Solend Founder Criticizes Alameda Research For Illegal Profits Of $80 Million From Solend IDO

Solend Founder, Rooter, revealed in a tweet that Alameda Research, an SBF-affiliated asset management firm, unexpectedly withdrew $80 million at the last minute prior to its IDO. Solend ends, in order to maximize its benefits in a way that hurts Solend.

On October 25, Rooter, the founder of Solend, the Solana lending project, shared in a tweet that Alameda Research manipulated the token price in the Solend IDO.

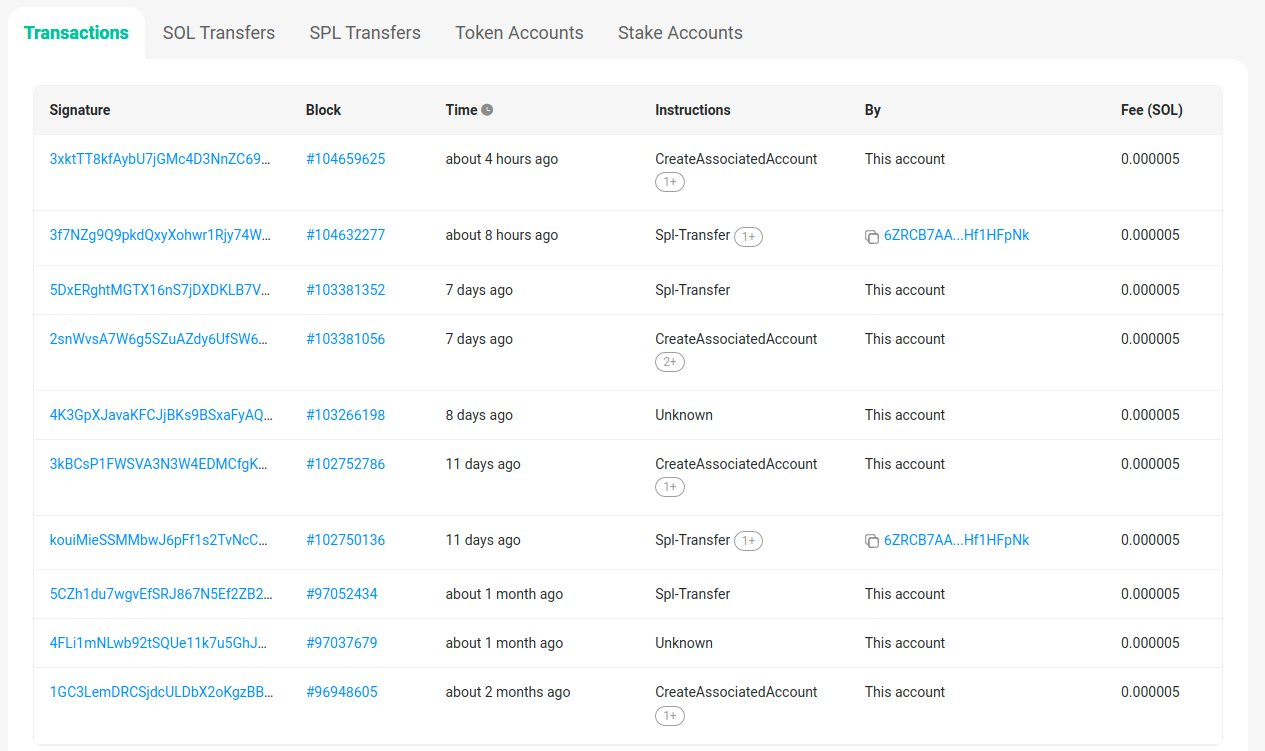

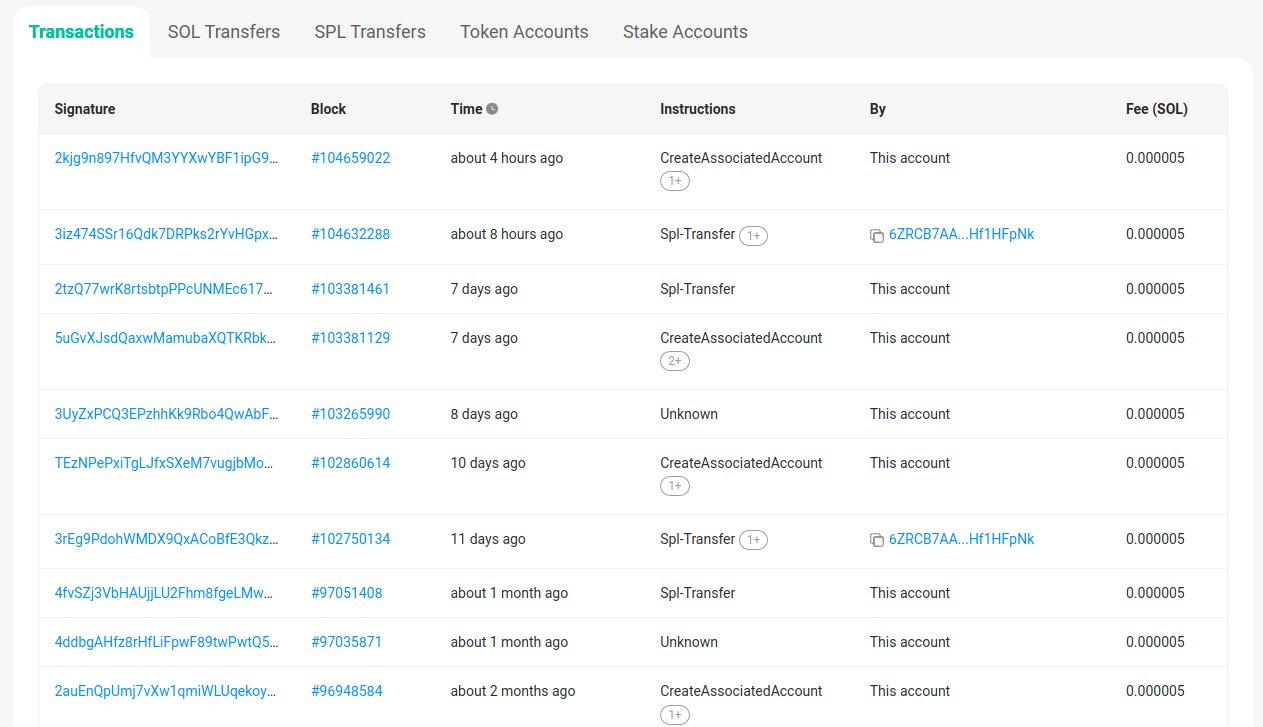

According to the share, during the Solend IDO in early November 2021, two addresses affiliated with Alameda Research pushed Solend’s FDV (Fully Diluted Valuation) to $2.5 billion by buying $40 million each code on the first day.

That action brought the total raised to more than $100 million to “shoo off” retail investors by raising prices, and withdrawing $80 million at the last minute of day two of IDO, Solend eventually raised $26 million.

Rooter also said: “Alameda’s actions reflect SBF’s ideology “profit absolves all sin” the ends justify the means.”

Neither Alameda Research nor Sam Bankman-Fried have commented on the allegations yet.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Website: coincu.com

Foxy

CoinCu News