Key Points:

- Silvergate is still under scrutiny by the SEC and the bank, but it’s still in the midst of a crisis.

- The innovative business model has allowed the bank to make a lot of money during the last bull run. However, it depends a lot on the market environment.

- The key for the bank to overcome the difficulty lies in whether they can get enough support to meet the withdrawal needs of their customers.

A slew of criticism has been leveled against crypto-friendly bank Silvergate.

On March 2, Silvergate recently declared that it would postpone the publishing of its 2022 annual report, acknowledging that it was “undercapitalized.” As a result, Coinbase, Paxos, and Circle ceased doing business with Silvergate, and Tether and Gemini said that they have no exposure to Silvergate. As a result, its stock dropped roughly 60% in a single day.

It has tight relationships with many exchanges, market makers, and stablecoin issuers as the second largest crypto banking service provider after Signature Bank, and it has suffered a series of blows following the FTX thunderstorm. The customer squeeze caused by the bear market might exacerbate the liquidity situation.

Yet, Silvergate remains subject to SEC and banking monitoring in general. It has accepted many loans and bailout funding. If the major run can be stopped and market and consumer trust is restored following regulatory action, the crisis is predicted to be contained within a particular range.

Crypto is used in the transition of community banks

Silvergate was created in 1988 in California, USA, according to its own statement. It began as a neighborhood retail bank. CEO Alan Lane was prepared to enter the crypto sector in 2013.

Its crypto global business model may be separated into three sectors: loan, SEN, and the stillborn DIEM stablecoin bought by Facebook. The financing business is mostly for mining firms Marathon and Microstrategy, whereas the SEN network is primarily for exchanges.

The primary customers are big exchanges and trading institutions, who aid exchanges and consumers in depositing and withdrawing cash and interfacing with the traditional banking system. and crypto firms, as well as the function of the fiat-to-crypto relationship. Silvergate has 1620 clients, including 104 exchangers, as of December 2022.

SEN (Silvergate Trade Network, Silvergate Exchange Network) is the most important business component, allowing exchanges and institutional investors to transmit dollars between their own Silvergate accounts and other Silvergate client accounts without interruption and trade real-time settlement.

Its RESTful JSON APIs enable clients to query wire transfer data while avoiding transaction delays due to bank business hours constraints. It is a critical pillar supporting the global bitcoin market’s 24-hour functioning. As the primary business, SEN assists the bank in earning transfer and service fees, which account for around 20% of the overall income.

Silvergate made a lot of money during the past bull market because of its creative business approach. Customer deposits hit $112 on October 20, 2021. SEN processed more than $200 billion in corporate transactions in the fourth quarter of 2021, making it the second biggest in the world. After Signature, this is the second largest crypto-friendly bank.

By the conclusion of the third quarter of 2022, Coinbase, Paxos, Crypto.com, Gemini, Kraken, Bitstamp, and Circle will be among Silvergate’s top ten depositors, accounting for over half of the bank’s deposits.

However, the lending industry contributes the most to revenue, and the profit model is also the classic interest rate spread of traditional banks, in which short-term deposits are used to buy bonds, stocks, and other investments or lend, and also include low-interest digital asset mortgages.

MicroStrategy obtained a $205 million loan from Silvergate in March 2022, which will expire in 2025. The company further indicated that owing to Silvergate’s insolvency, it would not return the debt in advance. Silvergate also pledged securities to get more funds, resulting in a $4.3 billion loan from the Federal Home Loan Bank.

Silvergate is overrun following the FTX storms

Silvergate was once considered the stock market’s darling. Cathie Wood’s ARK Fintech Innovation, State Street Bank, and market maker firm Citadel have all held big shares of its stock, assisting it in attaining its November 21, 2021, share price.

The peak was $239, and the market worth surpassed $7 billion. Nevertheless, as the problem worsened, the company’s stock price plummeted below its IPO price of $12 on January 5 of this year. Worryingly, more than 70% of its stocks had been shorted. Soros also took advantage of the opportunity to purchase 100,000 put options.

This strategy, however, is very dependent on the market situation. In truth, the whole crypto financial system has begun to face a catastrophic problem in 2022, but the most lethal impact on Silvergate is the FTX thunderstorm. FTX and Alameda both opened Silvergate accounts. The United States Department of Justice confiscated its assets.

With the demise of FTX, the consolidated withdrawal movement of several exchanges was activated. Users’ trust in the exchange was shaken, and many withdrew their funds. The exchange then made withdrawals from the Silvergate cooperative. Silvergate’s sole option was to continue selling its own assets in order to meet the resultant withdrawal obligations.

Silvergate’s cryptocurrency-related deposits fell by 68% in Q4 2022 alone, and it processed more than $8.1 billion in client withdrawals, resulting in a significant liquidity and repayment issue for Silvergate and cumulative losses of more than $949 million. Since 2013, all earnings have been taken, resulting in a debt operation. To preserve itself, it will sell bonds worth $5.2 billion at a cumulative discount in Q4 2022 and lay off 40% (about 200) of its staff.

Silvergate possessed more than $4.6 billion in cash and cash equivalents as of December 31, 2022, while total client deposits were $3.8 billion, which can often meet the number of consumer withdrawals.

Nevertheless, these assets are not completely current, and owing to the maturity mismatch, it is impossible to instantly meet the user’s withdrawal request. Banks, unlike exchanges, have always had a partial reserve system, so if they confront a large-scale withdrawal demand in the short term, it will generate a significant run-on issue.

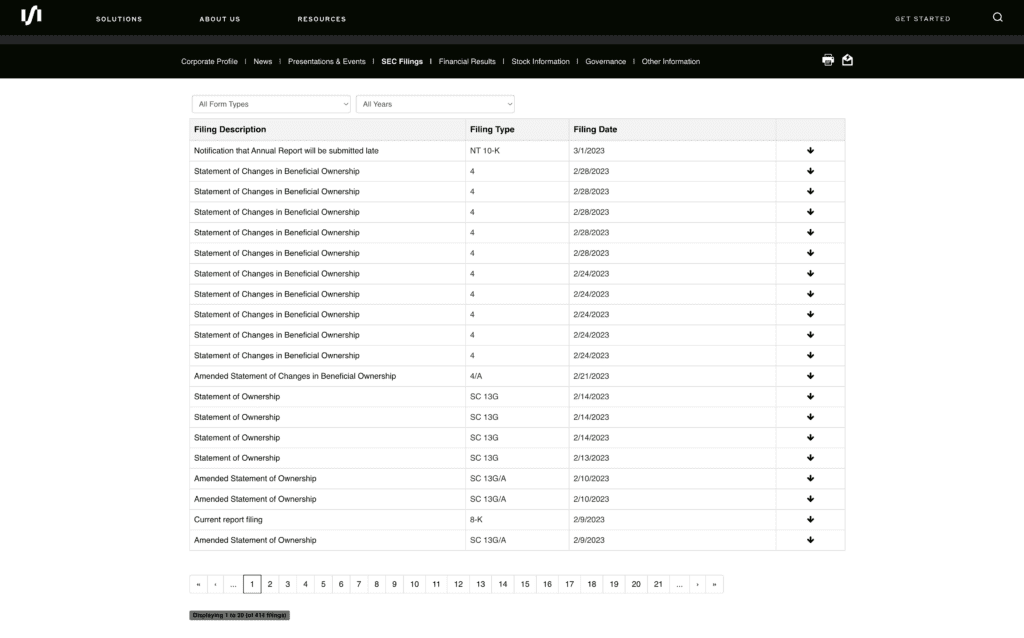

Silvergate has yet to release its 10-K report, and its solvency is a source of worry. The SEC requires companies to file 10-K reports. It is often more extensive than the annual report, with complete financial statements, balance sheets, and a cash flow statement. Silvergate has stated that it will issue one in 2023 to demonstrate its solvency.

Conclusion

Because of its economic strategy, Silvergate relies far too heavily on the crypto industry. A bank with fewer than 1,000 customers will succeed while losing everything. It will quickly enter a death spiral if there is a crisis in the crypto industry.

Its ability to weather the storm depends on whether it can obtain enough assistance to meet customers’ withdrawal needs while maintaining market confidence, whether ” takers ” are willing to acquire, or whether they will enter the zero-return mode and become another key player in the crypto circle.

It’s a conundrum. Nevertheless, if crypto restrictions tighten, the bank’s business model based on exchanges will no longer be viable. Silvergate will face a significant problem in the future in determining how to modify its business strategy.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News