Filecoin Tokenomics: The Force Behind The Strong Pull In The Storage Sector

Key Points:

- Since distributed storage network Filecoin released three major project updates in 2023 last week, FIL has consistently broken its own “ceiling.”

- Filecoin’s token economy is designed with this long-term vision in mind and helps incentivize the rapid growth and development of the network.

- The FIL token has many functions that facilitate sustainable development.

Since the distributed storage network Filecoin released three major project updates in 2023 (FVM, data computing, and retrieval market) last week, FIL has continuously broken its own “ceiling” in the past week. The price of FIL has exceeded $9 over the past week. Today, we will take everyone through the impact of the Filecoin tokenomics on token holders and the future ecosystem.

Introduction to Filecoin

Launched in October 2020, the Filecoin network introduces an incentive layer to the IPFS protocol and enables open data services. Today, the Filecoin network is known primarily as storage as an open service. However, an earlier article summarizing the direction of the network laid out a larger vision for Filecoin, also including “an infrastructure for storing, distributing, and transforming data.”

Filecoin’s “main plan” to execute this vision begins with accumulating massive hardware resources (storage capacity and computing power). This is important because the only way Web3 infrastructure can credibly replace (or even not only compete with) traditional cloud storage is if it can operate at orders of magnitude and scale beyond current offerings. While no Web3 protocol has achieved this yet, some progress has been made.

Furthermore, in order to drive long-term demand for network resources (capacity, retrieval, and computing power), it is crucial to guide the network with efficient data and develop software and tools to enable computing and composable services on top of data. Ultimately demand these services will be the foundation of a robust economy on top of the Filecoin blockchain.

Filecoin tokenomics was designed with this long-term vision in mind and helped incentivize rapid growth and development of the network. To date, the network has a committed storage capacity of over 16 EiB, with an explosion in the ecosystem driving demand for network resources. This growth and continued success is due to the efforts of the Filecoin community, an interconnected network of storage clients, developers, storage providers (SPs), ecosystem partners, and token holders.

Filecoin token

This global digital economy also requires a single effective currency for transactions. Since Filecoin is a permissionless marketplace with cryptographically verifiable goods, the design constraints can only be passed through the native utility token Filecoin. FIL tokens have multiple functions:

- Pay for messages on the chain.

- As collateral, create economic incentives for long-term reliable data storage and secure subnetworks or shards of the blockchain as well as Interplanetary Consensus (IPC: Consensus Lab flagship project) live.

- Burn to regulate shared resources (block space).

Unlike other storage networks, Filecoin tokens are primarily focused on incentivizing reliable service and facilitating on-chain economies. The storage market exists off-chain, but messages containing cryptographic proofs of storage are anchored on-chain. Crucially, this means that tokens can grow in value without placing undue pressure on users of the network’s various services (storage, retrieval, computation, etc.) ), and token holders can still benefit from FIL consumption.

Tokenomics for token holders

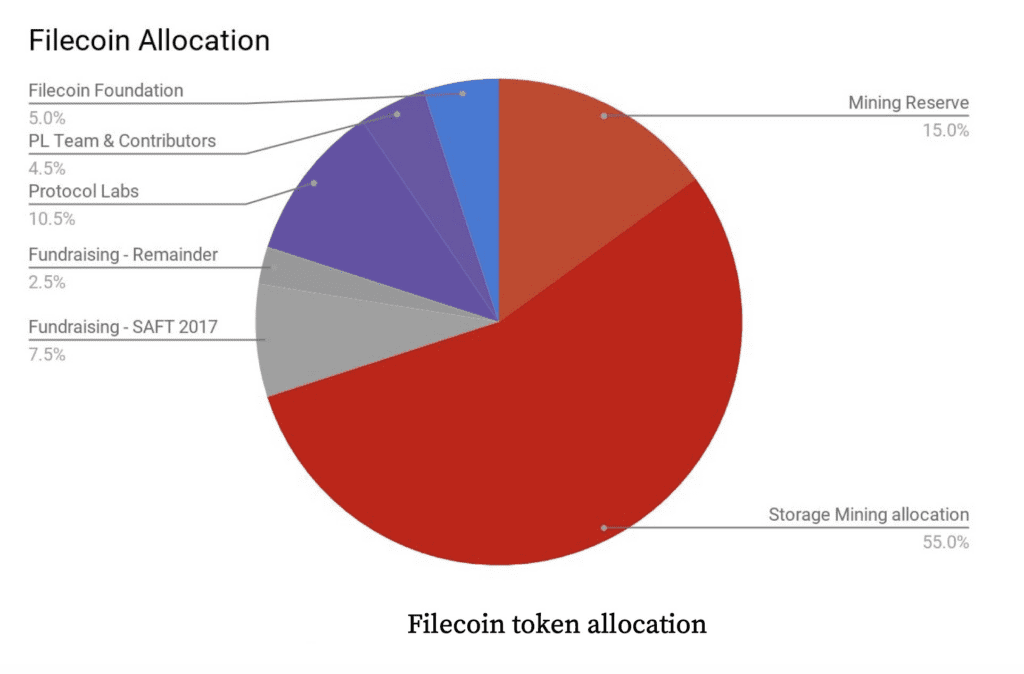

Token allocation of Filecoin

Filecoin tokenomics structure helps ensure that the value accretion of participants is aligned with the long-term utility of the protocol. Therefore, the purpose of Filecoin’s initial distribution at network launch is to support a protocol that incentivizes sustainable value creation.

According to the current protocol specification, up to 2 billion FILs will be created. Of this, 70% is allocated to storage and related services (i.e. minting tokens to reward storage providers), and 20% (granted over 6 years starting October 2020) is allocated to Protocol Labs and the Filecoin Foundation to support network development, adoption, and ecosystem growth. The remaining FILs are allocated to SAFT investors, beginning in October 2020, for periods ranging from 6 months to 3 years.

2 billion FILs is the maximum amount that can theoretically be minted and awarded. However, this may not be the amount of FIL that ends up in the network’s circulating supply:

- The 300 million FILs held as a mining reserve requires a protocol upgrade to be mined, which means it is up to the community to decide how much should be released.

- Network growth requires the use and consumption of tokens, reducing the available token supply. As of the end of September 2022, approximately 520 million FIL have been minted or awarded.

Of these, roughly 70% are in circulation, as large amounts of FIL are burned (permanently removed from circulation) due to network transaction fees or locked as collateral to secure the network and incentivize reliable storage. Token emission rates (vesting and minting) are expected to decrease gradually as the network matures, as Filecoin has a limited vesting schedule and a minting model where emissions are tied to network growth.

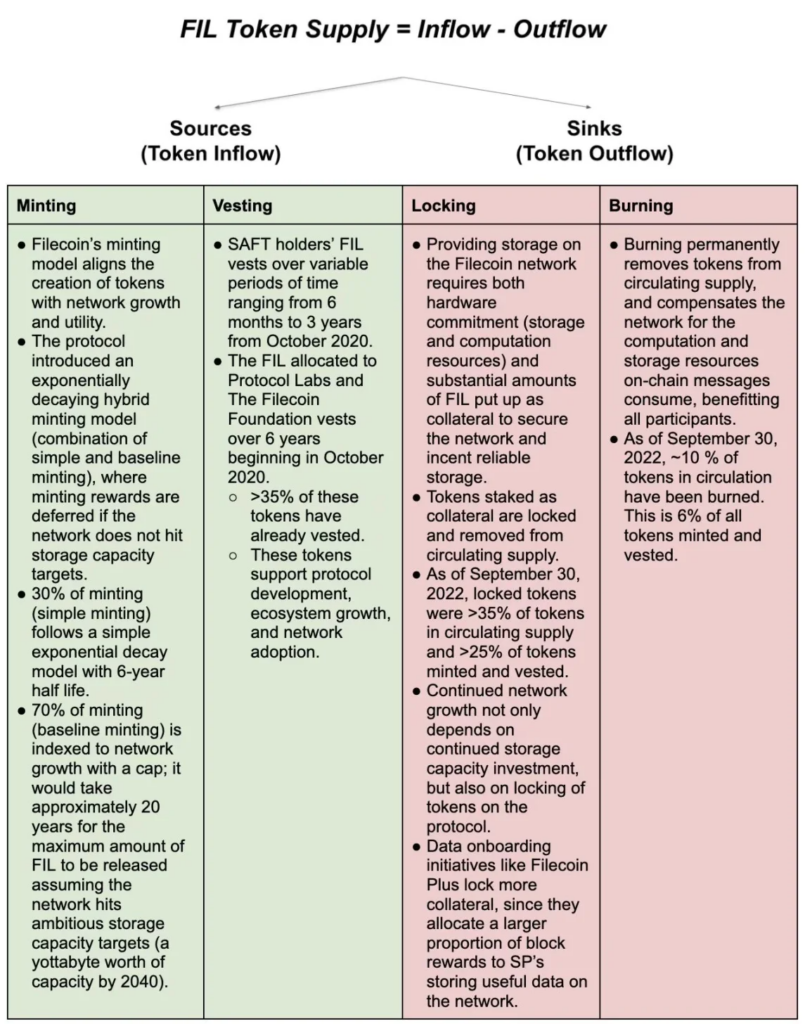

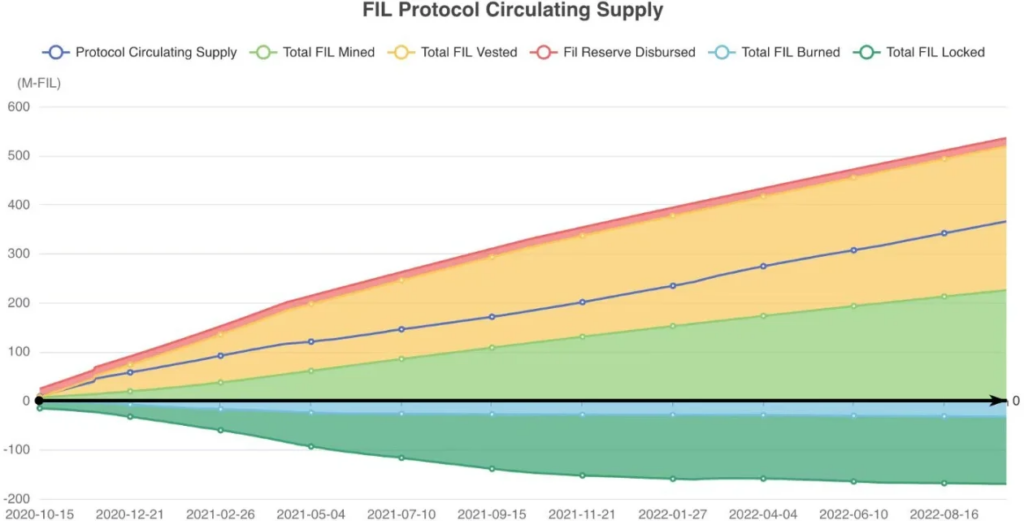

Token supply: Net Inflow or Outflow

Knowing the net inflows or outflows that determine the token supply will help token holders understand the relative purchasing power of tokens.

In simple terms, minting, vesting, locking, and burning contribute to the net inflow or outflow of tokens in the circulating supply. Below is the evolution of the Filecoin token supply since the mainnet launch.

Currently, the network is being expanded. Token vesting from the Filecoin Foundation and Protocol Labs supports the development and growth of the ecosystem, while block rewards from storage providers reward transactions and the onboarding of storage capacity. This presents a huge opportunity for token holders to participate in the growth of the ecosystem, as they can lend money to Storage Providers (SPs), facilitate storage provider demand for FIL, and share in the resulting network rewards. In this way, token holders can retrieve token emissions while supporting network growth and advancing Filecoin’s vision.

Filecoin ecosystem roadmap: Implications for token holders

In the Filecoin ecosystem, continuous improvements in user programmability, data logging, data retrievability, scalability, and computation will be achieved over the next three quarters. These initiatives should positively impact token holders by supporting client needs, unlocking various network use cases, and ultimately driving usage of the token. Some of these important improvements and their potential economic impact are discussed below.

Filecoin Virtual Machine (FVM)

The Filecoin Virtual Machine unlocks endless possibilities, from programmable storage primitives to cross-chain interoperability bridges, to data-centric DAOs and Layer 2 solutions. In short, this means that smart contracts and user programmability will come to Filecoin. Expected to be released in the first half of 2023, this network upgrade should have a positive impact on token holders, as it may increase the use cases of FIL and may affect the “outflow” component of the circulating supply equation (FIL locked and burned).

Outflows in FVM and Token Supply

As long as there is an operation or utility on the network, FIL tokens will be consumed (burned) to compensate for the computing and storage resources consumed by chain messages. The introduction of smart contract functionality may increase the demand for block space, resulting in an increase in FIL burned. This token burn rate is in the hands of the community as network participants compete for on-chain resources.

Additionally, FVM protocol upgrades increase the amount of FIL committed and/or locked. Currently, the majority of FIL locked on the network comes from storage provider collateral. FVM introduces the possibility of locking up a large number of funds to support various smart contract applications. DeFi protocols are just a subset of applications that can take advantage of Filecoin’s efficient proof-of-work chain, not only increasing token consumption but also generating new use cases for locking/locking FIL.

FVM is unique in that it brings new impetus to the Filecoin network. While today you can contract with a storage provider to store your data, with FVM, additional rules, automation, and composability with other services (e.g., DeFi) can be added. As the other components of the Filecoin roadmap (retrieval marketplace, data computation, etc.) are implemented, we hope that FVM can leverage Filecoin’s infrastructure to facilitate the implementation of more complex products, thereby promoting wider network adoption.

Filecoin Plus and Data Onboarding

Filecoin Plus (FIL+) is a practical solution to incentivize the efficient use of the Filecoin network. Since it is difficult to algorithmically distinguish real useful data from generated random data, FIL+ introduces a social trust layer into the network.

In the FIL+ program, clients who have passed the verification process are granted a new resource, DataCap, which they can use to conduct storage transactions with storage providers (SPs).

SPs are incentivized to enter into storage agreements with customers using DataCap, as FIL+ transactions increase the number of block rewards they receive compared to regular (non-FIL+) transactions or by submitting storage capacity to the network. To earn these additional rewards from FIL+, storage providers offer more collateral (approximately 10x the collateral in the non-FIL+ storage sector) and lock more tokens on the network.

So far, we have seen a strong increase in data from FIL+ customers, which indicates the number of effective global connection data (Data Onboarded: connecting offline and online data through tags, such as matching of B2B or B2C data sets) is increasing.

From a token economics perspective, the continuation of this trend will likely increase the tokens locked on the network and reduce the circulating supply of tokens. What’s more, as the Filecoin network evolves toward its mission of storing efficient data, token consumption and utilization will grow.

Interplanetary Consensus Upgrade (IPC: ConsensusLab Flagship Project)

IPC is an upcoming network upgrade aimed at increasing the use cases that Filecoin can support while improving the scalability, throughput, and finality of the network. It is an exciting blockchain innovation. Scaling out chains via subnets (shards), IPC also has potential implications for the crypto-economy and could increase:

- Due to the increased scalability and FVM utilization, the burning of FIL also reduces the gas fee for users.

- The amount of FIL locked (or staked) as collateral to secure the subnet.

- FIL consumption requirements for shards that support custom on-chain use cases.

Conclusion

As a new type of data storage and application network, Filecoin’s mission is to create a decentralized, efficient, and robust foundation for social information. The sheer number of developments in the Filecoin ecosystem supporting this mission will have a positive impact on token holders.

The purpose of the protocol’s token economy is to reward long-term participation and contribution to the network. Community participants can benefit from understanding the token economy, especially the sources of token inflows and outflows that underpin the token economy.

In the future, continued improvements to the protocol could lead to new and exciting use cases for the network and the token, potentially further driving token holder participation and actively driving the value proposition of this fast-growing ecosystem.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News