Bitcoin First Rally In 2023 Leads To Major Gains Of Publicly-traded Crypto Stocks

Key Points:

- Along with the rally of Bitcoin, Coinbase (COIN), which has increased by 49% this week, is one of the major movers.

- Marathon Digital (MARA) increased by 79%, Hut 8 Mining (HUT) increased by 49%, Bit Digital increased by 41%, while Riot is up just 27% this week.

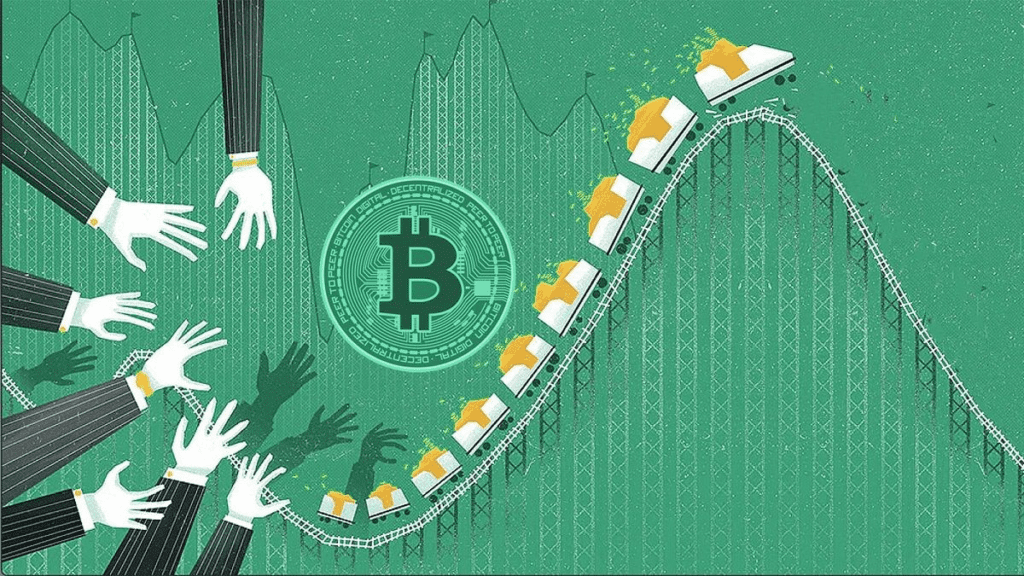

On January 14, Coindesk reported that just a tiny amount of comeback level in bitcoin (BTC) this week has resulted in an outsized gain of crypto stocks, despite the fact that all publicly listed crypto equities would be down 70%-90% or even more in 2022.

According to Coindesk, Coinbase (COIN), which has increased by 49% this week, is one of the major movers. To start the year, the cryptocurrency exchange has experienced a number of sell-side downgrades, price target reductions, and a credit rating downgrade from Moody’s.

Additionally, the business this week disclosed a 20% reduction in staff. However, Cathie Wood’s ARK Investment has been bottom-fishing, buying $7.5 million in Coinbase shares this week and around $28.5 million over the course of the previous month.

Bitcoin (BTC), which was trading at $19,434 at the time of publication, has increased by approximately 15% this week and has reached its highest level in more than two months, following the collapse of cryptocurrency exchange FTX.

The report also indicates that Bitcoin miners would face an existential crisis in 2023 as a result of a combination of low bitcoin prices, growing power costs, frequently high debt levels, and practically blocked capital markets.

As Coincu reported on December 21, 2022, Core Scientific, one of the biggest publicly traded crypto mining businesses in the U.S., is filing for Chapter 11 bankruptcy protection in Texas. While Argo Blockchain (ARBK) just avoided Chapter 11 bankruptcy thanks to a late-inning bailout from Michael Novogratz’s Galaxy Digital (GLXY.TO).

Riot Blockchain, one of the largest miners, began the year by removing any references to cryptocurrency from its name and rebranding it as Riot Platforms (RIOT).

However, some positive news for bitcoin drove the sector’s shares soaring. Marathon Digital (MARA) increased by 79% this week, Hut 8 Mining (HUT) increased by 49%, and Bit Digital increased by 41%. Riot is up just 27% this week, maybe as a result of dropping the word “blockchain” from its name.

Additionally, MicroStrategy (MSTR) has gained 30% this week and ailing Silvergate Capital (SI) has gained 11%.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Thana

Coincu News