The Thucydides Trap In The NFT Market: OpenSea Counterattacks And Starts A Fee War

Key Points:

- The emerging NFT market Blur is declaring war on the behemoth in the field.

- Blur had problems with OpenSea using a “blacklist” to prevent it, but with little success.

- Blur’s rapid growth exacerbated OpenSea’s concerns, causing the battle to heat up.

The Thucydides Trap, proposed by Graham Allison, a professor at Harvard University, means that a newly rising power must challenge the existing power, and the existing power must respond to this threat so that war becomes inevitable. Now, the Thucydides trap has happened to the two giants of the NFT market, OpenSea, and Blur.

Blur takes the lead

On February 15, Blur’s native token BLUR was launched for trading, and the transaction volume exceeded $1 billion in less than 24 hours. Perhaps taking advantage of this strong momentum, Blur began to confront OpenSea in a new chapter of the NFT royalty war.

On February 16, one day after the BLUR token was launched, Blur issued an official announcement announcing the update of the royalty policy, which straightforwardly recommends that users block OpenSea; as long as they do not use OpenSea, they can enjoy full royalties.

NFT projects set optional royalty settings. If OpenSea cancels this policy, NFT projects will be able to collect royalties on both platforms at the same time. Blur emphasizes that currently, NFT project creators cannot collect royalties on two platforms at the same time and can only collect full royalties on either OpenSea or Blur, but not at the same time.

In fact, it was not accidental that Blur showed his sword this time. In November 2022, OpenSea announced that in order to enforce full creator fees on the platform, individuals who create NFT smart contracts after January 2, 2023, must take on-chain actions to make royalties enforceable.

In other words, OpenSea requires creators to use on-chain tools to prohibit the sale of NFTs on marketplaces that don’t enforce royalties for creators — an obvious move against Blur, which is a royalty-free platform where creators have to ban NFTs sold on Blur can enjoy full royalties on OpenSea. If this is not done, OpenSea will automatically set the royalties of these NFT collections to “optional,” which in turn affects creator income.

Blur took issue with OpenSea’s use of a “blacklist” to suppress it, claiming that creators should decide where and how their products are sold – not companies – but had little success, and then also had to use the Seaport agreement Bypass restrictions.

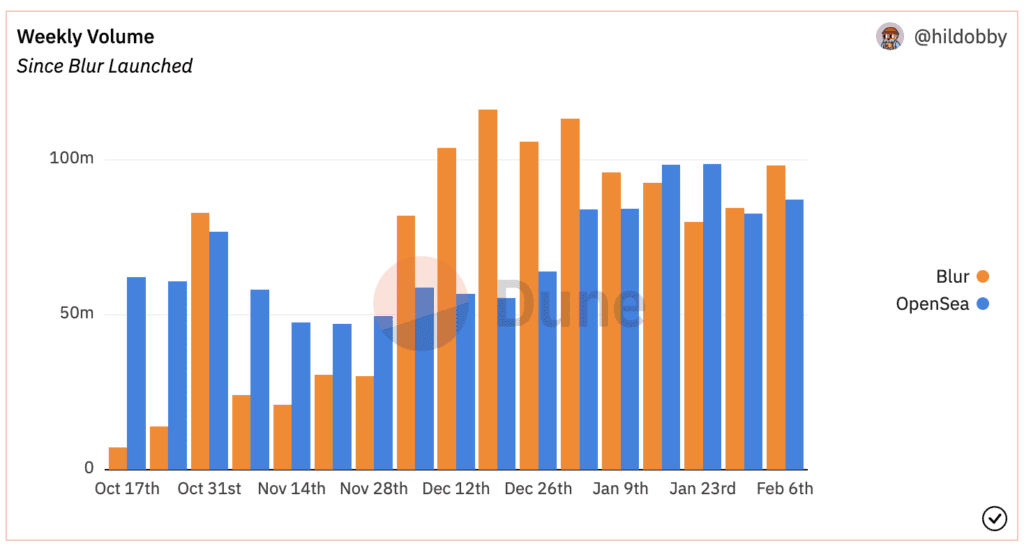

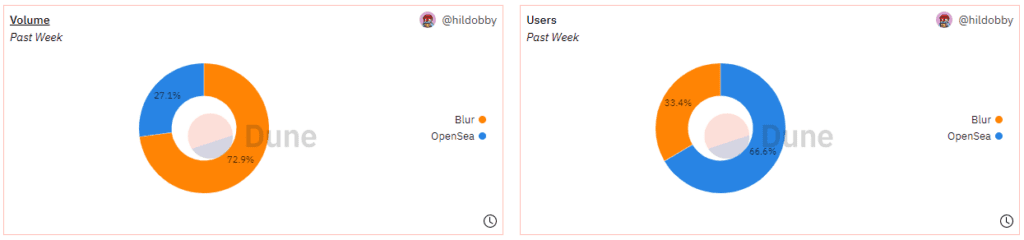

However, OpenSea’s wishful thinking did not succeed in suppressing the rapid development of Blur but caused users to defect. The figure below is a comparison of two platforms’ single-week transaction volume. It can be seen from the figure that since the beginning of December 2022 (that is, OpenSea began to restrict Blur), OpenSea’s transaction volume was higher than that of Blur in only two weeks, and it lagged behind in the rest of the time.

NFT ecosystem “big reversal”? OpenSea has given up

In the early hours of February 18, OpenSea announced the launch of a time-limited 0-fee transaction, provided an optional copyright service with a minimum standard of 0.5% and applicable to all NFT series that do not enforce royalties on the chain, and also updated the operator filter This allows NFT markets with the same policy to work together to increase market liquidity.

Finally, OpenSea bowed its head and gave in.

The NFT marketplace explained the reason for this decision, purportedly because of “dramatic changes in the NFT ecosystem,” in their words:

“In October, we started to see meaningful volume and users move to NFT marketplaces that don’t fully enforce creator earnings.

Today, that shift has accelerated dramatically despite our best efforts.

We’ve worked to defend creator earnings on ALL collections when others didn’t. And when we introduced the Operator Filter, it was our belief that on-chain enforcement was the best way for creators to secure their revenue stream from the ongoing resale of their work.

We thought we could catalyze widespread enforcement of creator earnings, and we hoped others might come up with more resilient solutions – this hasn’t happened.”

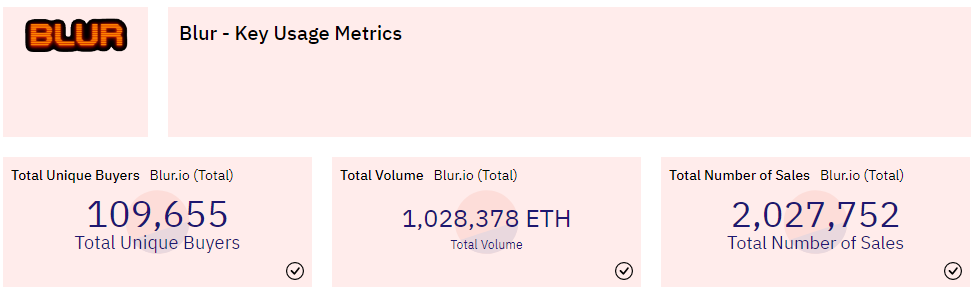

The rapid development of Blur has exacerbated OpenSea’s concerns. According to Dune Analytics data, the transaction volume of its platform has exceeded 1 million ETH, reaching 1,028,378 ETH, which is about $1.75 billion according to the current price, and the total sales volume has also exceeded 200 million ETH. 10,000, currently reaching 2,027,752. In addition, the number of independent buyers on the Blur platform is 109,655.

Did Blur win big?

Frankly, it’s too early to say Blur has won the turf war with OpenSea.

Blur’s recent surge in transaction volume is largely related to its airdrop of BLUR tokens, and it is uncertain whether it can maintain longer-term organic growth. It should be noted that the number of users of OpenSea is almost twice that of Blur (as shown in the figure below), which means that they still have a strong user base, and more importantly, OpenSea has not released its own governance token or platform so far once it tries Blur’s currency issuance strategy, it is bound to have an impact on the entire NFT market structure.

Galaxy researchers pointed out that NFT traders should pay close attention to the ongoing “battle” between OpenSea and Blur. In fact, most of Blur’s top traders have conducted wash sales in order to obtain airdrop tokens, which shows that the relationship with OpenSea In contrast, the transaction volume on Blur’s platform may not be organic.

On the other hand, perhaps in order to leave more retreats for itself, Blur’s counterattack strategy is actually not too radical because its updated royalty policy also provides the option not to block OpenSea and block Blur if the creator does not set blocking.

Blur will charge a 0.5% royalty (sellers can also choose a higher royalty), while OpenSea is an optional royalty; if blocking Blur or other NFT projects in the zero-royalty/royalty optional market will be enforced on OpenSea royalty, transactions, and listings can still be carried out on Blur, subject to a minimum 0.5% royalty.

The Galaxy analyst added:

“Clearly, Blur is using their influence to force OpenSea to work with them rather than show hostility to them, time will tell if Blur’s strategy will work, but both in terms of metrics and products In terms of both, they are by far the most successful OpenSea competitors.”

Additionally, Galaxy researchers also stated in a new report on Friday:

“With regard to Blur, there are two key issues to focus on. First and foremost is how much market share Blur can retain as their BLUR token has Liquidity. Second is trading volume, Blur trading volume is not expected to see a serious decline in the short term because their token incentive plan will continue for at least another 30 days in the second quarter, but it is worth seeing whether this model can work in the long run.”

In short, as the turf battle between two NFT marketplaces continues to heat up, the competition in the NFT market will only intensify. Perhaps after this battle is over, we will be able to find a development path that is most suitable for NFT creators and traders.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News