Key Points:

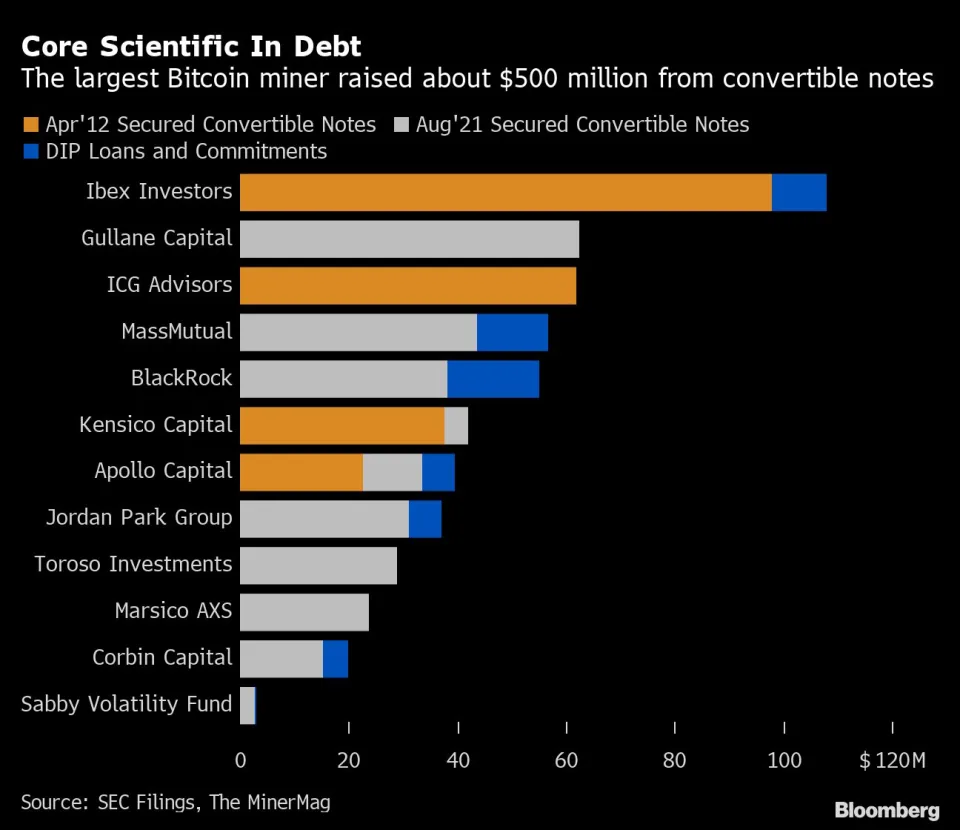

- BlackRock and Apollo Capital Management were among the creditors who provided Core Scientific, a defunct crypto miner, with a $500 million loan.

- BlackRock acquired $38.2 million in convertible notes from Core Scientific. Contrarily, according to the documents, Apollo bought $22.5 million worth of convertible notes in April 2021 and another $10.9 million in August 2021.

According to court documents, BlackRock and Apollo Capital Management were among the creditors who provided Core Scientific, a defunct crypto miner, with a $500 million loan.

When the price of Bitcoin (BTC) fell last year, Core Scientific, which recently filed for Chapter 11 bankruptcy, struggled to repay its obligations.

In August 2021, BlackRock acquired $38.2 million in convertible notes from Core Scientific. Contrarily, according to the documents, Apollo bought $22.5 million worth of convertible notes in April 2021 and another $10.9 million in August 2021.

Ibex Investors, which acquired convertible notes for $97.9 million from Core Scientific in April 2021, was the biggest creditor. In the same month, the miner raised $61.7 million and $37.6 million from ICG Advisors and Kensico Capital Management, respectively, using convertible notes.

The miner received additional payments from Kensico, Marsico, and Massachusetts Mutual Life Insurance Company totaling $43.6 million in August (MMLIC). In the same month, the miner sold convertible shares to Toroso Investments, Jordan Park Group, and Sabby Volatility Warrant Master Fund for amounts of $28.9 million, $31.1 million, and $2.7 million, respectively.

Core Scientific additionally raised $15.29 million

Many of these creditors also provided Core Scientific with debtor-in-possession (DIP) loans, allowing the miner to keep functioning despite filing for bankruptcy.

The defunct miner received DIP loans from Ibex, BlackRock, and Apollo totaling $10.1 million, $17 million, and $6.1 million, respectively. According to the documents, MMLIC, Sabby, Jordan, and Corbin collectively provided another $24 million in DIP loans.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Website: coincu.com

Annie

Coincu News