Key Points:

- Stronghold Digital Mining and noteholders have reached an agreement to trade $23.1 million in convertible preferred stock for $17.9 million in convertible debt.

- The transaction marks the Bitcoin miner’s most recent attempt to strengthen its balance sheet.

- A new series of convertible preferred shares that can be converted into common shares for a price of 40 cents per share will replace the 10% convertible notes under the terms of the deal.

According to a press release on Tuesday, Stronghold Digital Mining, a Bitcoin miner, has reached an agreement with noteholders to convert $17.9 million in convertible debt into $23.1 million in convertible preferred shares.

The transaction marks the Bitcoin miner’s most recent attempt to strengthen its balance sheet. Stronghold reached an arrangement in August to pay off a debt of $67.4 million by returning 26,200 mining machines to the lender NYDIG.

In an effort to increase its cash flow, the company terminated a hosting contract with Northern Data of Germany in September. Greg Beard, co-chairman and chief executive officer, stated:

“We are pleased to announce another deleveraging transaction that is expected to materially reduce our debt, strengthen our balance sheet, and improve our liquidity position.”

A new series of convertible preferred shares that can be converted into common shares for a price of 40 cents per share will be given in place of the 10% convertible notes under the terms of the deal that was announced on Tuesday. The transaction is anticipated to finalize on February 20 and bring the company’s debt down to less than $55 million.

“We acknowledge the significant number of shares of common stock that could be issued as a result of the Exchange Agreement, but we believe this is necessary to preserve cash, reduce our financial obligations, and better position the Company to survive a potentially prolonged crypto market downturn,” Beard said.

According to the firm, 57.8 million common shares would be issued if all the preferred stock is converted, increasing the existing common float by around 46%. The new preferred shares won’t receive a dividend payment from Stronghold.

Like other companies in the sector, it has seen mining economics deteriorate due to a decline in Bitcoin prices and an increase in energy costs.

Core Scientific, another Bitcoin miner, also has plans to convert the majority of its debt into equity after declaring bankruptcy last month.

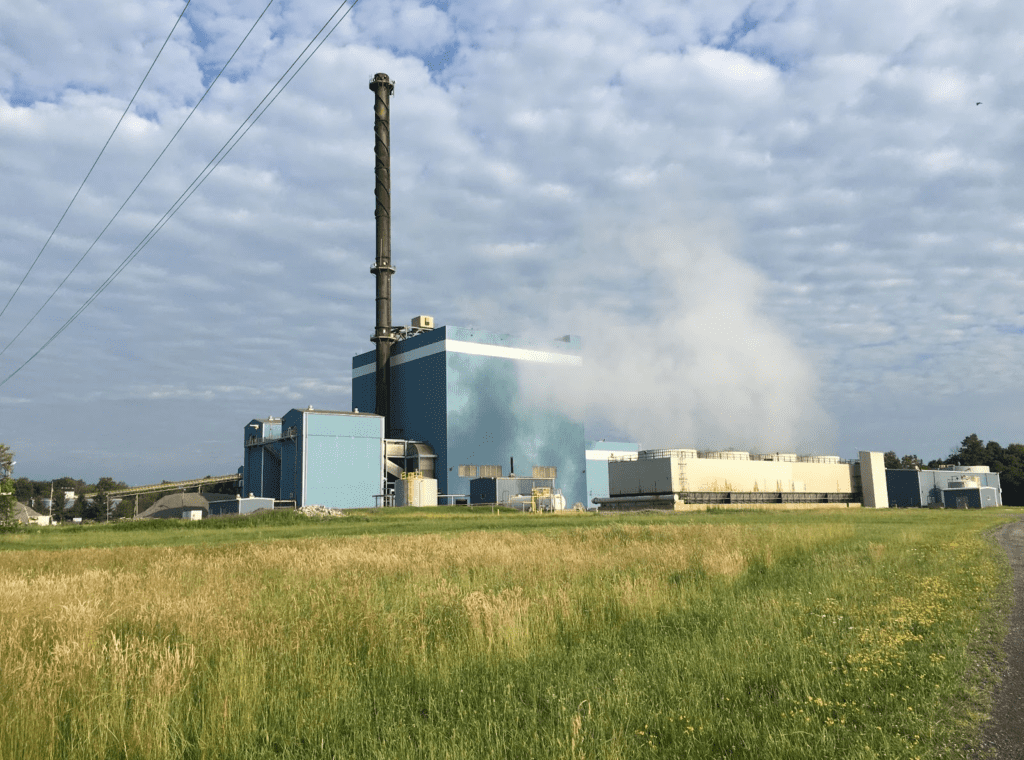

During the summer, Stronghold moved its emphasis from mining to selling power. In Pennsylvania, the company owns and runs two waste coal plants. Stronghold had roughly 6 Bitcoins and $12.4 million in unrestricted cash at the end of 2022.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Website: coincu.com

Harold

Coincu News