Key Points:

- Options trading in DeFi always offers access to high returns with a certain amount of risk.

- This is one of the ways to help investors survive in the market under all circumstances.

- Let’s take a look at 5 DeFi option protocols that deserve attention.

It’s a risky world, and when crypto investors have a strong view of where the wind is headed, they often turn to DeFi options.

This article will introduce options trading, explain some of the risks involved, and show you some of our favorite on-chain protocols where you can explore them further.

Know your options

As cryptocurrency investors face a minefield of potential volatility — with inflation data and regulators trumpeting their own concerns — it’s important to remember you have options.

The introduction to options trading is divided into:

- 101 Basics of DeFi Options

- Our Five Favorite On-Chain Options Protocols

If you’re dabbling in options, you’re probably a Degen trying to get highly leveraged returns without being a market maker, or you’re worried about volatility and looking to hedge the downside. Options trading may be the best solution for you.

101 Basics of DeFi Options

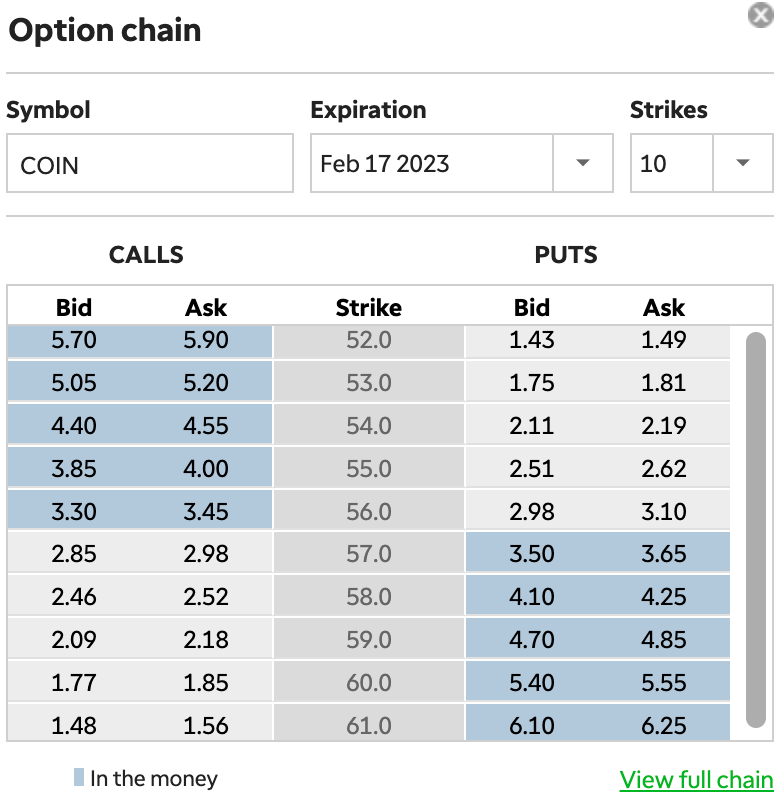

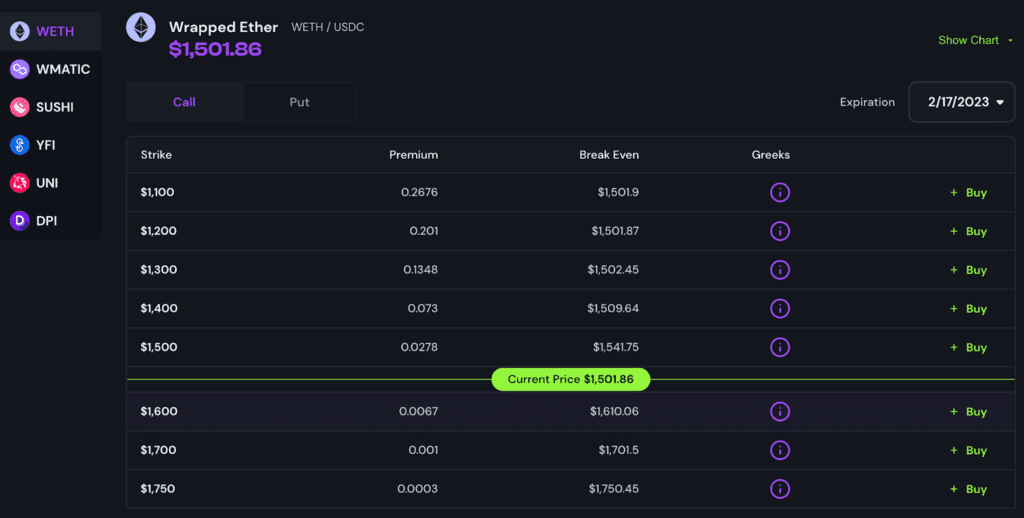

Does the picture below cause anxiety? Don’t know what an option chain is? Then this section is for you.

Above is the option chain for.Coinbase (COIN).

The option chain lists various strike prices (middle) for various calls (left) and puts (right) for a given expiration date (February 17, 2023).

The buyer of an option has the right to buy or sell the underlying asset at a predetermined strike price.

- ???? Calls: the ability to buy COIN at the strike price

- ???? Puts: the ability to sell COIN at the strike price.

Scenario: Your friend thinks the regulatory drama at Coinbase is total FUD, exclaiming:

“COIN is going to go supernormal by Friday! I have to ape now and use options to increase my gains, but I have no idea what to buy Know.”

Your response (not financial advice!!!): “Really? Well, if you insist…Given your strong bullish conviction, I recommend buying Feb at $60 strike Call options expiring on Friday the 17th.”

Your friend then trades $1,850 for the right, but not the obligation, to buy 1,000 COIN shares at $60 each on or before February 17.

Options can be thought of as insurance-like contracts: a premium ($1,850) is paid upfront to get coverage. When “disaster strikes” (i.e. COIN trades above $60 in this case), investors start to profit.

Your friend is not considered profitable until COIN is trading above $61.85 ($60 strike + $1.85 premium), but has no exposure beyond the initial $1850 investment, for every cent COIN exceeds $61.85 Money is all about real profit.

Capped losses and unlimited upside make options extremely attractive to many market participants across a variety of use cases.

Our Favorite 5 On-Chain Options Protocols

Whether it’s Degen or risk-averse, the same on-chain options protocol is used.

When it comes to cryptocurrency options, forget about exchanges because the best markets are built natively on-chain.

Let’s explore our top five favorites:

Trading cryptocurrency options丨Lyra

Options protocol Lyra Finance has over $29M in TVL split evenly between its Optimism and Arbitrum deployments. After launching on Arbitrum in January, its TVL doubled.

With a simple user interface, multiple strikes and expirations, and tight bid-ask spread, Lyra Finance provides options traders with more liquidity in ETH and BTC options than other protocols.

Lyra is recommended for: Seasoned traders looking to replicate the experience of traditional brokerages.

Hegic

If you feel constrained by Lyra’s preset expiration dates, maybe you’re interested in implementing complex multi-leg option strategies.

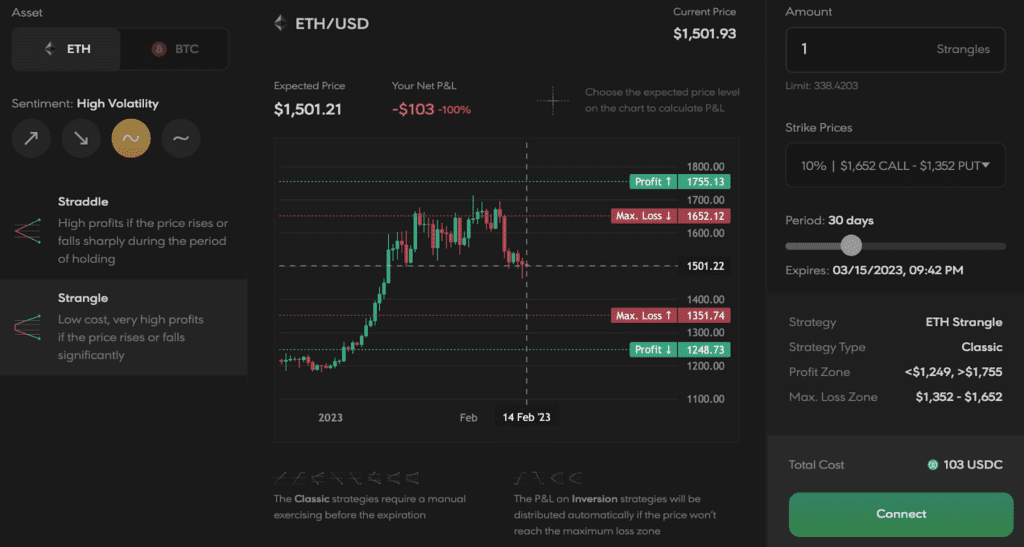

Hegic makes options easy with options on custom dates and a range of one-click strategies available at multiple strike levels.

Users can choose from a variety of bullish, bearish, high-volatility or low-volatility biases, tailoring return results to their unique risk tolerance and market sentiment. The dApp overlays the yield results you generate onto an interactive chart, giving users a visual idea of what they will gain (or lose) at the expected value of any underlying asset.

Recommend Hegic for: Degens looking for flexible expiration and one-click complex options strategies.

Whiteheart

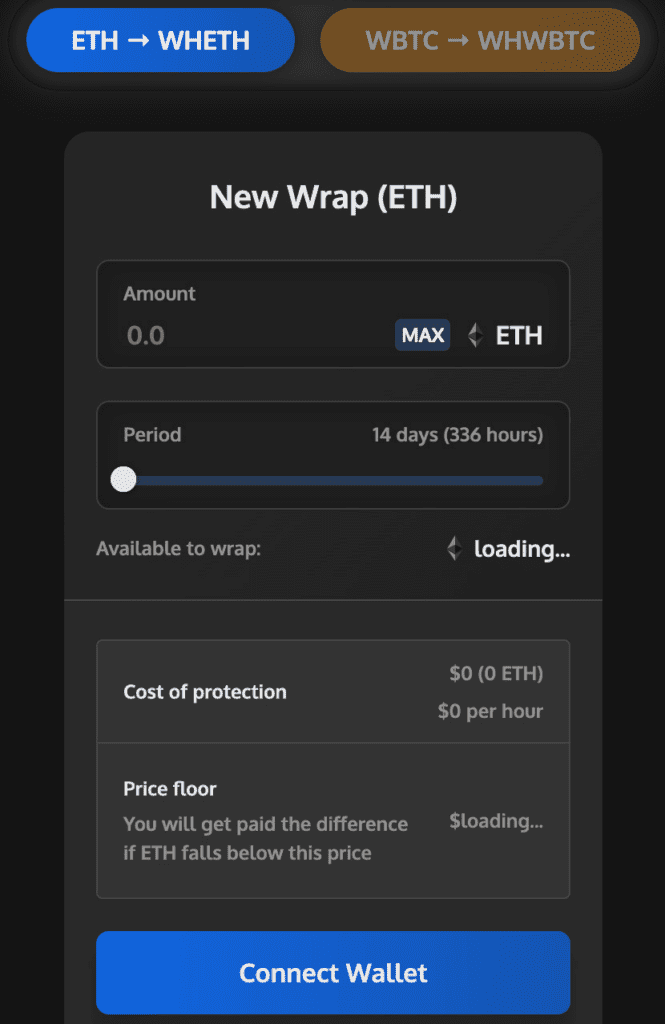

Do you have financial problems? Have you been looking for an easy way to lock in today’s ETH or BTC price and collect fees?

Whiteheart offers an extremely simple user interface with two decisions:

- Ethereum or Bitcoin

- The number of days you want to hedge

Closing the deal: you’ve locked in today’s ETH or BTC price for the duration of the contract! Whiteheart’s “hedging contract” provides users with deep options liquidity, minus the protocol’s complex interface and complex options strategies (which may be daunting for those new to DeFi).

Recommend Whiteheart for: Novice options traders looking for an easy-to-understand way to lock in to the current ETH or BTC price and eliminate downside risk over a fixed time period.

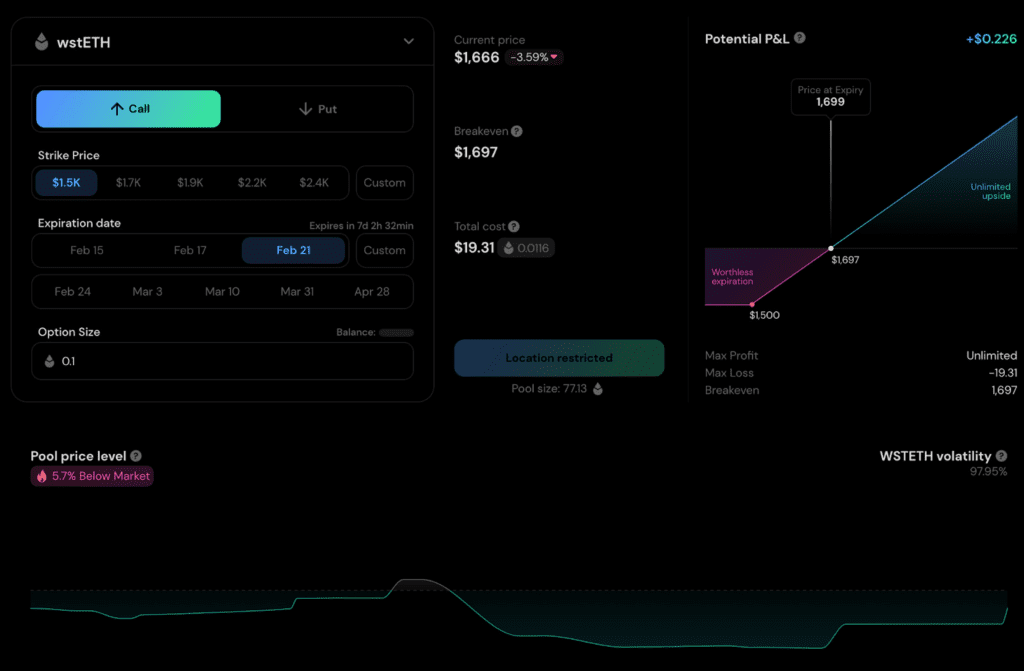

Premia

- Chains: Ethereum, Arbitrum, Optimism, Fantom

- Options: ETH, BTC, YFI, LINK, ALCX, alETH, OP, FTM

Who said options can only be used for ETH and BTC?

Premia offers options on smaller market capitalization assets that you may be interested in hedging tail risk or speculating on. Similar to Hegic, the protocol provides traders with custom expiration dates for various strike prices.

Unique to Premia is the Options Pricing Dashboard, which provides information to traders if options are overpriced or underpriced. The model employed is similar to the Black-Scholes model based on traditional option pricing, but has been tuned to be optimized for cryptoassets.

Premia is recommended for: Traders looking for flexible expiration dates and who want in-depth insight into option pricing on a variety of underlying assets.

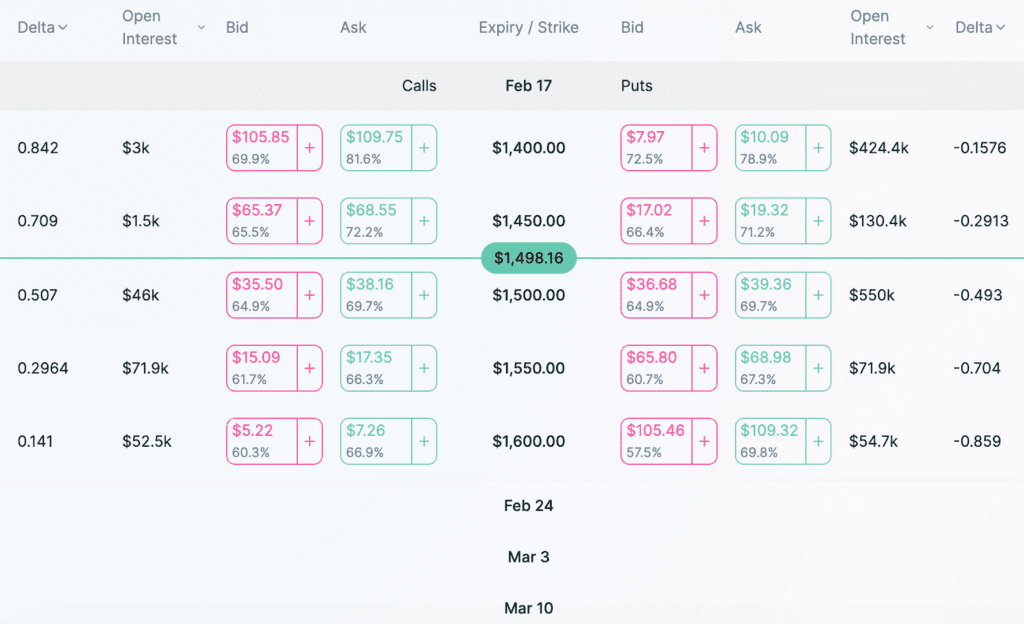

Siren

Siren, an options protocol on Polygon, offers a TradFi-inspired options interface with a more striking color scheme than Lyra. Both protocols utilize traditional option chains to display prices to users, and Siren is Lyra’s most direct competitor in terms of user experience as outlined in this guide. Siren offers options on a wider range of underlying collateral at more strike prices than Lyra.

Siren is recommended for: Experienced traders looking to replicate the experience of traditional brokers with a wider base of collateral and more OTM options than Lyra.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News