Key Points:

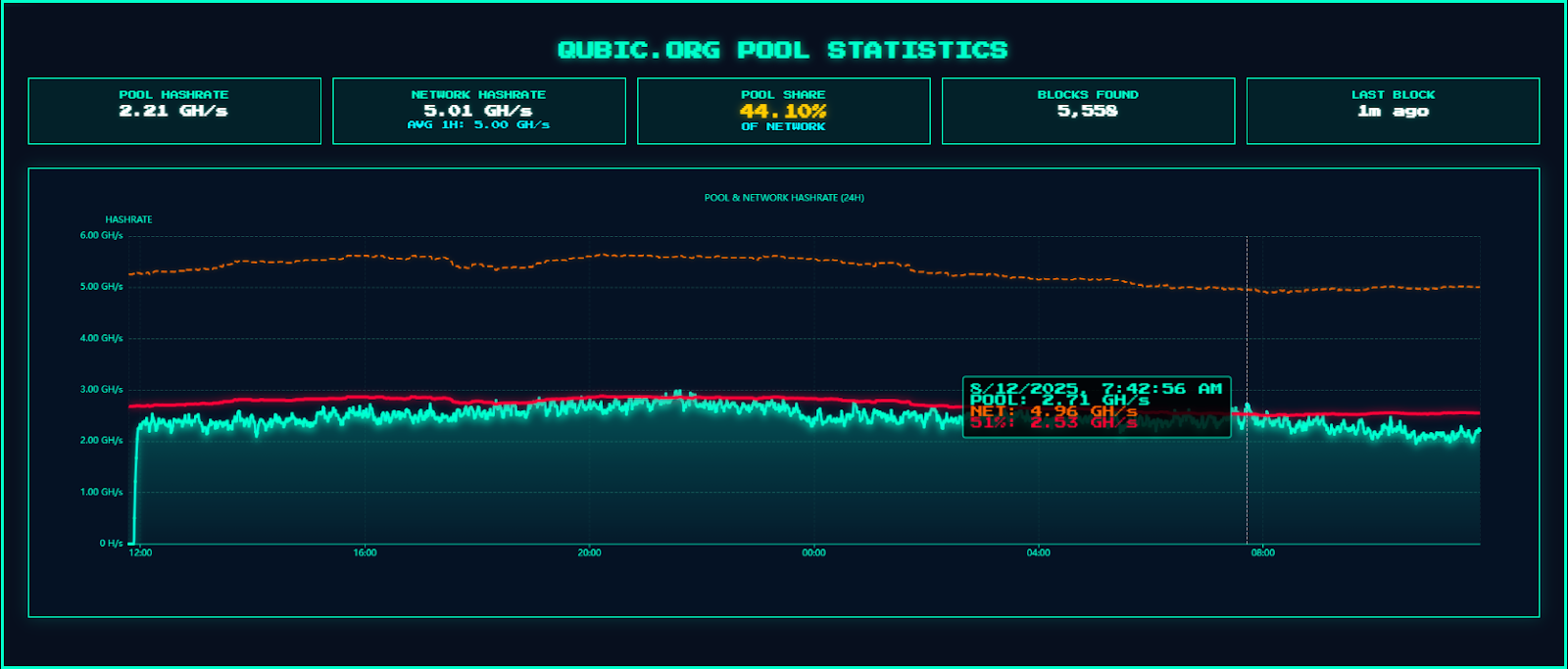

- Gains Network has introduced gTrade, a decentralized synthetic leverage trading protocol for equities, foreign currency, and cryptocurrencies, on Arbitrum.

- Users can deposit DAI to provide liquidity to generate income or use it for contract activities.

gTrade, a decentralized synthetic leverage trading protocol for cryptocurrencies, foreign exchange and stocks launched by Gains Network, has been launched on Arbitrum.

Users can use DAI for contract transactions or choose to deposit DAI to provide liquidity to obtain income.

According to Gains Network, gTrade is a “decentralized leveraged trading platform” that’s “liquidity-efficient, powerful, and user-friendly.” The characteristic that sets it apart is its “synthetic architecture.”

That implies the user never acquires the asset outright or borrows money to gain access to, leverage, and multiply prospective returns. Every trade has excessive collateral. The prices of the trades have no overall effects on the asset. Users don’t go through KYC identification processes and trade directly from their own wallets.

In any event, by utilizing a single liquidity pool, gTrade makes things simpler. In terms of leverage, it offers an incomparable product: 50x on stocks, 150x for cryptocurrencies, and up to 1000x on currency trades.

Additionally, the Gains Network product pays a yield that varies between 15% and 50% APY to liquidity providers. It makes all the difference if those profits come from trading commissions and liquidations rather than from liquidity mining or the Gains Network inflating the GNS utility token.

It makes sense since the main idea behind gTrade is the assurance that traders will lose more money than they would make. The dependence of the system on that reality is the problem, and that appears to be a systemic risk. It’s a weakness, and those can be targeted and exploited in ways that are still unthinkable. The central DAI vault, which serves as the counterparty to trades on the network, is a key component of the Gains Network’s gTrade.

Their native token is GNS, stakers receive a share of trading commissions and will eventually run the protocol through decentralized governance. The #RealYield shared with them from the platform’s revenue encourages users to keep their money in the GNS/DAI LP, DAI vault, and GNS staking pool.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Website: coincu.com

Harold

Coincu News