Sam Bankman-Fried Insisted He Didn’t Steal Funds From FTX And Alameda

Key Points:

- Sam Bankman-Fried denied any involvement regarding the allegations that Alameda had used FTX customer funds.

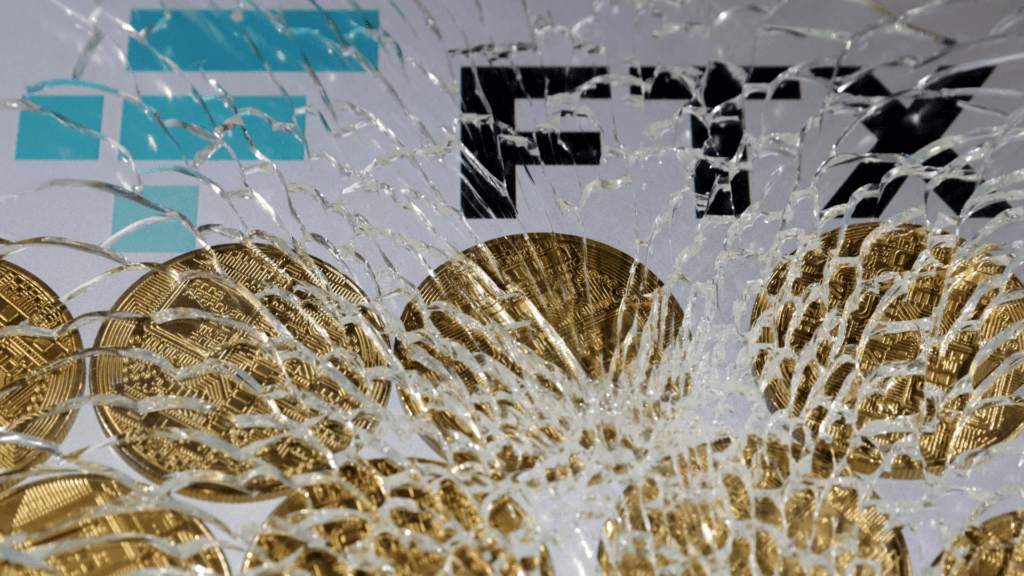

- He asserted that the collapse of FTX and its sister company Alameda Research was caused by the fall of the cryptocurrency market and insufficient hedging on Alameda’s side.

- The former FTX CEO said he was pressured into naming John Ray as the new CEO.

In a lengthy new post on Substack published on Thursday, Sam Bankman-Fried, the disgraced former CEO of FTX, denied concealing billions of dollars and provided his perspective on what occurred to his defunct cryptocurrency exchange.

In a pre-mortem overview of the bankruptcy of the cryptocurrency exchange, Bankman-Fried has mainly refuted the accusations leveled against him.

He denied taking funds and asserted that the collapse of FTX and its sister company Alameda Research was caused by the fall of the cryptocurrency market and insufficient hedging on Alameda’s side.

“I didn’t steal funds, and I certainly didn’t stash billions away. Nearly all of my assets were and still are utilizable to backstop FTX customers. I have, for instance, offered to contribute nearly all of my personal shares in Robinhood to customers–or 100%, if the Chapter 11 team would honor my D&O legal expense indemnification,” the former FTX said.

According to court documents, Bankman-Fried wants to keep ownership of the nearly 56 million Robinhood shares in order to pay his legal bills. Since then, the Justice Department has seized the contested shares.

He asserted that, in the wake of the company’s bankruptcy, there was a way for clients of specific FTX enterprises to be made whole. The former CEO claimed that FTX US had $350 million in cash on hand and was fully solvent when the company filed for Chapter 11 bankruptcy.

Bankman-Fried is currently free on bail at his parents’ California home despite being charged with many federal offenses, including conspiracy to commit fraud. Although FTX co-founder Gary Wang and Alameda CEO Caroline Ellison pleaded guilty to fraud charges and are now helping an investigation in the Southern District of New York, he has pleaded not guilty to the accusations.

Prior to the company’s bankruptcy, Bankman-Fried claimed that the legal firm Sullivan & Crowell and the FTX US general counsel exerted pressure on him to appoint John Ray as the new CEO of FTX, disturbing an apparent plan to make impacted users substantially whole.

He attributed a big portion of FTX’s failure to the 2022 crypto market meltdown and Changpeng Zhao, CEO of Binance, who waged a months-long PR campaign against FTX.

In three places in his note, Bankman-Fried referred to Binance’s early November announcement to remove cash from Alameda as a targeted attack since it caused a run on the FTX market.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News