Key Points:

- Bitcoin mining company Marathon Digital released an update on Bitcoin production and mining operations in February.

- The mining company produced 683 BTC and has produced 1,370 BTC so far this quarter.

- In February, the miner sold 650 BTCs.

Marathon Digital said on Thursday that it produced 683 Bitcoins in February, a 0.6% decrease from January while increasing its hash rate by 30% month over month to 9.5 EH/s.

Of the 683 Bitcoins produced in February, the miner sold 650.

Marathon mined 1,370 Bitcoins in the third quarter and boosted its average BTC production per day by 10% in February. During the month, the business charged around 18,800 Bitcoin miners.

Marathon sold 1,500 Bitcoins in January, marking the first time the company has traded any of its holdings.

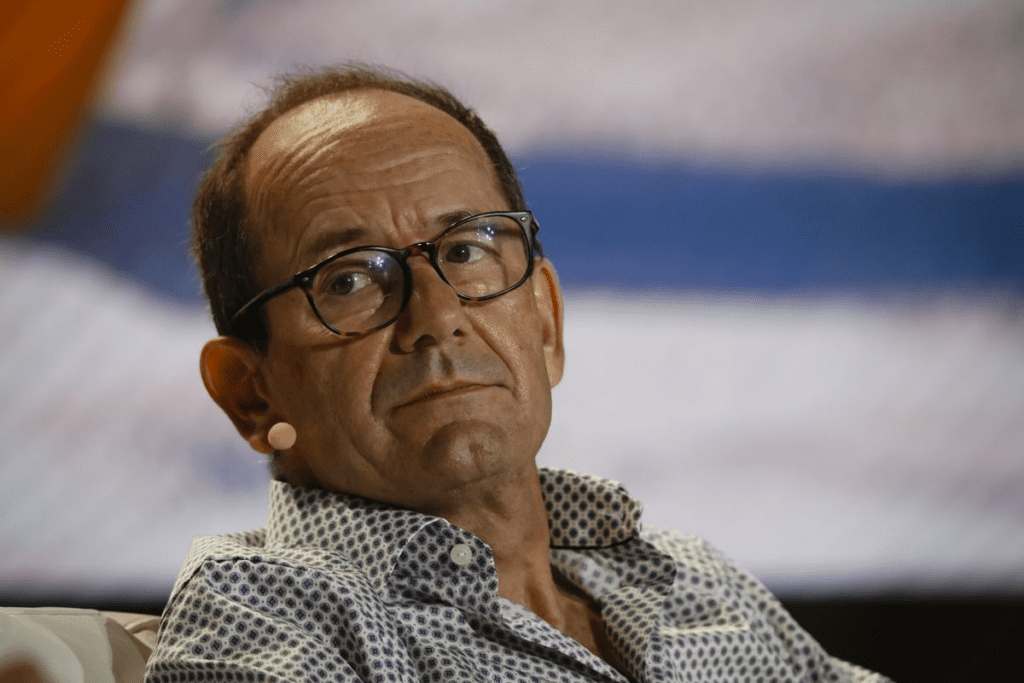

Notwithstanding the February sales, Marathon boosted its unconstrained Bitcoin holdings from 8,090 bitcoins as of January 31, 2023, to 8,260 Bitcoins valued at $191.2 million as of February 28, the company Chairman and. CEO Fred Thiel said in the report.

According to a statement, the miner sold the Bitcoin to assist in paying for operating expenses and other company objectives.

“To continue advancing operations and improve efficiency, our primary focus this year is to energize more miners and to optimize our fleet’s performance,” the CEO stated.

Other miners are also implementing similar strategies to “defensive” against the volatile market. In some tough times, Argo Blockchain or Core Scientific has struggled with financial problems. Marathon is one of the few companies still holding onto the mined Bitcoin, which the company says may become a seller at some point.

After an inquiry by the US Securities and Exchange Commission (SEC), Marathon postponed its earnings release earlier this week and stated that it would need to restate sections of its audited 2021 results and presently unaudited quarterly reports beginning in 2022.

Riot Platforms also announced that it would postpone its 10-K filings with the SEC owing to concerns highlighted by its accounting firm concerning the company’s impairment calculations for its Bitcoin assets.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News