Key Points:

- MakerDAO lowers fees as stablecoin demand falls; MakerDAO income falls 42% in 2022.

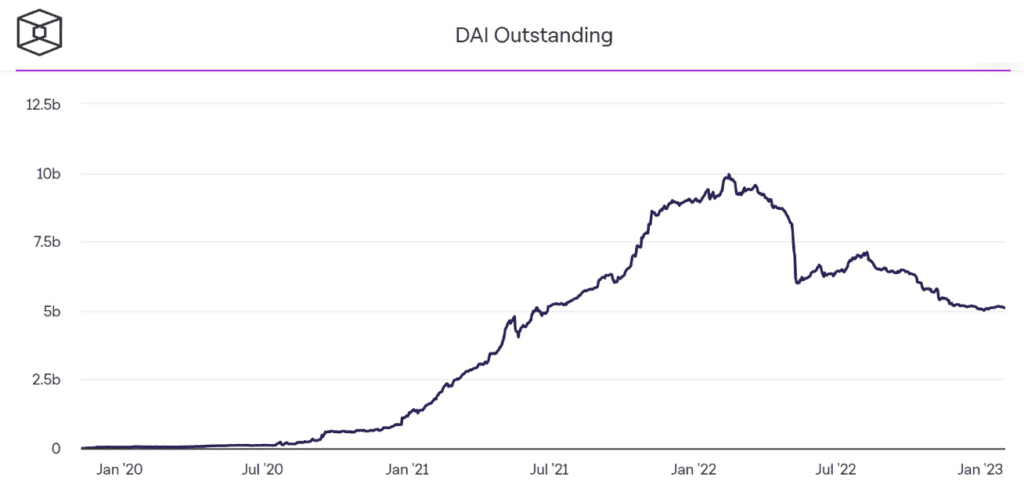

- According to Steakhouse, the circulating supply of Maker’s primary product, stablecoin DAI, is 5 billion DAI by the end of 2022, down 43% from 9 billion DAI in the same period last year.

MakerDAO’s revenue has dropped dramatically in 2022, with the decision to switch to real assets being the protocol’s primary source of income.

According to the study, MarkerDAO overall income fell by 42% from 112 million DAI ($112 million) in 2021 to 65 million DAI in 2022. This reduces the protocol’s net profit by 80% to just 19. million DAI; in 2021, this figure will be 90 million DAI. Meanwhile, the project’s running expenses are skyrocketing, reaching 46 million DAI in 2022, more than double from the previous year.

Based on Steakhouse, the circulating supply of MakerDAO primary product, stablecoin DAI, is 5 billion DAI by the end of 2022, down 43% from 9 billion DAI in the same period last year. After the overall crypto slump in 2022, MakerDAO revenue diminishes, and the market is now in a severe bear cycle caused by the collapse of the Terra ecosystem and the FTX exchange – factors that have created a severe bear cycle. The occurrence happened during a worldwide financial slump and had an impact on both the CeFi and DeFi loan markets.

Last year, the DeFi titan made a huge change by pivoting to more stable assets like as US government bonds, lessening Circle’s need for stablecoin USDC. By the end of 2022, Maker’s real-world asset balance had grown to 640 million DAI. This is a 37-fold increase from the end of 2021, with the majority of the expansion coming in the second half of 2022., which provides 500 million DAI to Monetalis Clydesdale for short-term bills and corporate bonds, and 100 million DAI to Huntingdon Valley Bank.

The impact of Maker’s real-world asset push can be seen in the platform’s revenue generating matrix, which accounted for 70% of MakerDAO’s total income in December, according to the study.

The MakerDAO community adopted a proposal in November 2022 to raise the interest rate on stablecoin DAI deposits from 0.01% to 1% yearly, with the goal of making stablecoins more appealing to investors. Another newly agreed proposal is to preserve the Gemini USD (GUSD) stablecoin as a DAI reserve asset, notwithstanding the exchange’s turmoil.

Paxos has proposed to pay MakerDAO interest in exchange for the protocol holding 1.5 billion USDP (Paxos stablecoin) as one of the reserve assets.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Chubbi

Coincu News