocks.”

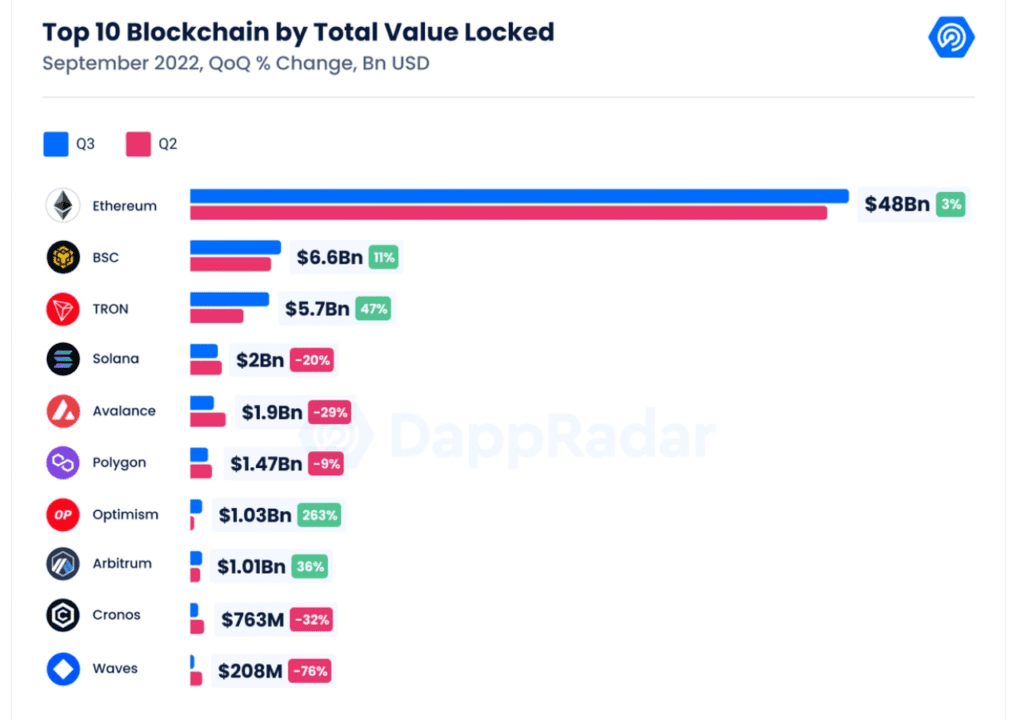

While Ethereum’s move from proof-of-work to proof-of-stake via The Merge drove up prices, crypto markets soon fell back. Furthermore, while Dappradar’s Gherghelas claims The Merge was a technological success, there was a 36% decline in layer two (L2) transactions.

Despite the overall performance of the market, technological use increased significantly.

Losses of $428.71 million were reported during the third quarter of 2022, according to Dappradar researchers. According to Dappradar, the majority of the losses were stolen from Nomad Bridge, which was robbed of $190 million.

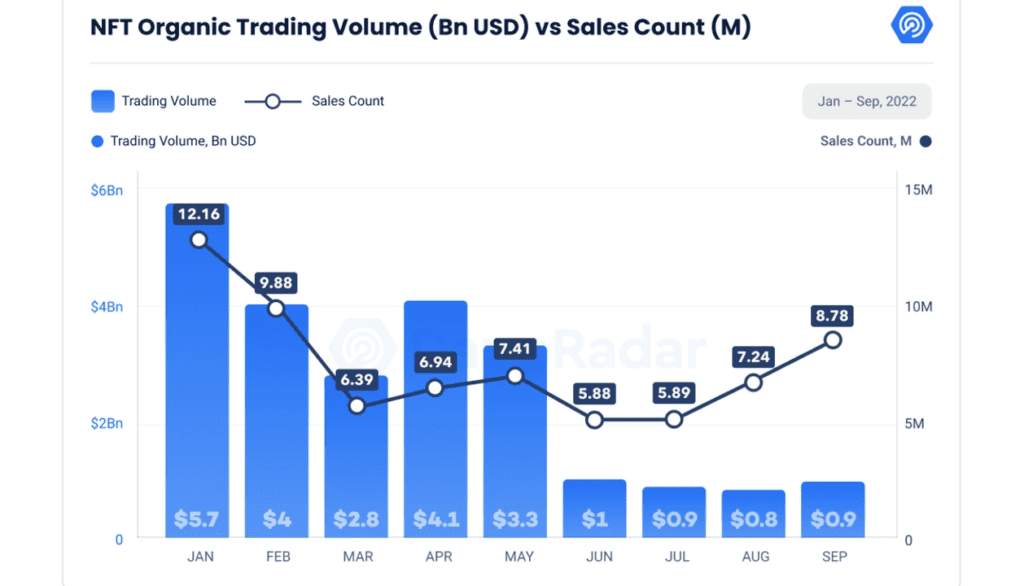

While the DeFi ecosystem and the crypto economy as a whole saw decreases in the third quarter, trade volume activity in non-fungible token markets also decreased. According to Dappradar’s data, NFT trading volume is down 67%, yet NFT sales volume is up 8.3% from Q2.

According to Dappradar’s study, the world economy is facing tremendous problems, and the tides may worsen, according to some. The academics believe we are still in the early stages of the crisis, but that as the tides flip, a bullish runup will occur.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Website: coincu.com

Harold

CoinCu News