Key Points:

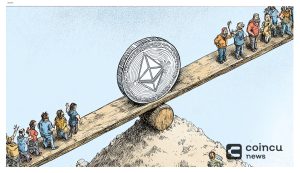

- The financial unit of the Lido DAO, Steakhouse Financial, has published two governance proposals that call for the project to stake or sell the ETH tokens kept in its treasury. The Lido community is debating these suggestions.

- Lido DAO would exchange ETH for a stablecoin that could be used to prolong the project’s runway as part of proposals for a complete or partial sale of the ETH tokens.

- The leftover ETH balance might likewise be staked after a partial sale.

Steakhouse Financial, the financial unit of Lido DAO, submitted four governance proposals, namely whether Lido DAO should stake the ETH in the vault or should sell the vault ETH, and whether the DAO should decentralize its stablecoin holdings or should it sell the remaining stETH of the agreement to pay for operating expenses.

Steakhouse Financial said the vault-related proposals are intended to get a clear signal from LDO holders about the fundamentals of how the DAO should manage its vaults.

The DAO would exchange ETH for a stablecoin that could be used to prolong the project’s runway as part of proposals for a complete or partial sale of the ETH tokens. The leftover ETH balance might likewise be staked after a partial sale.

One of the ideas also recommended that the DAO stake all of its ETH holdings.

Lido DAO is reported to hold 20,304 Ethereum worth about $30 million as part of its $350 million treasury. These funds are held in the project’s Aragon contract like funds in other treasuries. Lido has held these ETHs since completing the fund diversification process in April 2022.

These numbers should be adequate to meet monthly operational expenditures, according to Steakhouse Financial.

They are currently debating whether it would be beneficial to convert any extra stETH into a stablecoin, though, in order to be better prepared for any changes in market circumstances that would result in elevated operational costs.

The ideas came after a decline in stETH’s total value locked (TVL) of 6.66% from February 6 to February 13.

There may be a governance vote as a result of the discussions on the DAO forum. In order to determine the preferable choice, this procedure starts with a Snapshot vote to evaluate delegate mood.

At the time of writing, ETH is trading at $1550.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News