The general has witnessed the FTX collapse that some have called crypto’s “Lehman moment” in the past few weeks. Since the crypto giant FTX collapsed and its founder resigned as CEO, many entities have been put on the spot. Let review milestones in this serious incident.

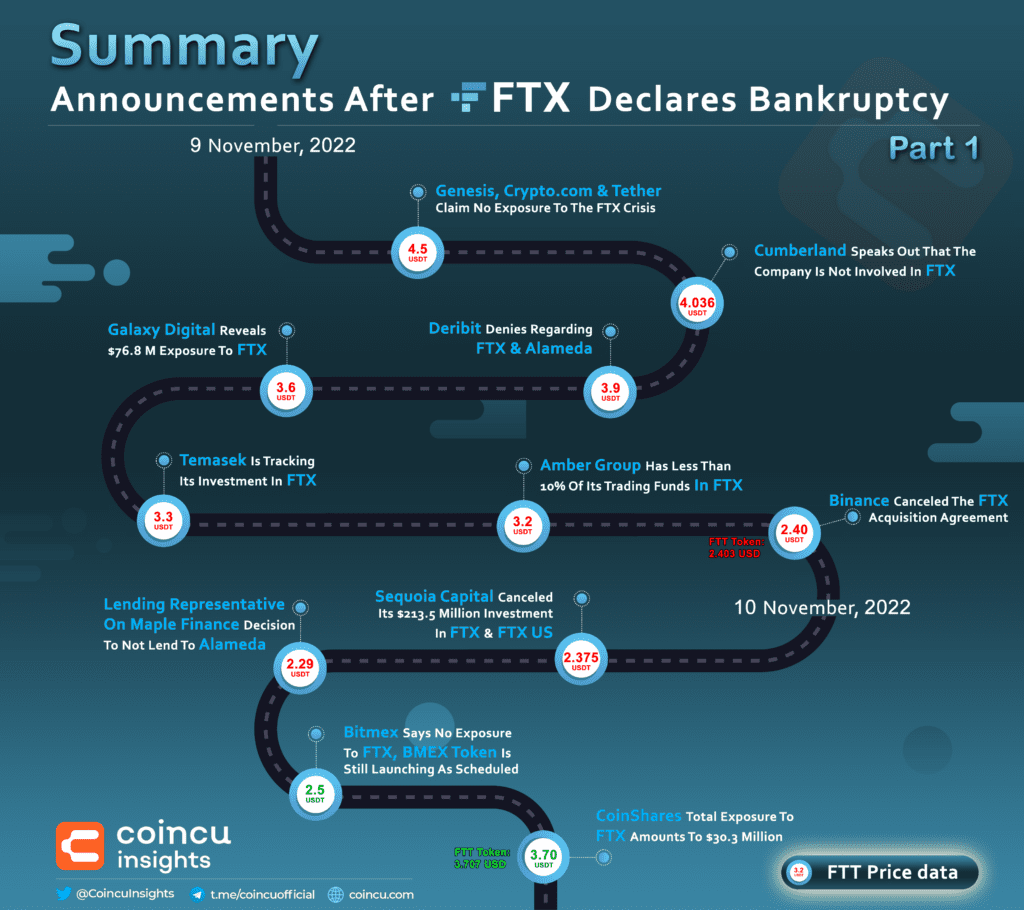

Genesis, Crypto.com, And Tether Claim No Exposure To The FTX Crisis

The recent FTX event has had serious consequences for the entire crypto market, with major industry players also quick to confirm their involvement. Genesis, Crypto.com, And Tether are the newest names on this list. For more specific information, you can read the article below:

Cumberland Speaks Out That The Company Is Not Involved In FTX

Crypto trading firm Cumberland claimed it had almost no exposure to the defunct FTX market, which had been experiencing a liquidity problem. For more specific information, you can read the article below:

Deribit Denies Regarding FTX And Alameda

It neither has assets with FTX nor exposure to its exchange token, FTT, or Solana’s SOL, which is intimately tied with FTX and Alameda Research. For more specific information, you can read the article below:

Galaxy Digital Reveals $76.8 Million Exposure To FTX

Michael Novogratz, a well-known investor, is the founder and CEO of the crypto-focused financial services company Galaxy Digital, which said on Wednesday that it owns around $76.8 million in cash and digital assets linked to the struggling cryptocurrency exchange FTX. For more specific information, you can read the article below:

Temasek Is Tracking Its Investment In FTX

Temasek took part in FTX’s $420 million B-1 financing round in October 2021 and its $1 billion Series B funding round. It also participated in FTX’s $400 million Series C round, which raised funds in January 2022 and valued the exchange at $32 billion. For more specific information, you can read the article below:

Amber Group Has Less Than 10% Of Its Trading Funds In FTX

Although Amber Group claimed to have no exposure to Alameda or FTT, it has been a frequent trader on FTX, and less than 10% of its total trading capital is invested there. For more specific information, you can read the article below:

Binance Canceled The FTX Acquisition Agreement

Cryptocurrency exchange Binance has withdrawn its offer to buy FTX after deeming it to be out of control. For more specific information, you can read the article below:

Sequoia Capital Canceled Its $213.5 Million Investment In FTX And FTX US

Sequoia Capital has announced the cancellation of its $213.5 million investment in FTX Global Growth Fund III. For more specific information, you can read the article below:

Lending Representative On Maple Finance Decision To Not Lend To Alameda

The representative of Maple Finance’s lending pools has no Alameda exposure and has not underwritten a loan to Alameda since Feb 22. For more specific information, you can read the article below:

Bitmex Says No Exposure To FTX, BMEX Token Is Still Launching As Scheduled

Despite market instability caused by the fall of FTX, Bitmex, which claims it has no exposure to FTX or Alameda, intends to introduce a native token on Friday. For more specific information, you can read the article below:

CoinShares Total Exposure To FTX Amounts To $30.3 Million

CoinShares discloses its exposure to the FTX exchange while confirming that the company has no exposure to FTX’s sister company, Alameda Research. For more specific information, you can read the article below:

You may refer to the next part of the summary to see more about what happened with FTX and its surrounding entities:

- Summarize The Impacts Of FTX Collapse | Part 2

- Summarize The Impacts Of FTX Collapse | Part 3

- Summarize The Impacts Of FTX Collapse | Part 4

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Website: coincu.com

Thana

CoinCu News