BTC, ETH, And BNB Surge 10% As Binance Converts $1 Billion Recovery Initiative Funds

Key Points:

- Binance moves $1 billion from BUSD to BTC, ETH, and BNB.

- BTC, ETH, and BNB continue to surge despite SVB’s recent collapse.

- CZ’s move is well-received by the crypto community and seen as “bullish”.

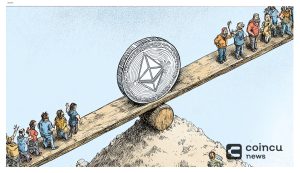

Binance has decided to convert its Industry Recovery Initiative funds worth $1 billion from Binance USD Coin (BUSD) to Bitcoin (BTC, Ethereum (ETH), and Binance Coin (BNB). This move by Binance CEO Changpeng Zhao comes amidst the U.S. government’s recent scrutiny of BUSD, a stablecoin.

The Industry Recovery Initiative was launched after FTX, Binance’s rival exchange, collapsed in November, and it aimed to provide aid to cryptocurrency projects experiencing liquidity issues post the FTX crash. The fund initially consisted of $1 billion worth of BUSD. CZ announced the conversion of these funds to native crypto in a tweet and stated that some fund movements will occur on-chain.

BTC, ETH, and BNB continue to surge despite the recent collapse of SVB. Bitcoin experienced a nearly 10% daily surge and was trading at $22,502 at the time of writing.

Meanwhile, Ethereum’s price rose by 9.62% over the last 24 hours and was priced at $1,615. Binance Coin, unaffected by the BUSD drama, saw a 9.43% increase in price and was trading at $305.31.

The move to convert the remaining Industry Recovery Initiative funds to native crypto has been well received by the cryptocurrency community. Many have lauded CZ for his “bullish” move, while others have noted the $1 billion buying pressure on BTC, ETH, and BNB. The decision to convert BUSD to BTC, ETH, and BNB is also attributed to the changes in stablecoins and banks that have been taking place lately.

As Binance prepares to shift the focus of the Industry Recovery Initiative towards native crypto, it remains to be seen how this move will impact the exchange’s standing in the crypto market. Nonetheless, it is clear that Binance is not willing to sit back and watch as the cryptocurrency industry continues to evolve rapidly.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Thana

Coincu News